VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ANNUAL</strong> <strong>REPORT</strong> 2008 | FINANCIAL RESULTS<br />

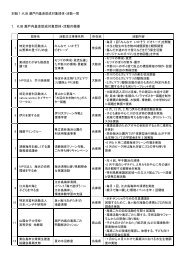

Credit risk concentration<br />

The Company monitors the concentration of credit risk by distribution regions.<br />

Classification of receivables by distribution regions:<br />

Czech Slovak<br />

Carrying amount as at December 31, 2008 (in CZK million) Republic Republic Other Total<br />

Receivables from third parties – domestic 1 007 - - 1 007<br />

Receivables from third parties – foreign - - 17 17<br />

Receivables from PMI Group entities - 204 506 710<br />

Total 1 007 204 523 1 734<br />

Czech Slovak<br />

Carrying amount as at December 31, 2007 (in CZK million) Republic Republic Other Total<br />

Receivables from third parties – domestic 5 920 - - 5 920<br />

Receivables from third parties – foreign - - 61 61<br />

Receivables from Altria Group entities - 439 56 495<br />

Total 5 920 439 117 6 476<br />

Credit quality of financial assets not yet due and not impaired<br />

The Company uses the following criteria when setting ratings of financial<br />

assets that are not yet due and are not impaired.<br />

• Solvency class 1 includes receivables from third parties secured<br />

by bank guarantees for which there is no objective evidence indicating<br />

impairment.<br />

• Solvency class 2 includes receivables that are unsecured trade<br />

receivables from third parties for which there is no objective evidence<br />

indicating impairment.<br />

• Receivables from and on-demand deposits with <strong>Philip</strong> <strong>Morris</strong><br />

International are classified according to Standard & Poor’s rating of the<br />

company <strong>Philip</strong> <strong>Morris</strong> International. In 2008, the S&P rating was A.<br />

• Receivables from and on-demand deposits with Altria Group are<br />

classified according to Standard & Poor’s rating of the company Altria Group.<br />

In 2007, the S&P rating was BBB+.<br />

• Cash with banks is classified according to Moody’s Long-term Deposit<br />

rating. For banks and financial institutions, only independently-rated parties<br />

with a minimum rating of AA3 (2007: AA3+) are accepted.<br />

Moody’s rating<br />

Standard & Poor’s Long-term<br />

Balance as at December 31, 2008 (in CZK million) Solvency class 1 Solvency class 2 Ratings (A) Deposit (AA3) Total<br />

Receivables from third parties - domestic 873 134 - - 1 007<br />

Receivables from third parties - foreign 13 4 - - 17<br />

Receivables from PMI Group entities - - 710 - 710<br />

Cash at banks - - - 14 14<br />

On demand deposits with related parties - - 1 360 - 1 360<br />

Total 886 138 2 070 14 3 108<br />

Moody’s rating<br />

Standard & Poor’s Long-term<br />

Balance as at December 31, 2007 (in CZK million) Solvency class 1 Solvency class 2 Ratings (BBB +) Deposit (AA3+) Total<br />

Receivables from third parties - domestic 5 075 840 - - 5 915<br />

Receivables from third parties - foreign 18 31 - - 49<br />

Receivables from Altria Group entities - - 495 - 495<br />

Cash at banks - - - 2 2<br />

On demand deposits with related parties - - 2 217 - 2 217<br />

Total 5 093 871 2 712 2 8 678<br />

Carrying amount of financial assets past due but not impaired<br />

Months past due<br />

Balance as at December 31, 2008 (in CZK million) Less than 1 month 1 – 3 months More than 3 months Total<br />

Receivables from third parties - domestic 15 - - 15<br />

Receivables from PMI Group entities 3 29 14 46<br />

Total 18 29 14 61<br />

Months past due<br />

Balance as at December 31, 2007 (in CZK million) Less than 1 month 1 – 3 months More than 3 months Total<br />

Receivables from third parties - domestic 5 - - 5<br />

Receivables from third parties - foreign 11 - 1 12<br />

Total 16 - 1 17<br />

75