Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IN FOCUS PSUs<br />

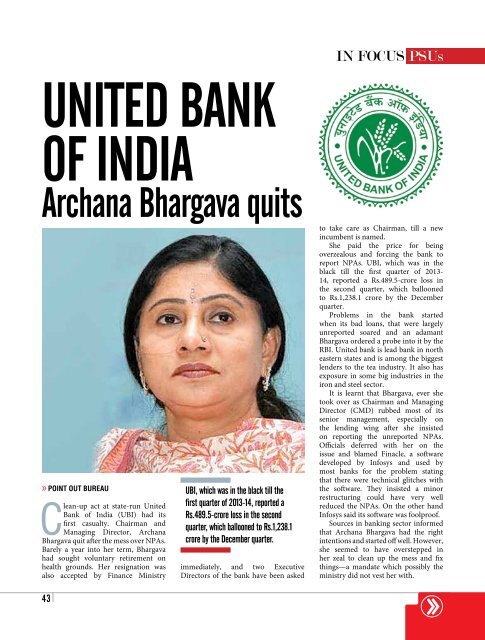

United Bank<br />

of India<br />

Archana Bhargava quits<br />

»»<br />

point out bureau<br />

Clean-up act at state-run United<br />

Bank of India (UBI) had its<br />

first casualty. Chairman and<br />

Managing Director, Archana<br />

Bhargava quit after the mess over NPAs.<br />

Barely a year into her term, Bhargava<br />

had sought voluntary retirement on<br />

health grounds. Her resignation was<br />

also accepted by Finance Ministry<br />

43<br />

UBI, which was in the black till the<br />

first quarter of 2013-14, reported a<br />

Rs.489.5-crore loss in the second<br />

quarter, which ballooned to Rs.1,238.1<br />

crore by the December quarter.<br />

immediately, and two Executive<br />

Directors of the bank have been asked<br />

to take care as Chairman, till a new<br />

incumbent is named.<br />

She paid the price for being<br />

overzealous and forcing the bank to<br />

report NPAs. UBI, which was in the<br />

black till the first quarter of 2013-<br />

14, reported a Rs.489.5-crore loss in<br />

the second quarter, which ballooned<br />

to Rs.1,238.1 crore by the December<br />

quarter.<br />

Problems in the bank started<br />

when its bad loans, that were largely<br />

unreported soared and an adamant<br />

Bhargava ordered a probe into it by the<br />

RBI. United bank is lead bank in north<br />

eastern states and is among the biggest<br />

lenders to the tea industry. It also has<br />

exposure in some big industries in the<br />

iron and steel sector.<br />

It is learnt that Bhargava, ever she<br />

took over as Chairman and Managing<br />

Director (CMD) rubbed most of its<br />

senior management, especially on<br />

the lending wing after she insisted<br />

on reporting the unreported NPAs.<br />

Officials deferred with her on the<br />

issue and blamed Finacle, a software<br />

developed by Infosys and used by<br />

most banks for the problem stating<br />

that there were technical glitches with<br />

the software. They insisted a minor<br />

restructuring could have very well<br />

reduced the NPAs. On the other hand<br />

Infosys said its software was foolproof.<br />

Sources in banking sector informed<br />

that Archana Bhargava had the right<br />

intentions and started off well. However,<br />

she seemed to have overstepped in<br />

her zeal to clean up the mess and fix<br />

things—a mandate which possibly the<br />

ministry did not vest her with.