Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

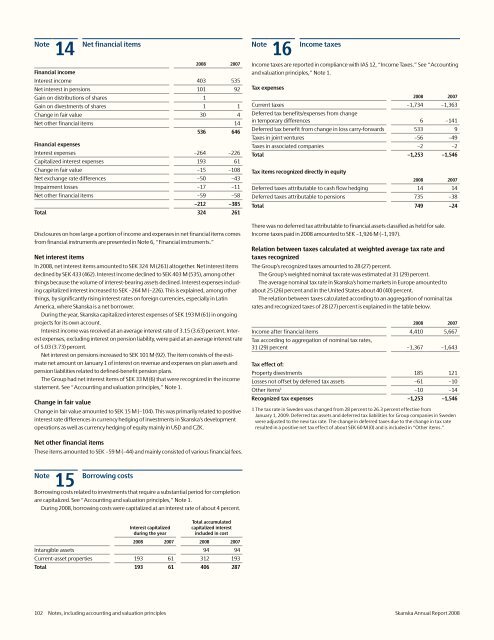

14 Net financial items <strong>2008</strong> 2007<br />

Financial income<br />

Interest income 403 535<br />

Net interest in pensions 101 92<br />

Gain on distributions of shares 1<br />

Gain on divestments of shares 1 1<br />

Change in fair value 30 4<br />

Net other financial items 14<br />

536 646<br />

Financial expenses<br />

Interest expenses –264 –226<br />

Capitalized interest expenses 193 61<br />

Change in fair value –15 –108<br />

Net exchange rate differences –50 –43<br />

Impairment losses –17 –11<br />

Net other financial items –59 –58<br />

–212 –385<br />

Total 324 261<br />

Disclosures on how large a portion of income and expenses in net financial items comes<br />

from financial instruments are presented in Note 6, “Financial instruments.”<br />

Net interest items<br />

In <strong>2008</strong>, net interest items amounted to SEK 324 M (261) altogether. Net interest items<br />

declined by SEK 433 (462). Interest income declined to SEK 403 M (535), among other<br />

things because the volume of interest-bearing assets declined. Interest expenses including<br />

capitalized interest increased to SEK –264 M (–226). This is explained, among other<br />

things, by significantly rising interest rates on foreign currencies, especially in Latin<br />

America, where <strong>Skanska</strong> is a net borrower.<br />

During the year, <strong>Skanska</strong> capitalized interest expenses of SEK 193 M (61) in ongoing<br />

projects for its own account.<br />

Interest income was received at an average interest rate of 3.15 (3.63) percent. Interest<br />

expenses, excluding interest on pension liability, were paid at an average interest rate<br />

of 5.03 (3.73) percent.<br />

Net interest on pensions increased to SEK 101 M (92). The item consists of the estimate<br />

net amount on January 1 of interest on revenue and expenses on plan assets and<br />

pension liabilities related to defined-benefit pension plans.<br />

The Group had net interest items of SEK 33 M (6) that were recognized in the income<br />

statement. See “Accounting and valuation principles,” Note 1.<br />

Change in fair value<br />

Change in fair value amounted to SEK 15 M (–104). This was primarily related to positive<br />

interest rate differences in currency hedging of investments in <strong>Skanska</strong>’s development<br />

operations as well as currency hedging of equity mainly in USD and CZK.<br />

Note<br />

16<br />

Income taxes<br />

Income taxes are reported in compliance with IAS 12, “Income Taxes.” See “Accounting<br />

and valuation principles,” Note 1.<br />

Tax expenses<br />

<strong>2008</strong> 2007<br />

Current taxes –1,734 –1,363<br />

Deferred tax benefits/expenses from change<br />

in temporary differences 6 –141<br />

Deferred tax benefit from change in loss carry-forwards 533 9<br />

Taxes in joint ventures –56 –49<br />

Taxes in associated companies –2 –2<br />

Total –1,253 –1,546<br />

Tax items recognized directly in equity<br />

<strong>2008</strong> 2007<br />

Deferred taxes attributable to cash flow hedging 14 14<br />

Deferred taxes attributable to pensions 735 –38<br />

Total 749 –24<br />

There was no deferred tax attributable to financial assets classified as held for sale.<br />

Income taxes paid in <strong>2008</strong> amounted to SEK –1,926 M (–1,197).<br />

Relation between taxes calculated at weighted average tax rate and<br />

taxes recognized<br />

The Group’s recognized taxes amounted to 28 (27) percent.<br />

The Group’s weighted nominal tax rate was estimated at 31 (29) percent.<br />

The average nominal tax rate in <strong>Skanska</strong>’s home markets in Europe amounted to<br />

about 25 (26) percent and in the United States about 40 (40) percent.<br />

The relation between taxes calculated according to an aggregation of nominal tax<br />

rates and recognized taxes of 28 (27) percent is explained in the table below.<br />

<strong>2008</strong> 2007<br />

Income after financial items 4,410 5,667<br />

Tax according to aggregation of nominal tax rates,<br />

31 (29) percent –1,367 –1,643<br />

Tax effect of:<br />

Property divestments 185 121<br />

Losses not offset by deferred tax assets –61 –10<br />

Other items 1 –10 –14<br />

Recognized tax expenses –1,253 –1,546<br />

1 The tax rate in Sweden was changed from 28 percent to 26.3 percent effective from<br />

January 1, 2009. Deferred tax assets and deferred tax liabilities for Group companies in Sweden<br />

were adjusted to the new tax rate. The change in deferred taxes due to the change in tax rate<br />

resulted in a positive net tax effect of about SEK 60 M (0) and is included in “Other items.”<br />

Net other financial items<br />

These items amounted to SEK –59 M (–44) and mainly consisted of various financial fees.<br />

Note<br />

15<br />

Borrowing costs<br />

Borrowing costs related to investments that require a substantial period for completion<br />

are capitalized. See “Accounting and valuation principles,” Note 1.<br />

During <strong>2008</strong>, borrowing costs were capitalized at an interest rate of about 4 percent.<br />

Interest capitalized<br />

during the year<br />

Total accumulated<br />

capitalized interest<br />

included in cost<br />

<strong>2008</strong> 2007 <strong>2008</strong> 2007<br />

Intangible assets 94 94<br />

Current-asset properties 193 61 312 193<br />

Total 193 61 406 287<br />

102 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>