Annual Report 2004 - Charles Stewart Mott Foundation

Annual Report 2004 - Charles Stewart Mott Foundation

Annual Report 2004 - Charles Stewart Mott Foundation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO FINANCIAL STATEMENTS<br />

A. Mission & Grant Programs:<br />

The <strong>Charles</strong> <strong>Stewart</strong> <strong>Mott</strong> <strong>Foundation</strong> is a private grantmaking foundation established in 1926 in Flint,<br />

Michigan. The <strong>Foundation</strong>’s mission is “to support efforts that promote a just, equitable and sustainable<br />

society.” The <strong>Foundation</strong>’s grantmaking activity is organized into four major programs: Civil Society,<br />

Environment, Flint Area and Pathways Out of Poverty. Other grantmaking opportunities, which do not match<br />

the major programs, are investigated through the <strong>Foundation</strong>’s Exploratory and Special Projects program.<br />

B. Accounting Policies:<br />

The following is a summary of significant accounting policies followed in the preparation of these<br />

financial statements.<br />

Estimates<br />

The preparation of financial statements in conformity with generally accepted accounting principles<br />

requires management to make estimates and assumptions that affect the reported amounts of assets<br />

and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements<br />

and the reported amounts of revenues and expenses during the reporting period. Actual results could<br />

differ from those estimates.<br />

Method of Accounting<br />

The financial statements have been prepared on the accrual basis of accounting, which includes<br />

recognition of dividends, interest, and other income and expenses as earned or incurred. Trustee and<br />

Executive Committee grant actions are recognized on the date of the action. Grants by the President or<br />

Executive Committee by specific authority conferred by the Trustees are recognized on the date the<br />

authority is exercised.<br />

Investments<br />

Investments are recorded on the trade date and are stated at market value based primarily on December 31<br />

published quotations. Gains and losses from sales of securities are determined on an average cost basis.<br />

Investments in limited partnerships are generally recorded at capital account value. The capital account<br />

is adjusted for the <strong>Foundation</strong>’s proportionate share of undistributed earnings/losses as reported on<br />

Schedule K-1 received from the partnership at year end and adjusted based on the fair value of the<br />

underlying securities held by the partnership. The <strong>Foundation</strong> believes the capital account fairly reflects the<br />

fair value of the partnerships.<br />

The <strong>Foundation</strong> is party to certain limited partnership agreements, whereby the <strong>Foundation</strong> is committed to<br />

invest future funds into these partnerships. As of December 31, <strong>2004</strong>, the <strong>Foundation</strong> has $79.7 million in<br />

outstanding limited partnership commitments, including both domestic and international partnerships.<br />

Other Assets<br />

Included in other assets is land that was purchased by the <strong>Foundation</strong> and is recorded at cost. The<br />

remaining assets included in other assets are recorded at cost.<br />

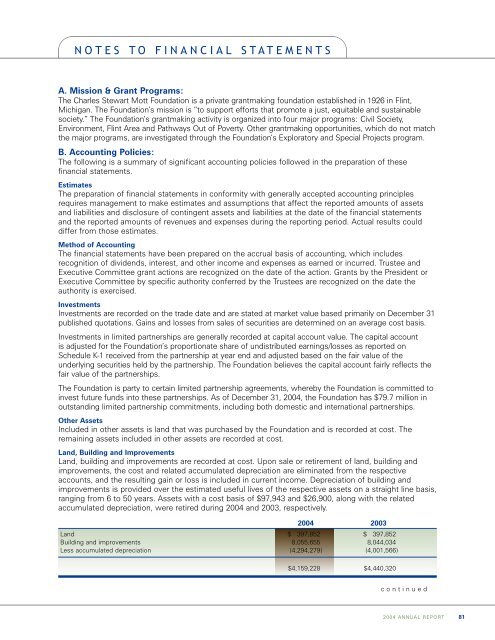

Land, Building and Improvements<br />

Land, building and improvements are recorded at cost. Upon sale or retirement of land, building and<br />

improvements, the cost and related accumulated depreciation are eliminated from the respective<br />

accounts, and the resulting gain or loss is included in current income. Depreciation of building and<br />

improvements is provided over the estimated useful lives of the respective assets on a straight line basis,<br />

ranging from 6 to 50 years. Assets with a cost basis of $97,943 and $26,900, along with the related<br />

accumulated depreciation, were retired during <strong>2004</strong> and 2003, respectively.<br />

<strong>2004</strong> 2003<br />

Land $ 397,852 $ 397,852<br />

Building and improvements 8,055,655 8,044,034<br />

Less accumulated depreciation (4,294,279) (4,001,566)<br />

$4,159,228 $4,440,320<br />

continued<br />

<strong>2004</strong> ANNUAL REPORT<br />

81