INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

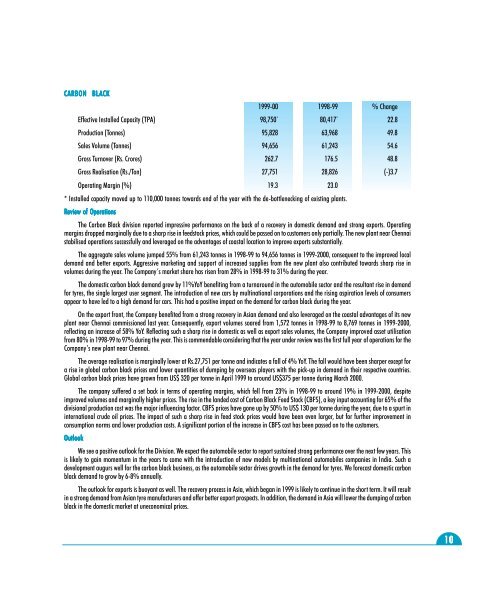

CARBON BLACK<br />

1999-00 1998-99 % Change<br />

Effective Installed Capacity (TPA) 98,750 * 80,417 * 22.8<br />

Production (Tonnes) 95,828 63,968 49.8<br />

Sales Volume (Tonnes) 94,656 61,243 54.6<br />

Gross Turnover (Rs. Crores) 262.7 176.5 48.8<br />

Gross Realisation (Rs./Ton) 27,751 28,826 (-)3.7<br />

Operating Margin (%) 19.3 23.0<br />

* Installed capacity moved up to 110,000 tonnes towards end of the year with the de-bottlenecking of existing plants.<br />

Review of Operations<br />

The Carbon Black division reported impressive performance on the back of a recovery in domestic demand and strong exports. Operating<br />

margins dropped marginally due to a sharp rise in feedstock prices, which could be passed on to customers only partially. The new plant near Chennai<br />

stabilised operations successfully and leveraged on the advantages of coastal location to improve exports substantially.<br />

The aggregate sales volume jumped 55% from 61,243 tonnes in 1998-99 to 94,656 tonnes in 1999-2000, consequent to the improved local<br />

demand and better exports. Aggressive marketing and support of increased supplies from the new plant also contributed towards sharp rise in<br />

volumes during the year. The Company’s market share has risen from 28% in 1998-99 to 31% during the year.<br />

The domestic carbon black demand grew by 11%YoY benefiting from a turnaround in the automobile sector and the resultant rise in demand<br />

for tyres, the single largest user segment. The introduction of new cars by multinational corporations and the rising aspiration levels of consumers<br />

appear to have led to a high demand for cars. This had a positive impact on the demand for carbon black during the year.<br />

On the export front, the Company benefited from a strong recovery in Asian demand and also leveraged on the coastal advantages of its new<br />

plant near Chennai commissioned last year. Consequently, export volumes soared from 1,572 tonnes in 1998-99 to 8,769 tonnes in 1999-2000,<br />

reflecting an increase of 58% YoY. Reflecting such a sharp rise in domestic as well as export sales volumes, the Company improved asset utilisation<br />

from 80% in 1998-99 to 97% during the year. This is commendable considering that the year under review was the first full year of operations for the<br />

Company’s new plant near Chennai.<br />

The average realisation is marginally lower at Rs.27,751 per tonne and indicates a fall of 4% YoY. The fall would have been sharper except for<br />

a rise in global carbon black prices and lower quantities of dumping by overseas players with the pick-up in demand in their respective countries.<br />

Global carbon black prices have grown from US$ 320 per tonne in April 1999 to around US$375 per tonne during March 2000.<br />

The company suffered a set back in terms of operating margins, which fell from 23% in 1998-99 to around 19% in 1999-2000, despite<br />

improved volumes and marginally higher prices. The rise in the landed cost of Carbon Black Feed Stock (CBFS), a key input accounting for 65% of the<br />

divisional production cost was the major influencing factor. CBFS prices have gone up by 50% to US$ 130 per tonne during the year, due to a spurt in<br />

international crude oil prices. The impact of such a sharp rise in feed stock prices would have been even larger, but for further improvement in<br />

consumption norms and lower production costs. A significant portion of the increase in CBFS cost has been passed on to the customers.<br />

Outlook<br />

We see a positive outlook for the Division. We expect the automobile sector to report sustained strong performance over the next few years. This<br />

is likely to gain momentum in the years to come with the introduction of new models by multinational automobiles companies in India. Such a<br />

development augurs well for the carbon black business, as the automobile sector drives growth in the demand for tyres. We forecast domestic carbon<br />

black demand to grow by 6-8% annually.<br />

The outlook for exports is buoyant as well. The recovery process in Asia, which began in 1999 is likely to continue in the short term. It will result<br />

in a strong demand from Asian tyre manufacturers and offer better export prospects. In addition, the demand in Asia will lower the dumping of carbon<br />

black in the domestic market at uneconomical prices.<br />

10