Annual Report 2004 - Charles Stewart Mott Foundation

Annual Report 2004 - Charles Stewart Mott Foundation

Annual Report 2004 - Charles Stewart Mott Foundation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

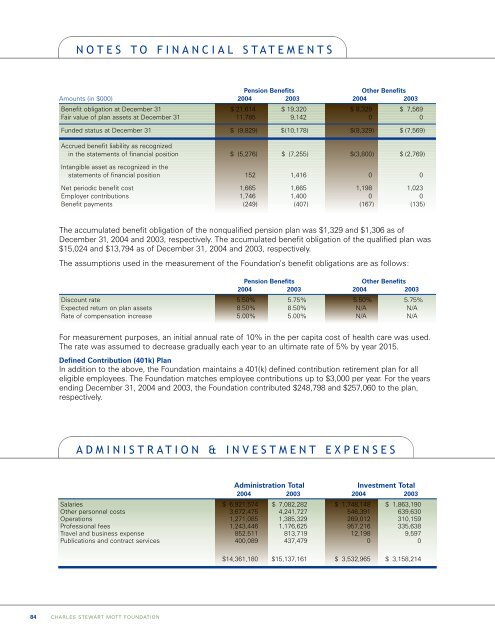

NOTES TO FINANCIAL STATEMENTS<br />

Pension Benefits<br />

Other Benefits<br />

Amounts (in $000) <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Benefit obligation at December 31 $ 21,614 $ 19,320 $ 8,329 $ 7,569<br />

Fair value of plan assets at December 31 11,785 9,142 0 0<br />

Funded status at December 31 $ (9,829) $(10,178) $(8,329) $ (7,569)<br />

Accrued benefit liability as recognized<br />

in the statements of financial position $ (5,276) $ (7,255) $(3,800) $ (2,769)<br />

Intangible asset as recognized in the<br />

statements of financial position 152 1,416 0 0<br />

Net periodic benefit cost 1,665 1,665 1,198 1,023<br />

Employer contributions 1,746 1,400 0 0<br />

Benefit payments (249) (407) (167) (135)<br />

The accumulated benefit obligation of the nonqualified pension plan was $1,329 and $1,306 as of<br />

December 31, <strong>2004</strong> and 2003, respectively. The accumulated benefit obligation of the qualified plan was<br />

$15,024 and $13,794 as of December 31, <strong>2004</strong> and 2003, respectively.<br />

The assumptions used in the measurement of the <strong>Foundation</strong>’s benefit obligations are as follows:<br />

Pension Benefits<br />

Other Benefits<br />

<strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Discount rate 5.50% 5.75% 5.50% 5.75%<br />

Expected return on plan assets 8.50% 8.50% N/A N/A<br />

Rate of compensation increase 5.00% 5.00% N/A N/A<br />

For measurement purposes, an initial annual rate of 10% in the per capita cost of health care was used.<br />

The rate was assumed to decrease gradually each year to an ultimate rate of 5% by year 2015.<br />

Defined Contribution (401k) Plan<br />

In addition to the above, the <strong>Foundation</strong> maintains a 401(k) defined contribution retirement plan for all<br />

eligible employees. The <strong>Foundation</strong> matches employee contributions up to $3,000 per year. For the years<br />

ending December 31, <strong>2004</strong> and 2003, the <strong>Foundation</strong> contributed $248,798 and $257,060 to the plan,<br />

respectively.<br />

ADMINISTRATION & INVESTMENT EXPENSES<br />

Administration Total<br />

Investment Total<br />

<strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Salaries $ 6,921,574 $ 7,082,282 $ 1,748,148 $ 1,863,190<br />

Other personnel costs 3,672,475 4,241,727 546,391 639,630<br />

Operations 1,271,085 1,385,329 269,012 310,159<br />

Professional fees 1,243,446 1,176,625 957,216 335,638<br />

Travel and business expense 852,511 813,719 12,198 9,597<br />

Publications and contract services 400,089 437,479 0 0<br />

$14,361,180 $15,137,161 $ 3,532,965 $ 3,158,214<br />

84 CHARLES STEWART MOTT FOUNDATION