Australian Dairy Industry In Focus 2009 - Dairying For Tomorrow

Australian Dairy Industry In Focus 2009 - Dairying For Tomorrow

Australian Dairy Industry In Focus 2009 - Dairying For Tomorrow

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong><strong>In</strong>dustry</strong> levies<br />

<strong>Dairy</strong> Services<br />

<strong>Dairy</strong> Australia is funded by farmerpaid<br />

levies that are imposed on the<br />

fat and protein content of all<br />

milk produced in Australia.<br />

The <strong>Australian</strong> Government matches<br />

expenditure on the industry’s research<br />

and development activities that<br />

meet established criteria.<br />

All <strong>Australian</strong> dairy farmers had the<br />

opportunity to participate, by mail, in the<br />

<strong>Dairy</strong> Poll 2007 conducted during February<br />

and March 2007. Compared to levy polls<br />

in other agricultural industries, a high<br />

participation rate of 53% was achieved.<br />

Some 68% of votes were cast in favour<br />

of maintaining the <strong>Dairy</strong> Service Levy<br />

at its current rate.<br />

Animal Health Australia<br />

<strong>Australian</strong> dairy farmers also contribute<br />

to the funding of Animal Health Australia<br />

(AHA), as do farmers in all other livestock<br />

industries. AHA is a non-profit public<br />

company limited by guarantee. Members<br />

include the <strong>Australian</strong>, state and territory<br />

governments, and key commodity and<br />

interest groups. AHA’s task is to facilitate<br />

partnerships between governments and<br />

livestock industries, and provide a national<br />

approach to animal health systems. The<br />

Animal Health Levy is the dairy industry’s<br />

contribution to AHA programs.<br />

<strong>Dairy</strong> Adjustment Authority<br />

As part of the <strong>Dairy</strong> Structural Adjustment<br />

Program (DSAP), the <strong>Dairy</strong> Adjustment<br />

Levy was imposed on domestic (retail)<br />

sales of products marketed as dairy<br />

beverages from 8 July 2000. The levy was<br />

removed by the Federal Government from<br />

23 February <strong>2009</strong> after repayment of the<br />

loans taken out to fund the DSAP.<br />

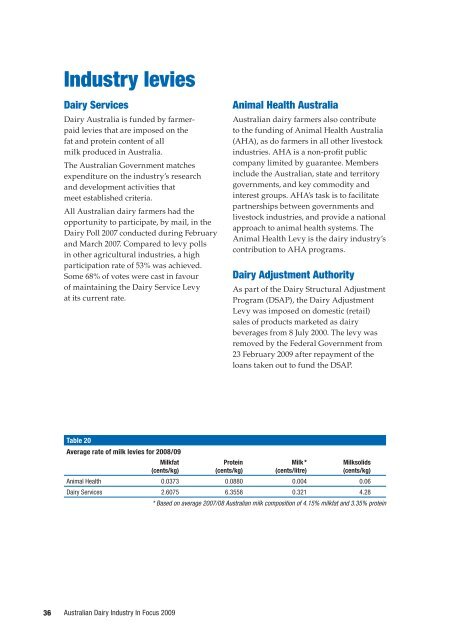

Table 20<br />

Average rate of milk levies for 2008/09<br />

Milkfat Protein Milk * Milksolids<br />

(cents/kg) (cents/kg) (cents/litre) (cents/kg)<br />

Animal Health 0.0373 0.0880 0.004 0.06<br />

<strong>Dairy</strong> Services 2.6075 6.3558 0.321 4.28<br />

* Based on average 2007/08 <strong>Australian</strong> milk composition of 4.15% milkfat and 3.35% protein<br />

36<br />

<strong>Australian</strong> <strong>Dairy</strong> <strong><strong>In</strong>dustry</strong> <strong>In</strong> <strong>Focus</strong> <strong>2009</strong>