INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Schedules<br />

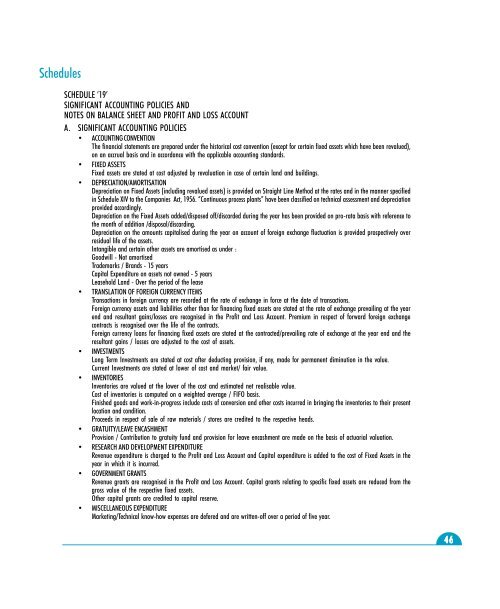

SCHEDULE ‘19’<br />

SIGNIFICANT ACCOUNTING POLICIES <strong>AND</strong><br />

NOTES ON BALANCE SHEET <strong>AND</strong> PROFIT <strong>AND</strong> LOSS ACCOUNT<br />

A. SIGNIFICANT ACCOUNTING POLICIES<br />

• ACCOUNTING CONVENTION<br />

The financial statements are prepared under the historical cost convention (except for certain fixed assets which have been revalued),<br />

on an accrual basis and in accordance with the applicable accounting standards.<br />

• FIXED ASSETS<br />

Fixed assets are stated at cost adjusted by revaluation in case of certain land and buildings.<br />

• DEPRECIATION/AMORTISATION<br />

Depreciation on Fixed Assets (including revalued assets) is provided on Straight Line Method at the rates and in the manner specified<br />

in Schedule XIV to the Companies Act, 1956. “Continuous process plants” have been classified on technical assessment and depreciation<br />

provided accordingly.<br />

Depreciation on the Fixed Assets added/disposed off/discarded during the year has been provided on pro-rata basis with reference to<br />

the month of addition /disposal/discarding.<br />

Depreciation on the amounts capitalised during the year on account of foreign exchange fluctuation is provided prospectively over<br />

residual life of the assets.<br />

Intangible and certain other assets are amortised as under :<br />

Goodwill - Not amortised<br />

Trademarks / Brands - 15 years<br />

Capital Expenditure on assets not owned - 5 years<br />

Leasehold Land - Over the period of the lease<br />

• TRANSLATION OF FOREIGN CURRENCY ITEMS<br />

Transactions in foreign currency are recorded at the rate of exchange in force at the date of transactions.<br />

Foreign currency assets and liabilities other than for financing fixed assets are stated at the rate of exchange prevailing at the year<br />

end and resultant gains/losses are recognised in the Profit and Loss Account. Premium in respect of forward foreign exchange<br />

contracts is recognised over the life of the contracts.<br />

Foreign currency loans for financing fixed assets are stated at the contracted/prevailing rate of exchange at the year end and the<br />

resultant gains / losses are adjusted to the cost of assets.<br />

• INVESTMENTS<br />

Long Term Investments are stated at cost after deducting provision, if any, made for permanent diminution in the value.<br />

Current Investments are stated at lower of cost and market/ fair value.<br />

• INVENTORIES<br />

Inventories are valued at the lower of the cost and estimated net realisable value.<br />

Cost of inventories is computed on a weighted average / FIFO basis.<br />

Finished goods and work-in-progress include costs of conversion and other costs incurred in bringing the inventories to their present<br />

location and condition.<br />

Proceeds in respect of sale of raw materials / stores are credited to the respective heads.<br />

• GRATUITY/LEAVE ENCASHMENT<br />

Provision / Contribution to gratuity fund and provision for leave encashment are made on the basis of actuarial valuation.<br />

• RESEARCH <strong>AND</strong> DEVELOPMENT EXPENDITURE<br />

Revenue expenditure is charged to the Profit and Loss Account and Capital expenditure is added to the cost of Fixed Assets in the<br />

year in which it is incurred.<br />

• GOVERNMENT GRANTS<br />

Revenue grants are recognised in the Profit and Loss Account. Capital grants relating to specific fixed assets are reduced from the<br />

gross value of the respective fixed assets.<br />

Other capital grants are credited to capital reserve.<br />

• MISCELLANEOUS EXPENDITURE<br />

Marketing/Technical know-how expenses are defered and are written-off over a period of five year.<br />

46