Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

06 Continued<br />

Credit risk<br />

The maximum credit exposure for financial assets on the balance sheet date is equivalent<br />

to their fair value. This credit risk is divided below into financial credit risk, which<br />

refers to risk in interest-bearing assets, and customer credit risk, which refers to the risk<br />

in trade accounts receivable. The risk in other operating receivables is also described.<br />

Financial credit risk − Risk in interest-bearing assets and derivatives<br />

This is the risk that the Group runs in its relations with financial counterparties in the<br />

case of deposits of surplus funds, bank account balances and investments in financial<br />

assets. Credit risk also arises when using derivatives and consists of the risk that a<br />

potential gain will not be realized in case the counterparty does not fulfill its part of the<br />

contract.<br />

In order to reduce the credit risk in derivatives, <strong>Skanska</strong> has signed standardized netting<br />

agreements with all financial counterparties with which it enters into derivative<br />

contracts.<br />

<strong>Skanska</strong> endeavors to limit the number of financial counterparties, which must possess<br />

a rating at least equivalent to BBB+ at Standard & Poor’s or the equivalent rating at<br />

Moody’s. The permitted exposure volume per counterparty is dependent on the counterparty’s<br />

credit rating and the maturity of the exposure.<br />

Exposure was SEK 15,411 M and maturity mainly within 3 months, as indicated by the<br />

table headed “Liquidity reserve and maturity structure.”<br />

At year-end, past-due interest-bearing assets and derivatives were SEK 0 M (0).<br />

Impairment losses on interest-bearing receivables were SEK 0 M (0).<br />

Customer credit risk − Risk in trade accounts receivable<br />

<strong>Skanska</strong>’s credit risk with regard to trade receivables has a high degree of risk diversification,<br />

due to the large number of projects of varying sizes and types with numerous different<br />

customer categories in a large number of geographic markets.<br />

The portion of <strong>Skanska</strong>’s operations related to construction projects extends only<br />

limited credit, since projects are invoiced in advance as much as possible. In other operations,<br />

the extension of credit is limited to customary invoicing periods.<br />

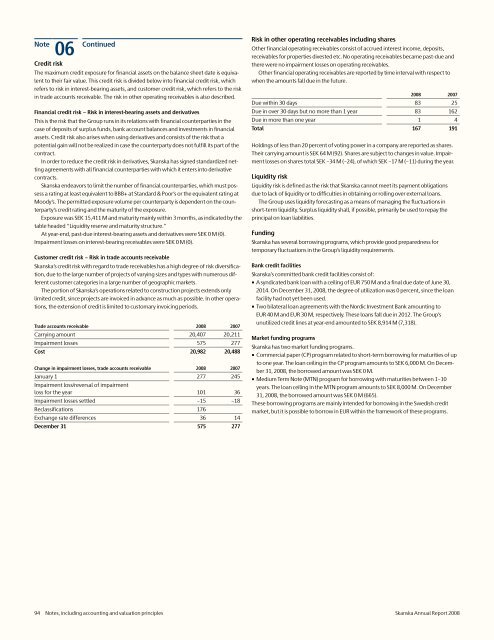

Trade accounts receivable <strong>2008</strong> 2007<br />

Carrying amount 20,407 20,211<br />

Impairment losses 575 277<br />

Cost 20,982 20,488<br />

Change in impairment losses, trade accounts receivable <strong>2008</strong> 2007<br />

January 1 277 245<br />

Impairment loss/reversal of impairment<br />

loss for the year 101 36<br />

Impairment losses settled –15 –18<br />

Reclassifications 176<br />

Exchange rate differences 36 14<br />

December 31 575 277<br />

Risk in other operating receivables including shares<br />

Other financial operating receivables consist of accrued interest income, deposits,<br />

receivables for properties divested etc. No operating receivables became past-due and<br />

there were no impairment losses on operating receivables.<br />

Other financial operating receivables are reported by time interval with respect to<br />

when the amounts fall due in the future.<br />

<strong>2008</strong> 2007<br />

Due within 30 days 83 25<br />

Due in over 30 days but no more than 1 year 83 162<br />

Due in more than one year 1 4<br />

Total 167 191<br />

Holdings of less than 20 percent of voting power in a company are reported as shares.<br />

Their carrying amount is SEK 64 M (92). Shares are subject to changes in value. Impairment<br />

losses on shares total SEK –34 M (–24), of which SEK –17 M (–11) during the year.<br />

Liquidity risk<br />

Liquidity risk is defined as the risk that <strong>Skanska</strong> cannot meet its payment obligations<br />

due to lack of liquidity or to difficulties in obtaining or rolling over external loans.<br />

The Group uses liquidity forecasting as a means of managing the fluctuations in<br />

short-term liquidity. Surplus liquidity shall, if possible, primarily be used to repay the<br />

principal on loan liabilities.<br />

Funding<br />

<strong>Skanska</strong> has several borrowing programs, which provide good preparedness for<br />

temporary fluctuations in the Group’s liquidity requirements.<br />

Bank credit facilities<br />

<strong>Skanska</strong>’s committed bank credit facilities consist of:<br />

• A syndicated bank loan with a ceiling of EUR 750 M and a final due date of June 30,<br />

2014. On December 31, <strong>2008</strong>, the degree of utilization was 0 percent, since the loan<br />

facility had not yet been used.<br />

• Two bilateral loan agreements with the Nordic Investment Bank amounting to<br />

EUR 40 M and EUR 30 M, respectively. These loans fall due in 2012. The Group’s<br />

unutilized credit lines at year-end amounted to SEK 8,914 M (7,318).<br />

Market funding programs<br />

<strong>Skanska</strong> has two market funding programs.<br />

• Commercial paper (CP) program related to short-term borrowing for maturities of up<br />

to one year. The loan ceiling in the CP program amounts to SEK 6,000 M. On December<br />

31, <strong>2008</strong>, the borrowed amount was SEK 0 M.<br />

• Medium Term Note (MTN) program for borrowing with maturities between 1–10<br />

years. The loan ceiling in the MTN program amounts to SEK 8,000 M. On December<br />

31, <strong>2008</strong>, the borrowed amount was SEK 0 M (665).<br />

These borrowing programs are mainly intended for borrowing in the Swedish credit<br />

market, but it is possible to borrow in EUR within the framework of these programs.<br />

94 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>