Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

property investors. Land value also increases as permitting<br />

risks diminish. A major step in value enhancement<br />

occurs when a parcel of undeveloped land is transformed<br />

into a building right. The process leading up to an<br />

approved commercial development plan may take several<br />

years. <strong>Skanska</strong> plays a proactive role, working closely<br />

with local government bodies in planning processes for<br />

land use, zoning and commercial development.<br />

Large-scale leasing sharply increases the value of the<br />

project. Leasing activity begins at an early stage. In many<br />

cases, long-term leases are signed with major tenants as<br />

early as the planning stage, or within a short time after<br />

construction work begins. By the completion date, the<br />

goal is to have leased most premises.<br />

Value increases further when the building right is turned<br />

into a completed project that generates rental income.<br />

In some cases, projects that have been fully leased are<br />

divested even before completion.<br />

Close collaboration<br />

To ensure that the development process results in appropriate<br />

Värdeskapande and efficient i Kommersiell commercial utveckling space, <strong>Skanska</strong> collaborates<br />

Värde closely in its design and planning work with tenants<br />

and potential buyers. Carrying out commercial 6. Försäljning development<br />

successfully on a long-term 5. basis Förvaltning is also facilitated<br />

4. Byggande<br />

by a limited portfolio of completed projects. Managing<br />

these properties provides daily contact with the leasing<br />

3. Uthyrning<br />

market. This, in turn, offers insights about changes in<br />

customer preferences and also generates new projects.<br />

2. Design och projektering<br />

Owning a portfolio of completed properties also lends<br />

flexibility 1. Planläggning to the divestment och bygglovprocess, because it enables<br />

<strong>Skanska</strong> to time the divestment of these properties based<br />

Tid<br />

on market conditions.<br />

18–36 månader<br />

Kapitalexponering<br />

i pågående projekt<br />

Mkr<br />

3 000<br />

2 500<br />

2 000<br />

1 500<br />

1 000<br />

500<br />

0<br />

1998 2000 2002 2004 2006 <strong>2008</strong><br />

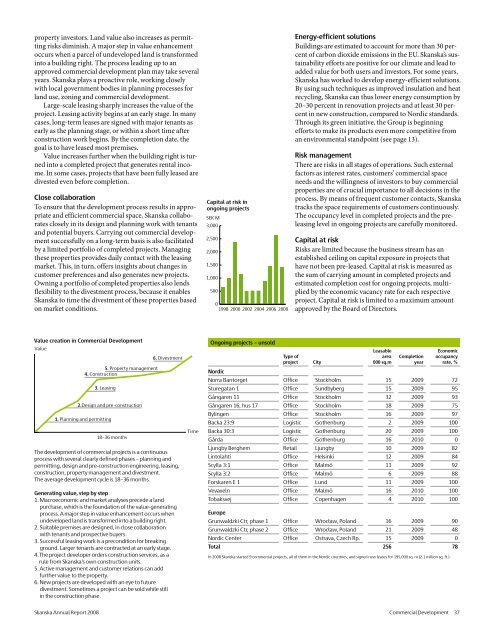

Capital at risk in<br />

ongoing projects<br />

SEK M<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

1998 2000 2002 2004 2006 <strong>2008</strong><br />

Energy-efficient solutions<br />

Buildings are estimated to account for more than 30 percent<br />

of carbon dioxide emissions in the EU. <strong>Skanska</strong>’s sustainability<br />

efforts are positive for our climate and lead to<br />

added value for both users and investors. For some years,<br />

<strong>Skanska</strong> has worked to develop energy-efficient solutions.<br />

By using such techniques as improved insulation and heat<br />

recycling, <strong>Skanska</strong> can thus lower energy consumption by<br />

20–30 percent in renovation projects and at least 30 percent<br />

in new construction, compared to Nordic standards.<br />

Through its green initiative, the Group is beginning<br />

efforts to make its products even more competitive from<br />

an environmental standpoint (see page 13).<br />

Risk management<br />

There are risks in all stages of operations. Such external<br />

factors as interest rates, customers’ commercial space<br />

needs and the willingness of investors to buy commercial<br />

properties are of crucial importance to all decisions in the<br />

process. By means of frequent customer contacts, <strong>Skanska</strong><br />

tracks the space requirements of customers continuously.<br />

The occupancy level in completed projects and the preleasing<br />

level in ongoing projects are carefully monitored.<br />

Capital at risk<br />

Risks are limited because the business stream has an<br />

established ceiling on capital exposure in projects that<br />

have not been pre-leased. Capital at risk is measured as<br />

the sum of carrying amount in completed projects and<br />

estimated completion cost for ongoing projects, multiplied<br />

by the economic vacancy rate for each respective<br />

project. Capital at risk is limited to a maximum amount<br />

approved by the Board of Directors.<br />

Value creation in Commercial Development<br />

Value<br />

3. Leasing<br />

2.Design and pre-construction<br />

1. Planning and permitting<br />

5. Property management<br />

4. Construction<br />

18–36 months<br />

6. Divestment<br />

The development of commercial projects is a continuous<br />

process with several clearly defined phases – planning and<br />

permitting, design and pre-construction engineering, leasing,<br />

construction, property management and divestment.<br />

The average development cycle is 18–36 months.<br />

Generating value, step by step<br />

1. Macroeconomic and market analyses precede a land<br />

purchase, which is the foundation of the value-generating<br />

process. A major step in value enhancement occurs when<br />

undeveloped land is transformed into a building right.<br />

2. Suitable premises are designed, in close collaboration<br />

with tenants and prospective buyers.<br />

3. Successful leasing work is a precondition for breaking<br />

ground. Larger tenants are contracted at an early stage.<br />

4. The project developer orders construction services, as a<br />

rule from <strong>Skanska</strong>’s own construction units.<br />

5. Active management and customer relations can add<br />

further value to the property.<br />

6. New projects are developed with an eye to future<br />

divestment. Sometimes a project can be sold while still<br />

in the construction phase.<br />

Time<br />

Ongoing projects – unsold<br />

Type of<br />

project<br />

City<br />

Leasable<br />

area<br />

000 sq.m<br />

Completion<br />

year<br />

Economic<br />

occupancy<br />

rate, %<br />

Nordic<br />

Norra Bantorget Office Stockholm 15 2009 72<br />

Sturegatan 1 Office Sundbyberg 15 2009 95<br />

Gångaren 11 Office Stockholm 32 2009 93<br />

Gångaren 16, hus 17 Office Stockholm 18 2009 75<br />

Bylingen Office Stockholm 16 2009 97<br />

Backa 23:9 Logistic Gothenburg 2 2009 100<br />

Backa 30:3 Logistic Gothenburg 20 2009 100<br />

Gårda Office Gothenburg 16 2010 0<br />

Ljungby Berghem Retail Ljungby 10 2009 82<br />

Lintolahti Office Helsinki 12 2009 84<br />

Scylla 3:1 Office Malmö 11 2009 92<br />

Scylla 3:2 Office Malmö 6 2009 88<br />

Forskaren E 1 Office Lund 11 2009 100<br />

Vevaxeln Office Malmö 16 2010 100<br />

Tobaksvej Office Copenhagen 4 2010 100<br />

Europe<br />

Grunwaldzki Ctr, phase 1 Office Wrocław, Poland 16 2009 90<br />

Grunwaldzki Ctr, phase 2 Office Wrocław, Poland 21 2009 48<br />

Nordic Center Office Ostrava, Czech Rp. 15 2009 0<br />

Total 256 78<br />

In <strong>2008</strong> <strong>Skanska</strong> started 9 commercial projects, all of them in the Nordic countries, and signed new leases for 195,000 sq. m (2.1 million sq. ft.).<br />

<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> Commercial Development 37