VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ANNUAL</strong> <strong>REPORT</strong> 2008<br />

Other information for shareholders<br />

1. INFORMATION ON REMUNERATION RECEIVED BY EXECUTIVES AND SUPERVISORY BOARD<br />

MEMBERS DURING THE ACCOUNTING PERIOD 2008<br />

The Act on business activities on the capital market, no. 256/2004 Coll., section 118 assesses the obligation to publish information on all monetary income<br />

and income in kind received by Executives and Supervisory Board members during the accounting period from the <strong>Philip</strong> <strong>Morris</strong> ČR a.s. (“the Company”). The<br />

Executive category includes income of directors whose position meets a definition of Section 73 of the Labour Code. Based on this definition, the Executive<br />

category represents the members of the Board of Directors who at the same time manage a defined area of the Company’s operations. The Chairman of the<br />

Board of Directors is the Managing Director of the Company at the same time.<br />

Remuneration of Executives and members of the Supervisory Board who are employees of the Company comprises annual base salary, annual bonus, sharebased<br />

payments and other remuneration in kind such as cars for use, lunch allowances, pension contribution, life and accident insurance.<br />

Bonus (Incentive Compensation) is a one-off payment, made in addition to the Annual Base Salary. This bonus is expressed as a percentage of the annual<br />

base salary and is based on assessments of both <strong>Philip</strong> <strong>Morris</strong> International, Inc (“PMI”) business performance as well as individual performance. PMI annual<br />

business performance is reviewed and evaluated by PMI by the Compensation Committee towards the end of the year versus objectives. Some of the key<br />

components used to assess those objectives are based on quantitative data such as operating company income, cash flow as well as qualitative data such as<br />

business development, strengthening the organization etc. Managing Director of the Company proposes IC bonuss to individual Executives and President EU<br />

region proposes the IC bonus to Managing Director of the Company. These proposals are validated at the Senior Management level to ensure consistency of<br />

treatment across PMI.<br />

Non-employee Executives are employees of <strong>Philip</strong> <strong>Morris</strong> Management Services S.A. or other PMI group of companies and their remuneration is provided by<br />

these companies. The Company provides them with other remuneration in kind such as cars for use and lunch allowances. Remuneration of members of the<br />

Supervisory Board who are non-employee of the Company or an entity within the PMI group comprises an annual fee.<br />

Executives and members of Supervisory Board who are employees of the Company or an entity within the PMI group of companies receive no additional<br />

compensation for services as members of the Board of Directors and Supervisory Board.<br />

In 2008 no matters which could lead to a conflict of interest were discovered either with Board of Directors members or with the Supervisory Board<br />

members.<br />

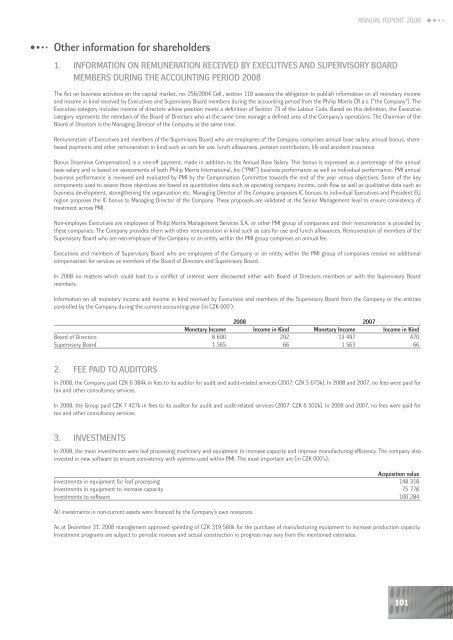

Information on all monetary income and income in kind received by Executives and members of the Supervisory Board from the Company or the entities<br />

controlled by the Company during the current accounting year (in CZK 000’):<br />

2008 2007<br />

Monetary Income Income in Kind Monetary Income Income in Kind<br />

Board of Directors 8 690 292 13 497 470<br />

Supervisory Board 1 565 66 1 563 66<br />

2. FEE PAID TO AUDITORS<br />

In 2008, the Company paid CZK 6 384k in fees to its auditor for audit and audit-related services (2007: CZK 5 673k). In 2008 and 2007, no fees were paid for<br />

tax and other consultancy services.<br />

In 2008, the Group paid CZK 7 427k in fees to its auditor for audit and audit-related services (2007: CZK 6 502k). In 2008 and 2007, no fees were paid for<br />

tax and other consultancy services.<br />

3. INVESTMENTS<br />

In 2008, the main investments were leaf processing machinery and equipment to increase capacity and improve manufacturing efficiency. The company also<br />

invested in new software to ensure consistency with systems used within PMI. The most important are (in CZK 000’s):<br />

Acquisition value<br />

Investments in equipment for leaf processing 148 318<br />

Investments in equipment to increase capacity 75 776<br />

Investments to software 100 284<br />

All investments in non-current assets were financed by the Company’s own resources.<br />

As at December 31, 2008 management approved spending of CZK 319 560k for the purchase of manufacturing equipment to increase production capacity.<br />

Investment programs are subject to periodic reviews and actual construction in progress may vary from the mentioned estimates.<br />

101