INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

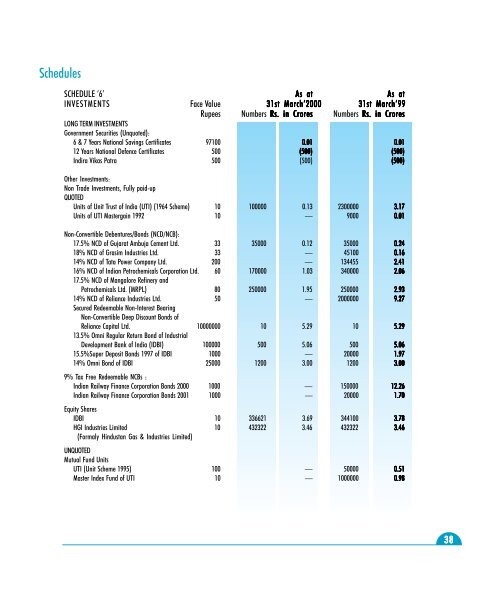

Schedules<br />

SCHEDULE ‘6’<br />

As at<br />

As at<br />

INVESTMENTS Face Value 31st March’2000<br />

31st March’99<br />

Rupees Numbers Rs. in Crores<br />

Numbers Rs. in Crores<br />

LONG TERM INVESTMENTS<br />

Government Securities (Unquoted):<br />

6 & 7 Years National Savings Certificates 97100 0.01 0.01<br />

12 Years National Defence Certificates 500 (500) (500)<br />

Indira Vikas Patra 500 (500) (500)<br />

Other Investments:<br />

Non Trade Investments, Fully paid-up<br />

QUOTED<br />

Units of Unit Trust of India (UTI) (1964 Scheme) 10 100000 0.13 2300000 3.17<br />

Units of UTI Mastergain 1992 10 — 9000 0.01<br />

Non-Convertible Debentures/Bonds (NCD/NCB):<br />

17.5% NCD of Gujarat Ambuja Cement <strong>Ltd</strong>. 33 35000 0.12 35000 0.24<br />

18% NCD of Grasim Industries <strong>Ltd</strong>. 33 — 45100 0.16<br />

14% NCD of Tata Power Company <strong>Ltd</strong>. 200 — 134455 2.41<br />

16% NCD of Indian Petrochemicals Corporation <strong>Ltd</strong>. 60 170000 1.03 340000 2.06<br />

17.5% NCD of Mangalore Refinery and<br />

Petrochemicals <strong>Ltd</strong>. (MRPL) 80 250000 1.95 250000 2.93<br />

14% NCD of Reliance Industries <strong>Ltd</strong>. 50 — 2000000 9.27<br />

Secured Redeemable Non-Interest Bearing<br />

Non-Convertible Deep Discount Bonds of<br />

Reliance Capital <strong>Ltd</strong>. 10000000 10 5.29 10 5.29<br />

13.5% Omni Regular Return Bond of Industrial<br />

Development Bank of India (IDBI) 100000 500 5.06 500 5.06<br />

15.5%Super Deposit Bonds 1997 of IDBI 1000 — 20000 1.97<br />

14% Omni Bond of IDBI 25000 1200 3.00 1200 3.00<br />

9% Tax Free Redeemable NCBs :<br />

Indian Railway Finance Corporation Bonds 2000 1000 — 150000 12.26<br />

Indian Railway Finance Corporation Bonds 2001 1000 — 20000 1.70<br />

Equity Shares<br />

IDBI 10 336621 3.69 344100 3.78<br />

HGI Industries Limited 10 432322 3.46 432322 3.46<br />

(Formaly Hindustan Gas & Industries Limited)<br />

UNQUOTED<br />

Mutual Fund Units<br />

UTI (Unit Scheme 1995) 100 — 50000 0.51<br />

Master Index Fund of UTI 10 — 1000000 0.98<br />

38