VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

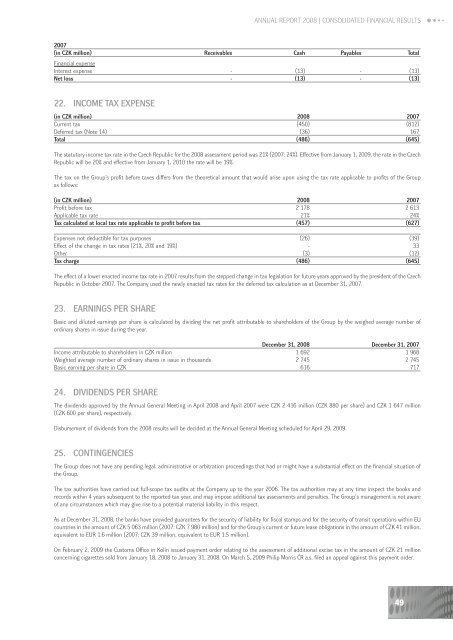

<strong>ANNUAL</strong> <strong>REPORT</strong> 2008 | CONSOLIDATED FINANCIAL RESULTS<br />

2007<br />

(in CZK million) Receivables Cash Payables Total<br />

Financial expense<br />

Interest expense - (13) - (13)<br />

Net loss - (13) - (13)<br />

22. INCOME TAX EXPENSE<br />

(in CZK million) 2008 2007<br />

Current tax (450) (812)<br />

Deferred tax (Note 14) (36) 167<br />

Total (486) (645)<br />

The statutory income tax rate in the Czech Republic for the 2008 assessment period was 21% (2007: 24%). Effective from January 1, 2009, the rate in the Czech<br />

Republic will be 20% and effective from January 1, 2010 the rate will be 19%.<br />

The tax on the Group’s profit before taxes differs from the theoretical amount that would arise upon using the tax rate applicable to profits of the Group<br />

as follows:<br />

(in CZK million) 2008 2007<br />

Profit before tax 2 178 2 613<br />

Applicable tax rate 21% 24%<br />

Tax calculated at local tax rate applicable to profit before tax (457) (627)<br />

Expenses not deductible for tax purposes (26) (39)<br />

Effect of the change in tax rates (21%, 20% and 19%) - 33<br />

Other (3) (12)<br />

Tax charge (486) (645)<br />

The effect of a lower enacted income tax rate in 2007 results from the stepped change in tax legislation for future years approved by the president of the Czech<br />

Republic in October 2007. The Company used the newly enacted tax rates for the deferred tax calculation as at December 31, 2007.<br />

23. EARNINGS PER SHARE<br />

Basic and diluted earnings per share is calculated by dividing the net profit attributable to shareholders of the Group by the weighed average number of<br />

ordinary shares in issue during the year.<br />

December 31, 2008 December 31, 2007<br />

Income attributable to shareholders in CZK million 1 692 1 968<br />

Weighted average number of ordinary shares in issue in thousands 2 745 2 745<br />

Basic earning per share in CZK 616 717<br />

24. DIVIDENDS PER SHARE<br />

The dividends approved by the Annual General Meeting in April 2008 and April 2007 were CZK 2 416 million (CZK 880 per share) and CZK 1 647 million<br />

(CZK 600 per share), respectively.<br />

Disbursement of dividends from the 2008 results will be decided at the Annual General Meeting scheduled for April 29, 2009.<br />

25. CONTINGENCIES<br />

The Group does not have any pending legal, administrative or arbitration proceedings that had or might have a substantial effect on the financial situation of<br />

the Group.<br />

The tax authorities have carried out full-scope tax audits at the Company up to the year 2006. The tax authorities may at any time inspect the books and<br />

records within 4 years subsequent to the reported tax year, and may impose additional tax assessments and penalties. The Group‘s management is not aware<br />

of any circumstances which may give rise to a potential material liability in this respect.<br />

As at December 31, 2008, the banks have provided guarantees for the security of liability for fiscal stamps and for the security of transit operations within EU<br />

countries in the amount of CZK 5 063 million (2007: CZK 7 980 million) and for the Group’s current or future lease obligations in the amount of CZK 41 million,<br />

equivalent to EUR 1.6 million (2007: CZK 39 million, equivalent to EUR 1.5 million).<br />

On February 2, 2009 the Customs Office in Kolín issued payment order relating to the assessment of additional excise tax in the amount of CZK 21 million<br />

concerning cigarettes sold from January 18, 2008 to January 31, 2008. On March 5, 2009 <strong>Philip</strong> <strong>Morris</strong> ČR a.s. filed an appeal against this payment order.<br />

49