You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

January 2012<br />

KMEFIC Research<br />

Equity Analysis Report<br />

Key Drivers: <strong>Cement</strong> Demand<br />

Construction Sector<br />

According to the latest <strong>Saudi</strong> Arabia Infrastructure Report published by Business Monitor<br />

International (BMI), the Kingdom’s construction industry is set to grow 4.1% this year to reach SAR<br />

87 billion ($23.2 billion). The construction sector in <strong>Saudi</strong> Arabia accounted for 6.9% of the<br />

country’s gross domestic product (GDP) in 2010, with a growth of 3.7% YoY. During the first<br />

quarter of 2011, the value of contracts awarded by the government grew five folds over the same<br />

period last year. A report by National Commercial Bank estimates the total value of these<br />

contracts to be around SAR 49.7 billion ($13.5 billion), with the majority of them in the oil and gas<br />

sectors.<br />

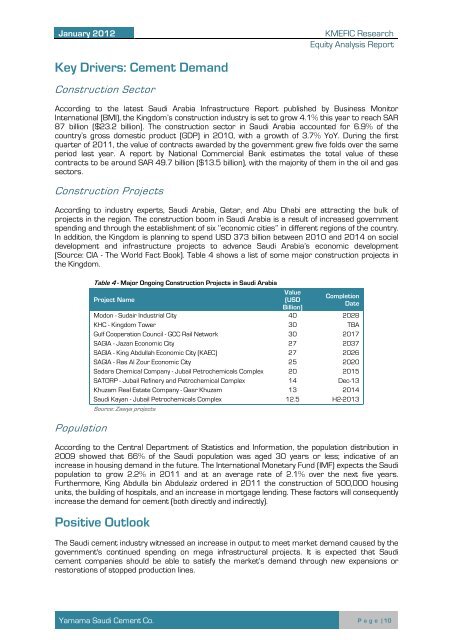

Construction Projects<br />

According to industry experts, <strong>Saudi</strong> Arabia, Qatar, and Abu Dhabi are attracting the bulk of<br />

projects in the region. The construction boom in <strong>Saudi</strong> Arabia is a result of increased government<br />

spending and through the establishment of six ‘’economic cities’’ in different regions of the country.<br />

In addition, the Kingdom is planning to spend USD 373 billion between 2010 and 2014 on social<br />

development and infrastructure projects to advance <strong>Saudi</strong> Arabia’s economic development<br />

(Source: CIA - The World Fact Book). Table 4 shows a list of some major construction projects in<br />

the Kingdom.<br />

Population<br />

Table 4 - Major Ongoing Construction Projects in <strong>Saudi</strong> Arabia<br />

Project Name<br />

Value<br />

(USD<br />

Billion)<br />

Completion<br />

Date<br />

Modon - Sudair Industrial City 40 2028<br />

KHC - Kingdom Tower 30 TBA<br />

Gulf Cooperation Council - GCC Rail Network 30 2017<br />

SAGIA - Jazan Economic City 27 2037<br />

SAGIA - King Abdullah Economic City (KAEC) 27 2026<br />

SAGIA - Ras Al Zour Economic City 25 2020<br />

Sadara Chemical <strong>Company</strong> - Jubail Petrochemicals Complex 20 2015<br />

SATORP - Jubail Refinery and Petrochemical Complex 14 Dec-13<br />

Khuzam Real Estate <strong>Company</strong> - Qasr Khuzam 13 2014<br />

<strong>Saudi</strong> Kayan - Jubail Petrochemicals Complex 12.5 H2-2013<br />

Source: Zawya projects<br />

According to the Central Department of Statistics and Information, the population distribution in<br />

2009 showed that 66% of the <strong>Saudi</strong> population was aged 30 years or less; indicative of an<br />

increase in housing demand in the future. The International Monetary Fund (IMF) expects the <strong>Saudi</strong><br />

population to grow 2.2% in 2011 and at an average rate of 2.1% over the next five years.<br />

Furthermore, King Abdulla bin Abdulaziz ordered in 2011 the construction of 500,000 housing<br />

units, the building of hospitals, and an increase in mortgage lending. These factors will consequently<br />

increase the demand for cement (both directly and indirectly).<br />

Positive Outlook<br />

The <strong>Saudi</strong> cement industry witnessed an increase in output to meet market demand caused by the<br />

government's continued spending on mega infrastructural projects. It is expected that <strong>Saudi</strong><br />

cement companies should be able to satisfy the market’s demand through new expansions or<br />

restorations of stopped production lines.<br />

Yamama <strong>Saudi</strong> <strong>Cement</strong> Co. P a g e | 10