RFG Annual Report 2007 - Retail Food Group

RFG Annual Report 2007 - Retail Food Group

RFG Annual Report 2007 - Retail Food Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

06/07<br />

<strong>Annual</strong> <strong>Report</strong><br />

4<br />

<strong>Retail</strong> <strong>Food</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong><br />

Managing Director’s <strong>Report</strong><br />

In an outstanding year for the Company, <strong>Retail</strong> <strong>Food</strong> <strong>Group</strong> (<strong>RFG</strong>) has consolidated its status as one of Australasia’s leading multi retail food<br />

brand managers and franchisors, growing organically to 360 outlets across the Donut King and bb’s café systems—an increase of 28 stores on<br />

the prior year. Indeed, the <strong>2007</strong> fi nancial year has been defi ned by continued growth including revenue increase of 15.1% on FY2006, and NPAT<br />

increase of 26.7% to $7.52 million.<br />

The 2008 fi nancial year will witness a progression of this growth trend for the Company with completion of the off market takeover of Brumby’s<br />

Bakeries Holdings Limited—contributing an additional 324 Brumby’s franchised outlets—and in September <strong>2007</strong> the execution of an agreement<br />

to acquire the Michel’s Patisserie franchise system. The acquisition of Brumby’s and impending addition of the 348 outlet Michel’s system is<br />

already positively impacting <strong>RFG</strong>’s relationships with landlords and trade partners whilst generating strong interest amongst franchisees in terms<br />

of multi-site and cross-system ownership.<br />

The Company’s Central Manufacturing and Coffee Roasting Facilities were also commissioned during the 2nd half of the <strong>2007</strong> fi nancial year<br />

and high quality product delivery to <strong>RFG</strong>’s franchisees is well advanced. The central manufacture and distribution of food and beverages<br />

products, which are subject to the Company’s proprietary blends and recipes, will ensure uniformity, quality, and consistency throughout all<br />

Australian outlets.<br />

EXCEEDING FORECASTS<br />

For the <strong>2007</strong> financial year, <strong>Retail</strong> <strong>Food</strong> <strong>Group</strong> achieved NPAT (net profit after tax) of $7.52 million.<br />

This strong result, representing a 26.7% increase on FY2006 and exceeding the Company’s May 2006 Prospectus forecast of $7.4 million,<br />

was driven by:<br />

• record new outlet commissionings of 37 stores; and<br />

• total network sales of $158.2 million, an increase of 10.6% on the prior year.<br />

Earnings per share (EPS) for FY<strong>2007</strong> was 10.5 cents, a 22.1% increase on FY2006 and, consistent with Prospectus forecasts, the Directors have<br />

declared a fi nal dividend for the year ended 30 June <strong>2007</strong> of 3.125 cents per share.<br />

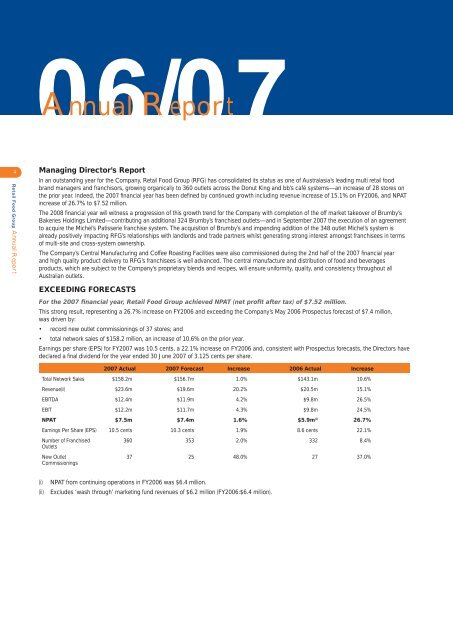

<strong>2007</strong> Actual <strong>2007</strong> Forecast Increase 2006 Actual Increase<br />

Total Network Sales $158.2m $156.7m 1.0% $143.1m 10.6%<br />

Revenue(ii) $23.6m $19.6m 20.2% $20.5m 15.1%<br />

EBITDA $12.4m $11.9m 4.2% $9.8m 26.5%<br />

EBIT $12.2m $11.7m 4.3% $9.8m 24.5%<br />

NPAT $7.5m $7.4m 1.6% $5.9m (i) 26.7%<br />

Earnings Per Share (EPS) 10.5 cents 10.3 cents 1.9% 8.6 cents 22.1%<br />

Number of Franchised<br />

Outlets<br />

New Outlet<br />

Commissionings<br />

360 353 2.0% 332 8.4%<br />

37 25 48.0% 27 37.0%<br />

(i)<br />

(ii)<br />

NPAT from continuing operations in FY2006 was $6.4 million.<br />

Excludes ‘wash through’ marketing fund revenues of $6.2 million (FY2006:$6.4 million).