VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ANNUAL</strong> <strong>REPORT</strong> 2008 | CONSOLIDATED FINANCIAL RESULTS<br />

Loans and deposits with related parties include interest-bearing, on-demand deposits (cash pool) of CZK 1 360 million with <strong>Philip</strong> <strong>Morris</strong> Finance S.A.<br />

(2007: CZK 2 217 million). The interest-bearing on-demand deposits are classified as Cash and cash equivalents in the Company’s balance sheet<br />

as at December 31, 2008 and 2007.<br />

The interest rate for on-demand deposits is calculated as overnight PRIMEAN - 0.25%. The actual interest rates reflect the current money market and the<br />

nature of the loan. The average effective interest rate of on-demand deposits was 3.171% p.a. (2007: 2.466% p.a.) in the Czech Republic and 3.66% p.a. in the<br />

Slovak Republic.<br />

Borrowings from related parties as at December 31, 2008 include interest-bearing on-demand borrowings (cash pool) and interest-bearing short-term<br />

borrowing with a maturity less than three months with <strong>Philip</strong> <strong>Morris</strong> Finance S.A. The average interest rate of interest bearing on-demand borrowings in EUR<br />

was 2.51% p.a. and in SKK was 2.45% p.a. (2007: 3.58% p.a.). In 2007, the interest rate for short-term borrowings from related party was 4.72% p.a.<br />

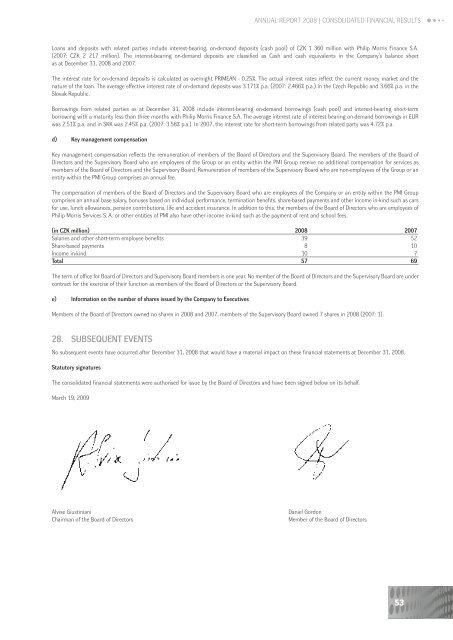

d) Key management compensation<br />

Key management compensation reflects the remuneration of members of the Board of Directors and the Supervisory Board. The members of the Board of<br />

Directors and the Supervisory Board who are employees of the Group or an entity within the PMI Group receive no additional compensation for services as<br />

members of the Board of Directors and the Supervisory Board. Remuneration of members of the Supervisory Board who are non-employees of the Group or an<br />

entity within the PMI Group comprises an annual fee.<br />

The compensation of members of the Board of Directors and the Supervisory Board who are employees of the Company or an entity within the PMI Group<br />

comprises an annual base salary, bonuses based on individual performance, termination benefits, share-based payments and other income in-kind such as cars<br />

for use, lunch allowances, pension contributions, life and accident insurance. In addition to this, the members of the Board of Directors who are employees of<br />

<strong>Philip</strong> <strong>Morris</strong> Services S. A. or other entities of PMI also have other income in-kind such as the payment of rent and school fees.<br />

(in CZK million) 2008 2007<br />

Salaries and other short-term employee benefits 39 52<br />

Share-based payments 8 10<br />

Income in-kind 10 7<br />

Total 57 69<br />

The term of office for Board of Directors and Supervisory Board members is one year. No member of the Board of Directors and the Supervisory Board are under<br />

contract for the exercise of their function as members of the Board of Directors or the Supervisory Board.<br />

e) Information on the number of shares issued by the Company to Executives<br />

Members of the Board of Directors owned no shares in 2008 and 2007, members of the Supervisory Board owned 7 shares in 2008 (2007: 1).<br />

28. SUBSEQUENT EVENTS<br />

No subsequent events have occurred after December 31, 2008 that would have a material impact on these financial statements at December 31, 2008.<br />

Statutory signatures<br />

The consolidated financial statements were authorised for issue by the Board of Directors and have been signed below on its behalf.<br />

March 19, 2009<br />

Alvise Giustiniani<br />

Chairman of the Board of Directors<br />

Daniel Gordon<br />

Member of the Board of Directors<br />

53