2013 Employee Benefits Guidebook - Administration Home

2013 Employee Benefits Guidebook - Administration Home

2013 Employee Benefits Guidebook - Administration Home

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

What is an FSA?<br />

FLEXIBLE SPENDING ACCOUNTS (FSA)<br />

An FSA is a Flexible Spending Account that allows you to set aside money for eligible expenses on a pre-tax<br />

basis. There are two types of Flexible Spending Accounts available - a healthcare account and a dependent day<br />

care account.<br />

What you need to know about FSAs<br />

• You may only determine your contribution in an FSA during open enrollment or when you first become<br />

eligible.<br />

• You do not need to be covered by your employer’s health plan to participate in an FSA.<br />

• Expenses must be for services received, not for services to be provided in the future.<br />

• Once you establish your plan year contribution, you may only change it if you experience a Qualifying Life<br />

Event.<br />

• Any claims that were incurred during the plan year must be submitted for reimbursement by the end of your<br />

run out period (60 days). The run out date is 60 days after the end of your plan year or February 28, 2014.<br />

• Any amount left in your healthcare and/or dependent day care FSA at the end of the plan year will be<br />

forfeited.<br />

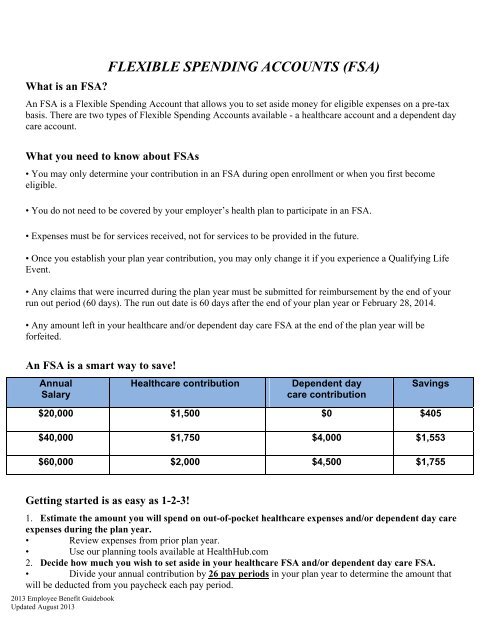

An FSA is a smart way to save!<br />

Annual<br />

Salary<br />

Healthcare contribution<br />

Dependent day<br />

care contribution<br />

Savings<br />

$20,000 $1,500 $0 $405<br />

$40,000 $1,750 $4,000 $1,553<br />

$60,000 $2,000 $4,500 $1,755<br />

Getting started is as easy as 1-2-3!<br />

1. Estimate the amount you will spend on out-of-pocket healthcare expenses and/or dependent day care<br />

expenses during the plan year.<br />

• Review expenses from prior plan year.<br />

• Use our planning tools available at HealthHub.com<br />

2. Decide how much you wish to set aside in your healthcare FSA and/or dependent day care FSA.<br />

• Divide your annual contribution by 26 pay periods in your plan year to determine the amount that<br />

will be deducted from you paycheck each pay period.<br />

<strong>2013</strong> <strong>Employee</strong> Benefit <strong>Guidebook</strong><br />

Updated August <strong>2013</strong>