Annual Report 2008-2009 - National Gallery of Canada

Annual Report 2008-2009 - National Gallery of Canada

Annual Report 2008-2009 - National Gallery of Canada

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3. Changes in Accounting Policies<br />

(a) Adoption <strong>of</strong> New Accounting Standards<br />

The Canadian Institute <strong>of</strong> Chartered Accountants (CICA) issued the following new standards effective for the <strong>Gallery</strong> on April 1,<br />

<strong>2008</strong>:<br />

Section 1535 Capital Disclosures, establishes standards for disclosing information about the entity’s capital and how it is<br />

managed. It requires disclosures <strong>of</strong> the <strong>Gallery</strong>’s objectives, policies and processes for managing capital, quantitative information<br />

about what the <strong>Gallery</strong> regards as capital and disclosures <strong>of</strong> any externally imposed capital requirements, as well as the<br />

consequences for non-compliance. Refer to note 14 Capital Management.<br />

Section 3862, Financial Instruments – Disclosures, and Section 3863, Financial Instruments – Presentation, replace<br />

Section 3861, Financial Instruments – Disclosure and Presentation, revising and enhancing its disclosure requirements, and<br />

carrying forward unchanged the former presentation requirements. The new standards increase the emphasis on disclosure on<br />

the nature and risks arising from financial instruments to which the <strong>Gallery</strong> is exposed during the period and at the balance<br />

sheet date, and how the <strong>Gallery</strong> manages those risks. Refer to note 18 Exposure to risk.<br />

Section 3031 replaces 3030, Inventories. The new Standard gives specific guidance for measurement <strong>of</strong> inventories and<br />

information to be disclosed. The new standard was effective April 1, <strong>2008</strong> and did not significantly impact the <strong>Gallery</strong>’s statements.<br />

Refer to note 2 b) Inventories.<br />

(b) Future Accounting Changes<br />

International Financial <strong>Report</strong>ing Standards<br />

In February <strong>2008</strong>, the CICA announced that the generally accepted accounting principles (GAAP) for publicly accountable enterprises<br />

will be replaced by International Financial <strong>Report</strong>ing Standards (IFRS) for fiscal years beginning on or after January 1, 2012.<br />

The <strong>Gallery</strong> will be required to begin reporting under IFRS for the fiscal year ending March 31, 2012. The <strong>Gallery</strong> will continue to<br />

monitor the current situation to determine the impact on its financial reporting.<br />

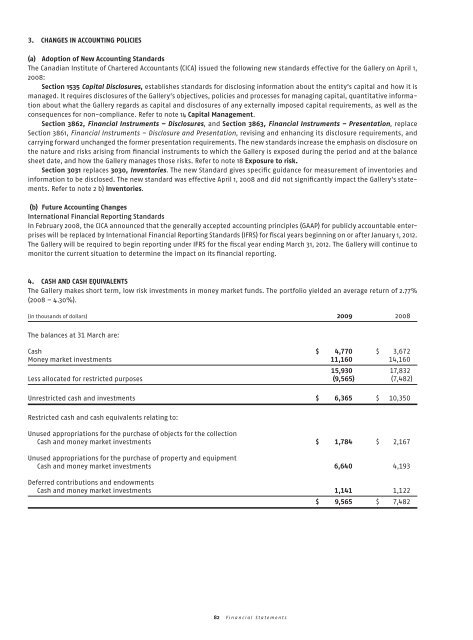

4. Cash and Cash Equivalents<br />

The <strong>Gallery</strong> makes short term, low risk investments in money market funds. The portfolio yielded an average return <strong>of</strong> 2.77%<br />

(<strong>2008</strong> – 4.30%).<br />

(in thousands <strong>of</strong> dollars) <strong>2009</strong> <strong>2008</strong><br />

The balances at 31 March are:<br />

Cash $ 4,770 $ 3,672<br />

Money market investments 11,160 14,160<br />

15,930 17,832<br />

Less allocated for restricted purposes (9,565) (7,482)<br />

Unrestricted cash and investments $ 6,365 $ 10,350<br />

Restricted cash and cash equivalents relating to:<br />

Unused appropriations for the purchase <strong>of</strong> objects for the collection<br />

Cash and money market investments $ 1,784 $ 2,167<br />

Unused appropriations for the purchase <strong>of</strong> property and equipment<br />

Cash and money market investments 6,640 4,193<br />

Deferred contributions and endowments<br />

Cash and money market investments 1,141 1,122<br />

$ 9,565 $ 7,482<br />

82 Financial Statements