Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

January 2012<br />

KMEFIC Research<br />

Equity Analysis Report<br />

Customers’ Power: A lot of the <strong>Saudi</strong> cement companies have shut down some of their production<br />

lines due to the export ban placed on cement. This reduction in supply is being coupled with an<br />

increase in demand due to the huge ongoing infrastructural projects. While the possibility of excess<br />

demand weakens customers’ power, the standardized nature of the product (cement) raises their<br />

power due to very low switching costs. Thus, customers’ power in the <strong>Saudi</strong> cement industry is<br />

moderate.<br />

Threat of Substitutes: <strong>Cement</strong> is a necessary input in most types of construction, and there is no<br />

real substitute for it in such projects. Thus, the threat of substitutes is very low.<br />

Business Rivalry: The large number of competing firms (13 to be exact) in the <strong>Saudi</strong> cement<br />

industry as well as the standardized nature of the product (cement) intensifies competition.<br />

However, an increase in total cement production is being met with an increase in sales volume due<br />

to growing demand. This makes price wars among the cement companies unlikely. Additionally,<br />

firms do not have to compete fiercely for market share due to the nature of the growing industry.<br />

Firms are able to improve revenues simply because of the expanding market. Furthermore, the<br />

companies are geographical dispersed due to the Kingdom’s size. Thus the business rivalry in the<br />

<strong>Saudi</strong> cement industry is moderate.<br />

Financial Performance<br />

Domestic Sales vs. Exports<br />

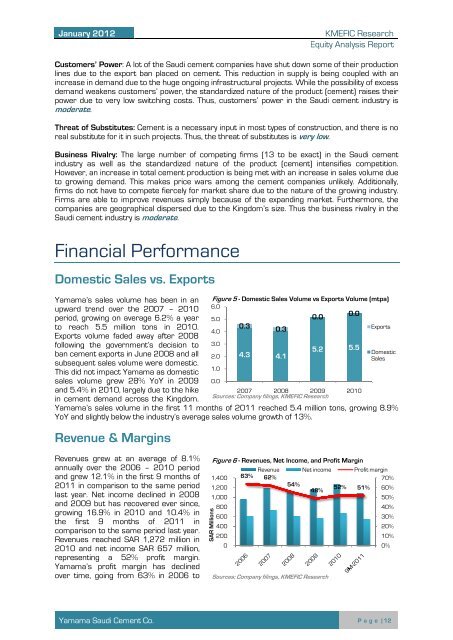

Yamama’s sales volume has been in an Figure 5 - Domestic Sales Volume vs Exports Volume (mtpa)<br />

upward trend over the 2007 – 2010<br />

6.0<br />

period, growing on average 0.0<br />

0.0<br />

6.2% a year 5.0<br />

to reach 5.5 million tons in 2010.<br />

0.3<br />

0.3<br />

Exports<br />

4.0<br />

Exports volume faded away after 2008<br />

following the government’s decision to 3.0<br />

5.2 5.5<br />

ban cement exports in June 2008 and all<br />

Domestic<br />

2.0 4.3 4.1<br />

Sales<br />

subsequent sales volume were domestic.<br />

1.0<br />

This did not impact Yamama as domestic<br />

sales volume grew 28% YoY in 2009<br />

and 5.4% in 2010, largely due to the hike<br />

in cement demand across the Kingdom.<br />

0.0<br />

2007 2008 2009<br />

Sources: <strong>Company</strong> filings, KMEFIC Research<br />

2010<br />

Yamama’s sales volume in the first 11 months of 2011 reached 5.4 million tons, growing 8.9%<br />

YoY and slightly below the industry’s average sales volume growth of 13%.<br />

Revenue & Margins<br />

Revenues grew at an average of 8.1%<br />

annually over the 2006 – 2010 period<br />

and grew 12.1% in the first 9 months of<br />

2011 in comparison to the same period<br />

last year. Net income declined in 2008<br />

and 2009 but has recovered ever since,<br />

growing 16.9% in 2010 and 10.4% in<br />

the first 9 months of 2011 in<br />

comparison to the same period last year.<br />

Revenues reached SAR 1,272 million in<br />

2010 and net income SAR 657 million,<br />

representing a 52% profit margin.<br />

Yamama’s profit margin has declined<br />

over time, going from 63% in 2006 to<br />

Figure 6 - Revenues, Net Income, and Profit Margin<br />

Revenue Net income<br />

Profit margin<br />

1,400 63% 62%<br />

70%<br />

1,200<br />

54%<br />

48%<br />

52% 51% 60%<br />

1,000<br />

50%<br />

SAR Millions<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Sources: <strong>Company</strong> filings, KMEFIC Research<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Yamama <strong>Saudi</strong> <strong>Cement</strong> Co.<br />

P a g e | 12