Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

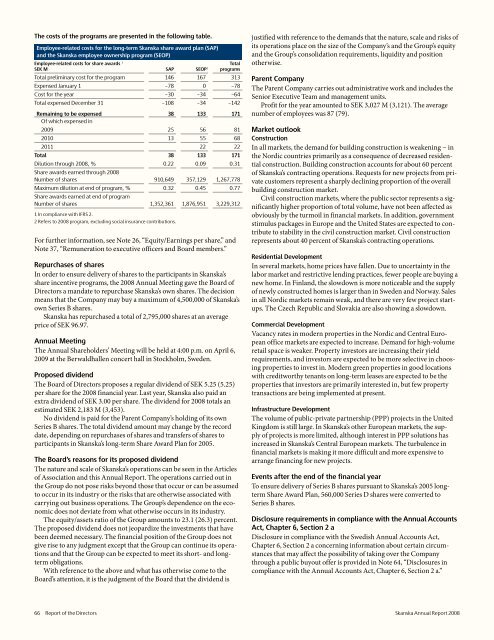

The costs of the programs are presented in the following table.<br />

Total<br />

Employee-related costs for the long-term <strong>Skanska</strong> share award plan (SAP)<br />

and the <strong>Skanska</strong> employee ownership program (SEOP)<br />

Employee-related costs for share awards 1<br />

SEK M SAP SEOP 2 programs<br />

Total preliminary cost for the program 146 167 313<br />

Expensed January 1 –78 0 –78<br />

Cost for the year –30 –34 –64<br />

Total expensed December 31 –108 –34 –142<br />

Remaining to be expensed 38 133 171<br />

Of which expensed in<br />

2009 25 56 81<br />

2010 13 55 68<br />

2011 22 22<br />

Total 38 133 171<br />

Dilution through <strong>2008</strong>, % 0.22 0.09 0.31<br />

Share awards earned through <strong>2008</strong><br />

Number of shares 910,649 357,129 1,267,778<br />

Maximum dilution at end of program, % 0.32 0.45 0.77<br />

Share awards earned at end of program<br />

Number of shares 1,352,361 1,876,951 3,229,312<br />

1 In compliance with IFRS 2.<br />

2 Refers to <strong>2008</strong> program, excluding social insurance contributions.<br />

For further information, see Note 26, “Equity/Earnings per share,” and<br />

Note 37, “Remuneration to executive officers and Board members.”<br />

Repurchases of shares<br />

In order to ensure delivery of shares to the participants in <strong>Skanska</strong>’s<br />

share incentive programs, the <strong>2008</strong> <strong>Annual</strong> Meeting gave the Board of<br />

Directors a mandate to repurchase <strong>Skanska</strong>’s own shares. The decision<br />

means that the Company may buy a maximum of 4,500,000 of <strong>Skanska</strong>’s<br />

own Series B shares.<br />

<strong>Skanska</strong> has repurchased a total of 2,795,000 shares at an average<br />

price of SEK 96.97.<br />

<strong>Annual</strong> Meeting<br />

The <strong>Annual</strong> Shareholders’ Meeting will be held at 4:00 p.m. on April 6,<br />

2009 at the Berwaldhallen concert hall in Stockholm, Sweden.<br />

Proposed dividend<br />

The Board of Directors proposes a regular dividend of SEK 5.25 (5.25)<br />

per share for the <strong>2008</strong> financial year. Last year, <strong>Skanska</strong> also paid an<br />

extra dividend of SEK 3.00 per share. The dividend for <strong>2008</strong> totals an<br />

estimated SEK 2,183 M (3,453).<br />

No dividend is paid for the Parent Company’s holding of its own<br />

Series B shares. The total dividend amount may change by the record<br />

date, depending on repurchases of shares and transfers of shares to<br />

participants in <strong>Skanska</strong>’s long-term Share Award Plan for 2005.<br />

The Board’s reasons for its proposed dividend<br />

The nature and scale of <strong>Skanska</strong>’s operations can be seen in the Articles<br />

of Association and this <strong>Annual</strong> <strong>Report</strong>. The operations carried out in<br />

the Group do not pose risks beyond those that occur or can be assumed<br />

to occur in its industry or the risks that are otherwise associated with<br />

carrying out business operations. The Group’s dependence on the economic<br />

does not deviate from what otherwise occurs in its industry.<br />

The equity/assets ratio of the Group amounts to 23.1 (26.3) percent.<br />

The proposed dividend does not jeopardize the investments that have<br />

been deemed necessary. The financial position of the Group does not<br />

give rise to any judgment except that the Group can continue its operations<br />

and that the Group can be expected to meet its short- and longterm<br />

obligations.<br />

With reference to the above and what has otherwise come to the<br />

Board’s attention, it is the judgment of the Board that the dividend is<br />

justified with reference to the demands that the nature, scale and risks of<br />

its operations place on the size of the Company’s and the Group’s equity<br />

and the Group’s consolidation requirements, liquidity and position<br />

otherwise.<br />

Parent Company<br />

The Parent Company carries out administrative work and includes the<br />

Senior Executive Team and management units.<br />

Profit for the year amounted to SEK 3,027 M (3,121). The average<br />

number of employees was 87 (79).<br />

Market outlook<br />

Construction<br />

In all markets, the demand for building construction is weakening − in<br />

the Nordic countries primarily as a consequence of decreased residential<br />

construction. Building construction accounts for about 60 percent<br />

of <strong>Skanska</strong>’s contracting operations. Requests for new projects from private<br />

customers represent a sharply declining proportion of the overall<br />

building construction market.<br />

Civil construction markets, where the public sector represents a significantly<br />

higher proportion of total volume, have not been affected as<br />

obviously by the turmoil in financial markets. In addition, government<br />

stimulus packages in Europe and the United States are expected to contribute<br />

to stability in the civil construction market. Civil construction<br />

represents about 40 percent of <strong>Skanska</strong>’s contracting operations.<br />

Residential Development<br />

In several markets, home prices have fallen. Due to uncertainty in the<br />

labor market and restrictive lending practices, fewer people are buying a<br />

new home. In Finland, the slowdown is more noticeable and the supply<br />

of newly constructed homes is larger than in Sweden and Norway. Sales<br />

in all Nordic markets remain weak, and there are very few project startups.<br />

The Czech Republic and Slovakia are also showing a slowdown.<br />

Commercial Development<br />

Vacancy rates in modern properties in the Nordic and Central European<br />

office markets are expected to increase. Demand for high-volume<br />

retail space is weaker. Property investors are increasing their yield<br />

requirements, and investors are expected to be more selective in choosing<br />

properties to invest in. Modern green properties in good locations<br />

with creditworthy tenants on long-term leases are expected to be the<br />

properties that investors are primarily interested in, but few property<br />

transactions are being implemented at present.<br />

Infrastructure Development<br />

The volume of public-private partnership (PPP) projects in the United<br />

Kingdom is still large. In <strong>Skanska</strong>’s other European markets, the supply<br />

of projects is more limited, although interest in PPP solutions has<br />

increased in <strong>Skanska</strong>’s Central European markets. The turbulence in<br />

financial markets is making it more difficult and more expensive to<br />

arrange financing for new projects.<br />

Events after the end of the financial year<br />

To ensure delivery of Series B shares pursuant to <strong>Skanska</strong>’s 2005 longterm<br />

Share Award Plan, 560,000 Series D shares were converted to<br />

Series B shares.<br />

Disclosure requirements in compliance with the <strong>Annual</strong> Accounts<br />

Act, Chapter 6, Section 2 a<br />

Disclosure in compliance with the Swedish <strong>Annual</strong> Accounts Act,<br />

Chapter 6, Section 2 a concerning information about certain circumstances<br />

that may affect the possibility of taking over the Company<br />

through a public buyout offer is provided in Note 64, “Disclosures in<br />

compliance with the <strong>Annual</strong> Accounts Act, Chapter 6, Section 2 a.”<br />

66 <strong>Report</strong> of the Directors <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>