Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

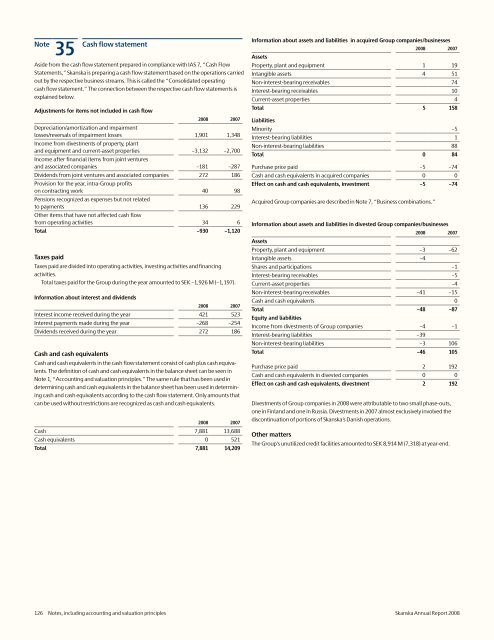

35 Cash flow statement Information about assets and liabilities in acquired Group companies/businesses<br />

<strong>2008</strong> 2007<br />

Assets<br />

Aside from the cash flow statement prepared in compliance with IAS 7, “Cash Flow Property, plant and equipment 1 19<br />

Statements,” <strong>Skanska</strong> is preparing a cash flow statement based on the operations carried Intangible assets 4 51<br />

out by the respective business streams. This is called the “Consolidated operating<br />

Non-interest-bearing receivables 74<br />

cash flow statement.” The connection between the respective cash flow statements is Interest-bearing receivables 10<br />

explained below.<br />

Current-asset properties 4<br />

Adjustments for items not included in cash flow<br />

Total 5 158<br />

<strong>2008</strong> 2007 Liabilities<br />

Depreciation/amortization and impairment<br />

Minority –5<br />

losses/reversals of impairment losses 1,901 1,348<br />

Interest-bearing liabilities 1<br />

Income from divestments of property, plant<br />

Non-interest-bearing liabilities 88<br />

and equipment and current-asset properties –3,132 –2,700<br />

Total 0 84<br />

Income after financial items from joint ventures<br />

and associated companies –181 –287 Purchase price paid –5 –74<br />

Dividends from joint ventures and associated companies 272 186 Cash and cash equivalents in acquired companies 0 0<br />

Provision for the year, intra-Group profits<br />

Effect on cash and cash equivalents, investment –5 –74<br />

on contracting work 40 98<br />

Pensions recognized as expenses but not related<br />

to payments 136 229<br />

Acquired Group companies are described in Note 7, “Business combinations.”<br />

Other items that have not affected cash flow<br />

from operating activities 34 6 Information about assets and liabilities in divested Group companies/businesses<br />

Total –930 –1,120<br />

Taxes paid<br />

Taxes paid are divided into operating activities, investing activities and financing<br />

activities.<br />

Total taxes paid for the Group during the year amounted to SEK –1,926 M (–1,197).<br />

Information about interest and dividends<br />

<strong>2008</strong> 2007<br />

Interest income received during the year 421 523<br />

Interest payments made during the year –268 –254<br />

Dividends received during the year 272 186<br />

Cash and cash equivalents<br />

Cash and cash equivalents in the cash flow statement consist of cash plus cash equivalents.<br />

The definition of cash and cash equivalents in the balance sheet can be seen in<br />

Note 1, “Accounting and valuation principles.” The same rule that has been used in<br />

determining cash and cash equivalents in the balance sheet has been used in determining<br />

cash and cash equivalents according to the cash flow statement. Only amounts that<br />

can be used without restrictions are recognized as cash and cash equivalents.<br />

<strong>2008</strong> 2007<br />

Cash 7,881 13,688<br />

Cash equivalents 0 521<br />

Total 7,881 14,209<br />

<strong>2008</strong> 2007<br />

Assets<br />

Property, plant and equipment –3 –62<br />

Intangible assets –4<br />

Shares and participations –1<br />

Interest-bearing receivables –5<br />

Current-asset properties –4<br />

Non-interest-bearing receivables –41 –15<br />

Cash and cash equivalents 0<br />

Total –48 –87<br />

Equity and liabilities<br />

Income from divestments of Group companies –4 –1<br />

Interest-bearing liabilities –39<br />

Non-interest-bearing liabilities –3 106<br />

Total –46 105<br />

Purchase price paid 2 192<br />

Cash and cash equivalents in divested companies 0 0<br />

Effect on cash and cash equivalents, divestment 2 192<br />

Divestments of Group companies in <strong>2008</strong> were attributable to two small phase-outs,<br />

one in Finland and one in Russia. Divestments in 2007 almost exclusively involved the<br />

discontinuation of portions of <strong>Skanska</strong>’s Danish operations.<br />

Other matters<br />

The Group’s unutilized credit facilities amounted to SEK 8,914 M (7,318) at year-end.<br />

126 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>