VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ANNUAL</strong> <strong>REPORT</strong> 2008<br />

Summary explanatory report of <strong>Philip</strong> <strong>Morris</strong> ČR a.s.<br />

for the year 2008 pursuant to article 118 par. 3 letters g) to q) of act no. 256/2004 coll., on business activities on the capital market, as amended<br />

The Board of Directors of <strong>Philip</strong> <strong>Morris</strong> ČR a.s. (“the Company”) hereby submits the following summary explanatory report to the shareholders pursuant to<br />

Article 118 par. 3 letters g) to q) of Act no. 256/2004 Coll., on business activities on the capital market, as amended:<br />

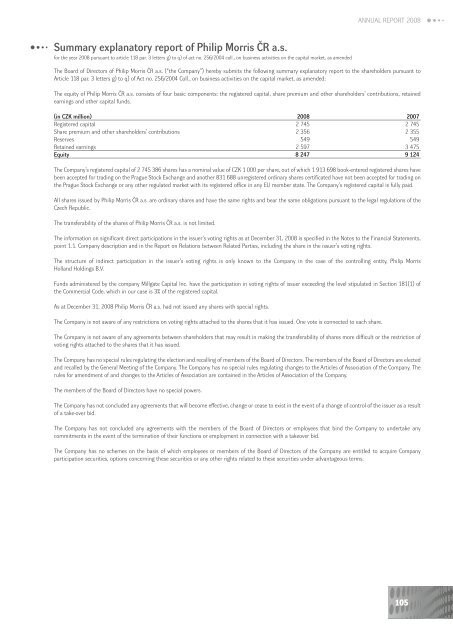

The equity of <strong>Philip</strong> <strong>Morris</strong> ČR a.s. consists of four basic components: the registered capital, share premium and other shareholders’ contributions, retained<br />

earnings and other capital funds.<br />

(in CZK million) 2008 2007<br />

Registered capital 2 745 2 745<br />

Share premium and other shareholders’ contributions 2 356 2 355<br />

Reserves 549 549<br />

Retained earnings 2 597 3 475<br />

Equity 8 247 9 124<br />

The Company’s registered capital of 2 745 386 shares has a nominal value of CZK 1 000 per share, out of which 1 913 698 book-entered registered shares have<br />

been accepted for trading on the Prague Stock Exchange and another 831 688 unregistered ordinary shares certificated have not been accepted for trading on<br />

the Prague Stock Exchange or any other regulated market with its registered office in any EU member state. The Company’s registered capital is fully paid.<br />

All shares issued by <strong>Philip</strong> <strong>Morris</strong> ČR a.s. are ordinary shares and have the same rights and bear the same obligations pursuant to the legal regulations of the<br />

Czech Republic.<br />

The transferability of the shares of <strong>Philip</strong> <strong>Morris</strong> ČR a.s. is not limited.<br />

The information on significant direct participations in the issuer’s voting rights as at December 31, 2008 is specified in the Notes to the Financial Statements,<br />

point 1.1. Company description and in the Report on Relations between Related Parties, including the share in the issuer’s voting rights.<br />

The structure of indirect participation in the issuer’s voting rights is only known to the Company in the case of the controlling entity, <strong>Philip</strong> <strong>Morris</strong><br />

Holland Holdings B.V.<br />

Funds administered by the company Millgate Capital Inc. have the participation in voting rights of issuer exceeding the level stipulated in Section 181(1) of<br />

the Commercial Code, which in our case is 3% of the registered capital.<br />

As at December 31, 2008 <strong>Philip</strong> <strong>Morris</strong> ČR a.s. had not issued any shares with special rights.<br />

The Company is not aware of any restrictions on voting rights attached to the shares that it has issued. One vote is connected to each share.<br />

The Company is not aware of any agreements between shareholders that may result in making the transferability of shares more difficult or the restriction of<br />

voting rights attached to the shares that it has issued.<br />

The Company has no special rules regulating the election and recalling of members of the Board of Directors. The members of the Board of Directors are elected<br />

and recalled by the General Meeting of the Company. The Company has no special rules regulating changes to the Articles of Association of the Company. The<br />

rules for amendment of and changes to the Articles of Association are contained in the Articles of Association of the Company.<br />

The members of the Board of Directors have no special powers.<br />

The Company has not concluded any agreements that will become effective, change or cease to exist in the event of a change of control of the issuer as a result<br />

of a take-over bid.<br />

The Company has not concluded any agreements with the members of the Board of Directors or employees that bind the Company to undertake any<br />

commitments in the event of the termination of their functions or employment in connection with a takeover bid.<br />

The Company has no schemes on the basis of which employees or members of the Board of Directors of the Company are entitled to acquire Company<br />

participation securities, options concerning these securities or any other rights related to these securities under advantageous terms.<br />

105