RFG Annual Report 2007 - Retail Food Group

RFG Annual Report 2007 - Retail Food Group

RFG Annual Report 2007 - Retail Food Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

06/07<br />

<strong>Annual</strong> <strong>Report</strong><br />

48<br />

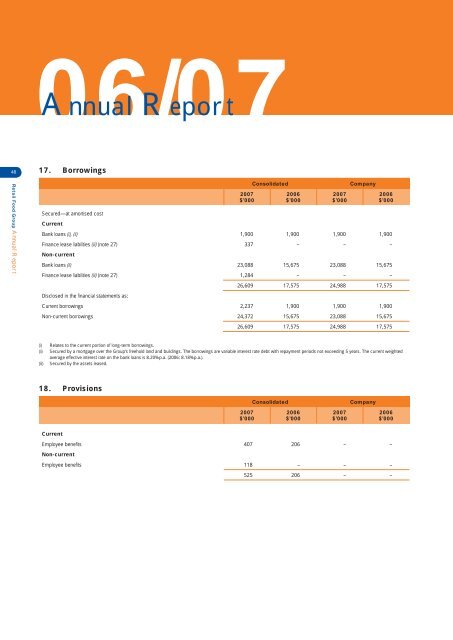

17. Borrowings<br />

<strong>Retail</strong> <strong>Food</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong><br />

<strong>2007</strong><br />

$’000<br />

Consolidated<br />

2006<br />

$’000<br />

<strong>2007</strong><br />

$’000<br />

Company<br />

Secured—at amortised cost<br />

Current<br />

Bank loans (i), (ii) 1,900 1,900 1,900 1,900<br />

Finance lease liabilities (iii) (note 27) 337 – – –<br />

Non-current<br />

Bank loans (ii) 23,088 15,675 23,088 15,675<br />

Finance lease liabilities (iii) (note 27) 1,284 – – –<br />

26,609 17,575 24,988 17,575<br />

Disclosed in the fi nancial statements as:<br />

Current borrowings 2,237 1,900 1,900 1,900<br />

Non-current borrowings 24,372 15,675 23,088 15,675<br />

26,609 17,575 24,988 17,575<br />

2006<br />

$’000<br />

(i)<br />

(ii)<br />

(iii)<br />

Relates to the current portion of long-term borrowings.<br />

Secured by a mortgage over the <strong>Group</strong>’s freehold land and buildings. The borrowings are variable interest rate debt with repayment periods not exceeding 5 years. The current weighted<br />

average effective interest rate on the bank loans is 8.20%p.a. (2006: 8.18%p.a.).<br />

Secured by the assets leased.<br />

18. Provisions<br />

<strong>2007</strong><br />

$’000<br />

Consolidated<br />

2006<br />

$’000<br />

<strong>2007</strong><br />

$’000<br />

Company<br />

2006<br />

$’000<br />

Current<br />

Employee benefi ts 407 206 – –<br />

Non-current<br />

Employee benefi ts 118 – – –<br />

525 206 – –