Annual Report 2004 - Charles Stewart Mott Foundation

Annual Report 2004 - Charles Stewart Mott Foundation

Annual Report 2004 - Charles Stewart Mott Foundation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

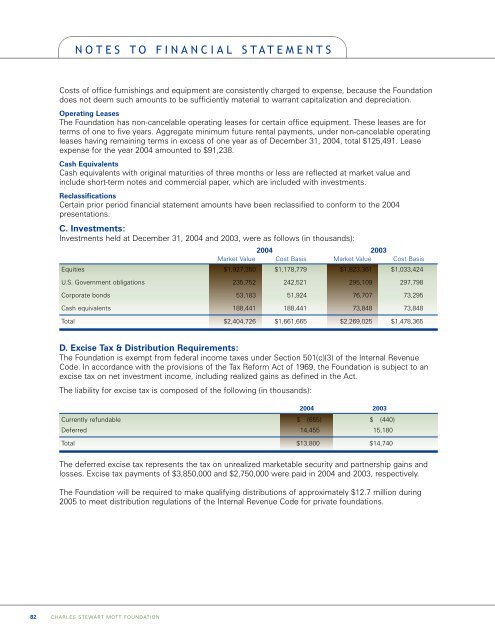

NOTES TO FINANCIAL STATEMENTS<br />

Costs of office furnishings and equipment are consistently charged to expense, because the <strong>Foundation</strong><br />

does not deem such amounts to be sufficiently material to warrant capitalization and depreciation.<br />

Operating Leases<br />

The <strong>Foundation</strong> has non-cancelable operating leases for certain office equipment. These leases are for<br />

terms of one to five years. Aggregate minimum future rental payments, under non-cancelable operating<br />

leases having remaining terms in excess of one year as of December 31, <strong>2004</strong>, total $125,491. Lease<br />

expense for the year <strong>2004</strong> amounted to $91,238.<br />

Cash Equivalents<br />

Cash equivalents with original maturities of three months or less are reflected at market value and<br />

include short-term notes and commercial paper, which are included with investments.<br />

Reclassifications<br />

Certain prior period financial statement amounts have been reclassified to conform to the <strong>2004</strong><br />

presentations.<br />

C. Investments:<br />

Investments held at December 31, <strong>2004</strong> and 2003, were as follows (in thousands):<br />

<strong>2004</strong> 2003<br />

Market Value Cost Basis Market Value Cost Basis<br />

Equities $1,927,350 $1,178,779 $1,823,361 $1,033,424<br />

U.S. Government obligations 235,752 242,521 295,109 297,798<br />

Corporate bonds 53,183 51,924 76,707 73,295<br />

Cash equivalents 188,441 188,441 73,848 73,848<br />

Total $2,404,726 $1,661,665 $2,269,025 $1,478,365<br />

D. Excise Tax & Distribution Requirements:<br />

The <strong>Foundation</strong> is exempt from federal income taxes under Section 501(c)(3) of the Internal Revenue<br />

Code. In accordance with the provisions of the Tax Reform Act of 1969, the <strong>Foundation</strong> is subject to an<br />

excise tax on net investment income, including realized gains as defined in the Act.<br />

The liability for excise tax is composed of the following (in thousands):<br />

<strong>2004</strong> 2003<br />

Currently refundable $ (655) $ (440)<br />

Deferred 14,455 15,180<br />

Total $13,800 $14,740<br />

The deferred excise tax represents the tax on unrealized marketable security and partnership gains and<br />

losses. Excise tax payments of $3,850,000 and $2,750,000 were paid in <strong>2004</strong> and 2003, respectively.<br />

The <strong>Foundation</strong> will be required to make qualifying distributions of approximately $12.7 million during<br />

2005 to meet distribution regulations of the Internal Revenue Code for private foundations.<br />

82 CHARLES STEWART MOTT FOUNDATION