Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

January 2012<br />

KMEFIC Research<br />

Equity Analysis Report<br />

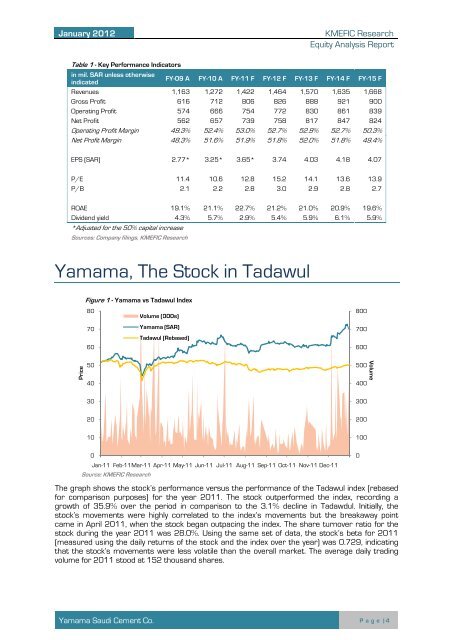

Table 1 - Key Performance Indicators<br />

in mil. SAR unless otherwise<br />

indicated<br />

FY-09 A FY-10 A FY-11 F FY-12 F FY-13 F FY-14 F FY-15 F<br />

Revenues 1,163 1,272 1,422 1,464 1,570 1,635 1,668<br />

Gross Profit 616 712 806 826 888 921 900<br />

Operating Profit 574 666 754 772 830 861 839<br />

Net Profit 562 657 739 758 817 847 824<br />

Operating Profit Margin 49.3% 52.4% 53.0% 52.7% 52.9% 52.7% 50.3%<br />

Net Profit Margin 48.3% 51.6% 51.9% 51.8% 52.0% 51.8% 49.4%<br />

EPS (SAR) 2.77* 3.25* 3.65* 3.74 4.03 4.18 4.07<br />

P/E 11.4 10.6 12.8 15.2 14.1 13.6 13.9<br />

P/B 2.1 2.2 2.8 3.0 2.9 2.8 2.7<br />

ROAE 19.1% 21.1% 22.7% 21.2% 21.0% 20.9% 19.6%<br />

Dividend yield 4.3% 5.7% 2.9% 5.4% 5.9% 6.1% 5.9%<br />

*Adjusted for the 50% capital increase<br />

Sources: <strong>Company</strong> filings, KMEFIC Research<br />

Yamama, The Stock in Tadawul<br />

Figure 1 - Yamama vs Tadawul Index<br />

80<br />

70<br />

60<br />

Volume (000s)<br />

Yamama (SAR)<br />

Tadawul (Rebased)<br />

800<br />

700<br />

600<br />

Price<br />

50<br />

40<br />

500<br />

400<br />

Volume<br />

30<br />

300<br />

20<br />

200<br />

10<br />

100<br />

0<br />

Jan-11 Feb-11Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11<br />

Source: KMEFIC Research<br />

0<br />

The graph shows the stock’s performance versus the performance of the Tadawul index (rebased<br />

for comparison purposes) for the year 2011. The stock outperformed the index, recording a<br />

growth of 35.9% over the period in comparison to the 3.1% decline in Tadawdul. Initially, the<br />

stock’s movements were highly correlated to the index’s movements but the breakaway point<br />

came in April 2011, when the stock began outpacing the index. The share turnover ratio for the<br />

stock during the year 2011 was 28.0%. Using the same set of data, the stock’s beta for 2011<br />

(measured using the daily returns of the stock and the index over the year) was 0.729, indicating<br />

that the stock’s movements were less volatile than the overall market. The average daily trading<br />

volume for 2011 stood at 152 thousand shares.<br />

Yamama <strong>Saudi</strong> <strong>Cement</strong> Co. P a g e | 4