RFG Annual Report 2007 - Retail Food Group

RFG Annual Report 2007 - Retail Food Group

RFG Annual Report 2007 - Retail Food Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

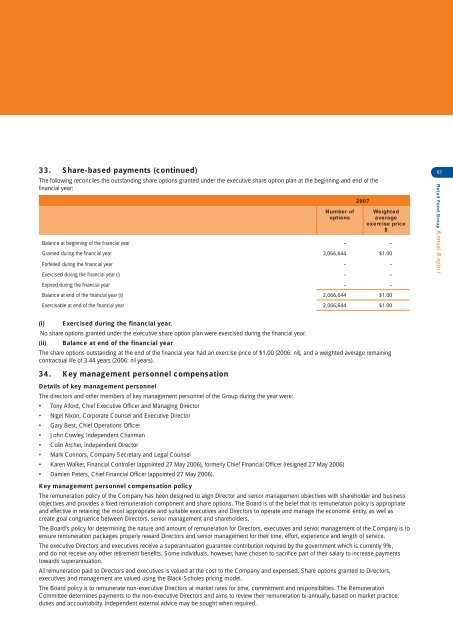

33. Share-based payments (continued)<br />

The following reconciles the outstanding share options granted under the executive share option plan at the beginning and end of the<br />

fi nancial year:<br />

Number of<br />

options<br />

<strong>2007</strong><br />

Weighted<br />

average<br />

exercise price<br />

$<br />

Balance at beginning of the fi nancial year – –<br />

Granted during the fi nancial year 2,066,644 $1.00<br />

Forfeited during the fi nancial year – –<br />

Exercised during the fi nancial year (i) – –<br />

Expired during the fi nancial year – –<br />

Balance at end of the fi nancial year (ii) 2,066,644 $1.00<br />

Exercisable at end of the fi nancial year 2,066,644 $1.00<br />

63<br />

<strong>Retail</strong> <strong>Food</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong><br />

(i)<br />

Exercised during the financial year.<br />

No share options granted under the executive share option plan were exercised during the fi nancial year.<br />

(ii) Balance at end of the financial year<br />

The share options outstanding at the end of the fi nancial year had an exercise price of $1.00 (2006: nil), and a weighted average remaining<br />

contractual life of 3.44 years (2006: nil years).<br />

34. Key management personnel compensation<br />

Details of key management personnel<br />

The directors and other members of key management personnel of the <strong>Group</strong> during the year were:<br />

• Tony Alford, Chief Executive Offi cer and Managing Director<br />

• Nigel Nixon, Corporate Counsel and Executive Director<br />

• Gary Best, Chief Operations Offi cer<br />

• John Cowley, Independent Chairman<br />

• Colin Archer, Independent Director<br />

• Mark Connors, Company Secretary and Legal Counsel<br />

• Karen Walker, Financial Controller (appointed 27 May 2006), formerly Chief Financial Offi cer (resigned 27 May 2006)<br />

• Damien Peters, Chief Financial Offi cer (appointed 27 May 2006).<br />

Key management personnel compensation policy<br />

The remuneration policy of the Company has been designed to align Director and senior management objectives with shareholder and business<br />

objectives and provides a fi xed remuneration component and share options. The Board is of the belief that its remuneration policy is appropriate<br />

and effective in retaining the most appropriate and suitable executives and Directors to operate and manage the economic entity, as well as<br />

create goal congruence between Directors, senior management and shareholders.<br />

The Board’s policy for determining the nature and amount of remuneration for Directors, executives and senior management of the Company is to<br />

ensure remuneration packages properly reward Directors and senior management for their time, effort, experience and length of service.<br />

The executive Directors and executives receive a superannuation guarantee contribution required by the government which is currently 9%,<br />

and do not receive any other retirement benefi ts. Some individuals, however, have chosen to sacrifi ce part of their salary to increase payments<br />

towards superannuation.<br />

All remuneration paid to Directors and executives is valued at the cost to the Company and expensed. Share options granted to Directors,<br />

executives and management are valued using the Black-Scholes pricing model.<br />

The Board policy is to remunerate non-executive Directors at market rates for time, commitment and responsibilities. The Remuneration<br />

Committee determines payments to the non-executive Directors and aims to review their remuneration bi-annually, based on market practice,<br />

duties and accountability. Independent external advice may be sought when required.