INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

INDIAN RAYON AND INDUSTRIES LIMITED - Aditya Birla Nuvo, Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Schedules<br />

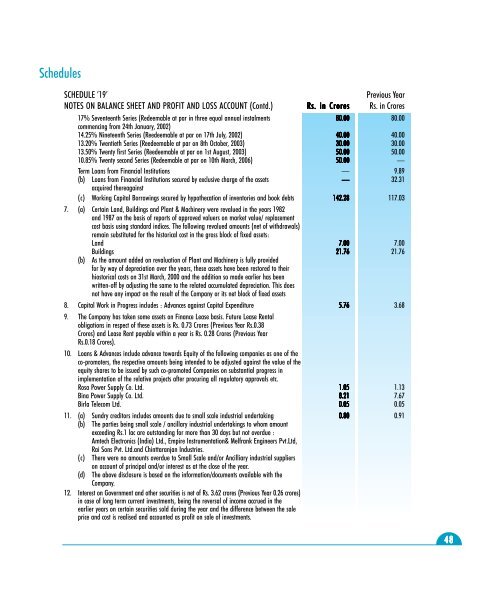

SCHEDULE ‘19’<br />

NOTES ON BALANCE SHEET <strong>AND</strong> PROFIT <strong>AND</strong> LOSS ACCOUNT (Contd.)<br />

Rs. in Crores<br />

Previous Year<br />

Rs. in Crores<br />

17% Seventeenth Series (Redeemable at par in three equal annual instalments 80.00 80.00<br />

commencing from 24th January, 2002)<br />

14.25% Nineteenth Series (Reedeemable at par on 17th July, 2002) 40.00 40.00<br />

13.20% Twentieth Series (Reedeemable at par on 8th October, 2003) 30.00 30.00<br />

13.50% Twenty first Series (Reedeemable at par on 1st August, 2003) 50.00 50.00<br />

10.85% Twenty second Series (Redeemable at par on 10th March, 2006) 50.00 —<br />

Term Loans from Financial Institutions — 9.89<br />

(b) Loans from Financial Institutions secured by exclusive charge of the assets — 32.31<br />

acquired thereagainst<br />

(c) Working Capital Borrowings secured by hypothecation of inventories and book debts 142.28 117.03<br />

7. (a) Certain Land, Buildings and Plant & Machinery were revalued in the years 1982<br />

and 1987 on the basis of reports of approved valuers on market value/ replacement<br />

cost basis using standard indices. The following revalued amounts (net of withdrawals)<br />

remain substituted for the historical cost in the gross block of fixed assets:<br />

Land 7.00 7.00<br />

Buildings 21.76 21.76<br />

(b) As the amount added on revaluation of Plant and Machinery is fully provided<br />

for by way of depreciation over the years, these assets have been restored to their<br />

hiostorical costs on 31st March, 2000 and the addition so made earlier has been<br />

written-off by adjusting the same to the related accumulated depreciation. This does<br />

not have any impact on the result of the Company or its net block of fixed assets<br />

8. Capital Work in Progress includes : Advances against Capital Expenditure 5.76 3.68<br />

9. The Company has taken some assets on Finance Lease basis. Future Lease Rental<br />

obligations in respect of these assets is Rs. 0.73 Crores (Previous Year Rs.0.38<br />

Crores) and Lease Rent payable within a year is Rs. 0.28 Crores (Previous Year<br />

Rs.0.18 Crores).<br />

10. Loans & Advances include advance towards Equity of the following companies as one of the<br />

co-promoters, the respective amounts being intended to be adjusted against the value of the<br />

equity shares to be issued by such co-promoted Companies on substantial progress in<br />

implementation of the relative projects after procuring all regulatory approvals etc.<br />

Rosa Power Supply Co. <strong>Ltd</strong>. 1.05 1.13<br />

Bina Power Supply Co. <strong>Ltd</strong>. 8.21 7.67<br />

<strong>Birla</strong> Telecom <strong>Ltd</strong>. 0.05 0.05<br />

11. (a) Sundry creditors includes amounts due to small scale industrial undertaking 0.80 0.91<br />

(b) The parties being small scale / ancillary industrial undertakings to whom amount<br />

exceeding Rs.1 lac are outstanding for more than 30 days but not overdue :<br />

Amtech Electronics (India) <strong>Ltd</strong>., Empire Instrumentation& Melfrank Engineers Pvt.<strong>Ltd</strong>,<br />

Rai Sons Pvt. <strong>Ltd</strong>.and Chinttaranjan Industries.<br />

(c) There were no amounts overdue to Small Scale and/or Ancilliary industrial suppliers<br />

on account of principal and/or interest as at the close of the year.<br />

(d) The above disclosure is based on the information/documents available with the<br />

Company.<br />

12. Interest on Government and other securities is net of Rs. 3.62 crores (Previous Year 0.26 crores)<br />

in case of long term current investments, being the reversal of income accrued in the<br />

earlier years on certain securities sold during the year and the difference between the sale<br />

price and cost is realised and accounted as profit on sale of investments.<br />

48