Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

Annual Report 2008 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

28 Continued<br />

The ITP 1 occupational pension plan in Sweden is a defined-contribution plan. <strong>Skanska</strong><br />

pays premiums for employees covered by ITP 1, and each employee selects a manager.<br />

The Company offers employees the opportunity to select <strong>Skanska</strong> as the manager. For<br />

employees who have selected <strong>Skanska</strong> as their manager, there is a guaranteed minimum<br />

amount that the employee will receive upon retirement. This guarantee means that<br />

the portion of the ITP plan for which <strong>Skanska</strong> is the manager is recognized as a definedbenefit<br />

plan. The net amount of obligations and plan assets for ITP 1 managed by <strong>Skanska</strong><br />

is recognized in the Company’s balance sheet. This net amount was marginal, since<br />

payments into this portion of the plan began late in <strong>2008</strong>.<br />

The ITP 2 occupational pension plan in Sweden is a defined-benefit plan. A small<br />

portion is secured by insurance from the retirement insurance company Alecta. This is<br />

a multi-employer insurance plan, and there is insufficient information to report these<br />

obligations as a defined-benefit plan. Pensions secured by insurance from Alecta are<br />

therefore reported as a defined-contribution plan.<br />

Defined-contribution plans<br />

These plans mainly cover retirement pension, disability pension and family pension. The<br />

premiums are paid regularly during the year by the respective Group company to separate<br />

legal entities, for example insurance companies. The size of the premium is based<br />

on salary. The pension expense for the period is included in the income statement.<br />

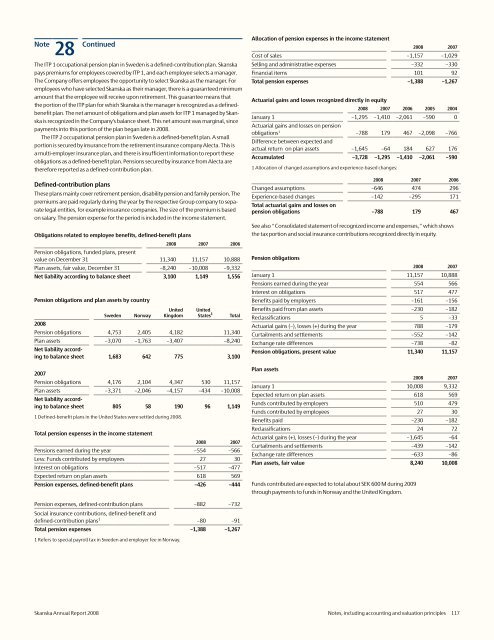

Obligations related to employee benefits, defined-benefit plans<br />

<strong>2008</strong> 2007 2006<br />

Pension obligations, funded plans, present<br />

value on December 31 11,340 11,157 10,888<br />

Plan assets, fair value, December 31 –8,240 –10,008 –9,332<br />

Net liability according to balance sheet 3,100 1,149 1,556<br />

Pension obligations and plan assets by country<br />

Sweden<br />

Norway<br />

United<br />

Kingdom<br />

United<br />

States 1<br />

<strong>2008</strong><br />

Pension obligations 4,753 2,405 4,182 11,340<br />

Total<br />

Plan assets –3,070 –1,763 –3,407 –8,240<br />

Net liability according<br />

to balance sheet 1,683 642 775 3,100<br />

2007<br />

Pension obligations 4,176 2,104 4,347 530 11,157<br />

Plan assets –3,371 –2,046 –4,157 –434 –10,008<br />

Net liability according<br />

to balance sheet 805 58 190 96 1,149<br />

1 Defined-benefit plans in the United States were settled during <strong>2008</strong>.<br />

Total pension expenses in the income statement<br />

<strong>2008</strong> 2007<br />

Pensions earned during the year –554 –566<br />

Less: Funds contributed by employees 27 30<br />

Interest on obligations –517 –477<br />

Expected return on plan assets 618 569<br />

Pension expenses, defined-benefit plans –426 –444<br />

Allocation of pension expenses in the income statement<br />

Actuarial gains and losses recognized directly in equity<br />

<strong>2008</strong> 2007 2006 2005 2004<br />

January 1 –1,295 –1,410 –2,061 –590 0<br />

Actuarial gains and losses on pension<br />

obligations 1 –788 179 467 –2,098 –766<br />

Difference between expected and<br />

actual return on plan assets –1,645 –64 184 627 176<br />

Accumulated –3,728 –1,295 –1,410 –2,061 –590<br />

1 Allocation of changed assumptions and experience-based changes:<br />

Pension obligations<br />

<strong>2008</strong> 2007<br />

Cost of sales –1,157 –1,029<br />

Selling and administrative expenses –332 –330<br />

Financial items 101 92<br />

Total pension expenses –1,388 –1,267<br />

<strong>2008</strong> 2007 2006<br />

Changed assumptions –646 474 296<br />

Experience-based changes –142 –295 171<br />

Total actuarial gains and losses on<br />

pension obligations –788 179 467<br />

See also “Consolidated statement of recognized income and expenses,” which shows<br />

the tax portion and social insurance contributions recognized directly in equity.<br />

<strong>2008</strong> 2007<br />

January 1 11,157 10,888<br />

Pensions earned during the year 554 566<br />

Interest on obligations 517 477<br />

Benefits paid by employers –161 –156<br />

Benefits paid from plan assets –230 –182<br />

Reclassifications 5 –33<br />

Actuarial gains (–), losses (+) during the year 788 –179<br />

Curtailments and settlements –552 –142<br />

Exchange rate differences –738 –82<br />

Pension obligations, present value 11,340 11,157<br />

Plan assets<br />

<strong>2008</strong> 2007<br />

January 1 10,008 9,332<br />

Expected return on plan assets 618 569<br />

Funds contributed by employers 510 479<br />

Funds contributed by employees 27 30<br />

Benefits paid –230 –182<br />

Reclassifications 24 72<br />

Actuarial gains (+), losses (–) during the year –1,645 –64<br />

Curtailments and settlements –439 –142<br />

Exchange rate differences –633 –86<br />

Plan assets, fair value 8,240 10,008<br />

Funds contributed are expected to total about SEK 600 M during 2009<br />

through payments to funds in Norway and the United Kingdom.<br />

Pension expenses, defined-contribution plans –882 –732<br />

Social insurance contributions, defined-benefit and<br />

defined-contribution plans 1 –80 –91<br />

Total pension expenses –1,388 –1,267<br />

1 Refers to special payroll tax in Sweden and employer fee in Norway.<br />

<strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> Notes, including accounting and valuation principles 117