You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Point<br />

Out<br />

State of Economy<br />

Financial Inclusion-<br />

A Collective Responsibility<br />

»»<br />

S. L. Bansal<br />

As a professional banker, I would<br />

always like to foresee inclusive<br />

growth for our 1.2 billion<br />

population. However, after over<br />

four decades of nationalization of banks,<br />

the challenges of financial inclusion<br />

still remain as only 36,000+ habitations<br />

have a commercial bank branch out of<br />

the 6,00,000 habitations in the country.<br />

With the help of technology banks have<br />

expanded their network by opening of<br />

more & more branches over the last few<br />

years. Inspite of this, only 40% of the<br />

population across the country have bank<br />

accounts and only 10% have access to<br />

credit products.<br />

We can divide 1.2 billion population<br />

of the country into three segments. The<br />

first segment includes those who are not<br />

dealing with the banks and are financially<br />

excluded. The remaining population is of<br />

two segments - high networth individuals<br />

(HNIs) and small and medium income<br />

groups. This latter group is growing fast.<br />

Every year close to 3 crore people from<br />

the young generation are being added to<br />

the banking system and these people who<br />

will be the core customers in the future,<br />

have non-conventional banking habits<br />

and are very close to Western culture.<br />

They don’t live by their pay package and<br />

obligations - they live by their EMIs. As a<br />

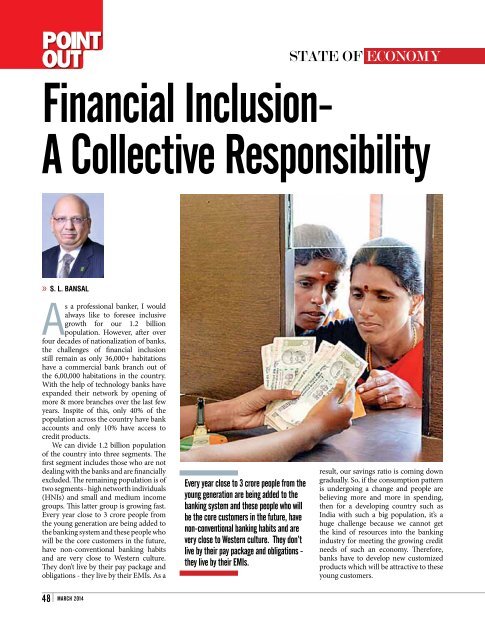

Every year close to 3 crore people from the<br />

young generation are being added to the<br />

banking system and these people who will<br />

be the core customers in the future, have<br />

non-conventional banking habits and are<br />

very close to Western culture. They don’t<br />

live by their pay package and obligations -<br />

they live by their EMIs.<br />

result, our savings ratio is coming down<br />

gradually. So, if the consumption pattern<br />

is undergoing a change and people are<br />

believing more and more in spending,<br />

then for a developing country such as<br />

India with such a big population, it’s a<br />

huge challenge because we cannot get<br />

the kind of resources into the banking<br />

industry for meeting the growing credit<br />

needs of such an economy. Therefore,<br />

banks have to develop new customized<br />

products which will be attractive to these<br />

young customers.<br />

48<br />

<strong>MARCH</strong> 2014