(formely M-Cell Limited) - Business Report 2003 - MTN Group

(formely M-Cell Limited) - Business Report 2003 - MTN Group

(formely M-Cell Limited) - Business Report 2003 - MTN Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2003</strong> 2002<br />

Rm<br />

Rm<br />

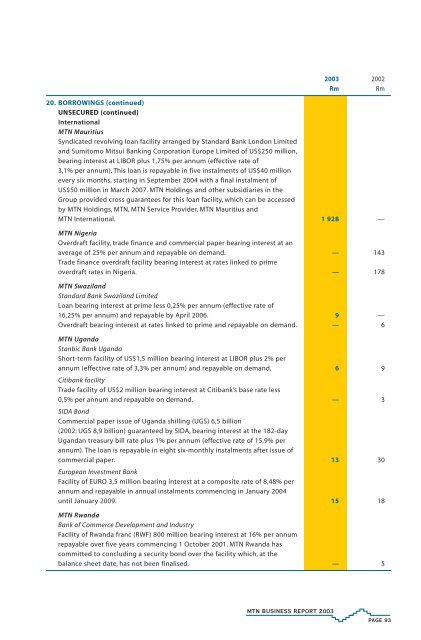

20. BORROWINGS (continued)<br />

UNSECURED (continued)<br />

International<br />

<strong>MTN</strong> Mauritius<br />

Syndicated revolving loan facility arranged by Standard Bank London <strong>Limited</strong><br />

and Sumitomo Mitsui Banking Corporation Europe <strong>Limited</strong> of US$250 million,<br />

bearing interest at LIBOR plus 1,75% per annum (effective rate of<br />

3,1% per annum). This loan is repayable in five instalments of US$40 million<br />

every six months, starting in September 2004 with a final instalment of<br />

US$50 million in March 2007. <strong>MTN</strong> Holdings and other subsidiaries in the<br />

<strong>Group</strong> provided cross guarantees for this loan facility, which can be accessed<br />

by <strong>MTN</strong> Holdings, <strong>MTN</strong>, <strong>MTN</strong> Service Provider, <strong>MTN</strong> Mauritius and<br />

<strong>MTN</strong> International. 1 928 —<br />

<strong>MTN</strong> Nigeria<br />

Overdraft facility, trade finance and commercial paper bearing interest at an<br />

average of 25% per annum and repayable on demand. — 143<br />

Trade finance overdraft facility bearing interest at rates linked to prime<br />

overdraft rates in Nigeria. — 178<br />

<strong>MTN</strong> Swaziland<br />

Standard Bank Swaziland <strong>Limited</strong><br />

Loan bearing interest at prime less 0,25% per annum (effective rate of<br />

16,25% per annum) and repayable by April 2006. 9 —<br />

Overdraft bearing interest at rates linked to prime and repayable on demand. — 6<br />

<strong>MTN</strong> Uganda<br />

Stanbic Bank Uganda<br />

Short-term facility of US$1,5 million bearing interest at LIBOR plus 2% per<br />

annum (effective rate of 3,3% per annum) and repayable on demand. 6 9<br />

Citibank facility<br />

Trade facility of US$2 million bearing interest at Citibank’s base rate less<br />

0,5% per annum and repayable on demand. — 3<br />

SIDA Bond<br />

Commercial paper issue of Uganda shilling (UGS) 6,5 billion<br />

(2002: UGS 8,9 billion) guaranteed by SIDA, bearing interest at the 182-day<br />

Ugandan treasury bill rate plus 1% per annum (effective rate of 15,9% per<br />

annum). The loan is repayable in eight six-monthly instalments after issue of<br />

commercial paper. 13 30<br />

European Investment Bank<br />

Facility of EURO 3,5 million bearing interest at a composite rate of 8,48% per<br />

annum and repayable in annual instalments commencing in January 2004<br />

until January 2009. 15 18<br />

<strong>MTN</strong> Rwanda<br />

Bank of Commerce Development and Industry<br />

Facility of Rwanda franc (RWF) 800 million bearing interest at 16% per annum<br />

repayable over five years commencing 1 October 2001. <strong>MTN</strong> Rwanda has<br />

committed to concluding a security bond over the facility which, at the<br />

balance sheet date, has not been finalised. — 5<br />

<strong>MTN</strong> BUSINESS REPORT <strong>2003</strong><br />

PAGE 93