VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

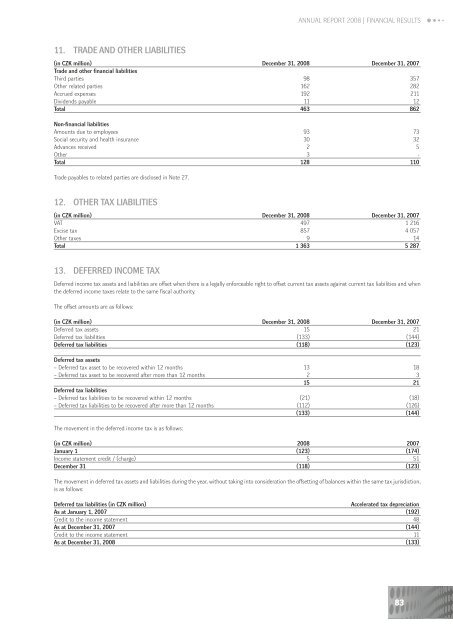

<strong>ANNUAL</strong> <strong>REPORT</strong> 2008 | FINANCIAL RESULTS<br />

11. TRADE AND OTHER LIABILITIES<br />

(in CZK million) December 31, 2008 December 31, 2007<br />

Trade and other financial liabilities<br />

Third parties 98 357<br />

Other related parties 162 282<br />

Accrued expenses 192 211<br />

Dividends payable 11 12<br />

Total 463 862<br />

Non-financial liabilities<br />

Amounts due to employees 93 73<br />

Social security and health insurance 30 32<br />

Advances received 2 5<br />

Other 3 -<br />

Total 128 110<br />

Trade payables to related parties are disclosed in Note 27.<br />

12. OTHER TAX LIABILITIES<br />

(in CZK million) December 31, 2008 December 31, 2007<br />

VAT 497 1 216<br />

Excise tax 857 4 057<br />

Other taxes 9 14<br />

Total 1 363 5 287<br />

13. DEFERRED INCOME TAX<br />

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities and when<br />

the deferred income taxes relate to the same fiscal authority.<br />

The offset amounts are as follows:<br />

(in CZK million) December 31, 2008 December 31, 2007<br />

Deferred tax assets 15 21<br />

Deferred tax liabilities (133) (144)<br />

Deferred tax liabilities (118) (123)<br />

Deferred tax assets<br />

– Deferred tax asset to be recovered within 12 months 13 18<br />

– Deferred tax asset to be recovered after more than 12 months 2 3<br />

15 21<br />

Deferred tax liabilities<br />

– Deferred tax liabilities to be recovered within 12 months (21) (18)<br />

– Deferred tax liabilities to be recovered after more than 12 months (112) (126)<br />

(133) (144)<br />

The movement in the deferred income tax is as follows:<br />

(in CZK million) 2008 2007<br />

January 1 (123) (174)<br />

Income statement credit / (charge) 5 51<br />

December 31 (118) (123)<br />

The movement in deferred tax assets and liabilities during the year, without taking into consideration the offsetting of balances within the same tax jurisdiction,<br />

is as follows:<br />

Deferred tax liabilities (in CZK million)<br />

Accelerated tax depreciation<br />

As at January 1, 2007 (192)<br />

Credit to the income statement 48<br />

As at December 31, 2007 (144)<br />

Credit to the income statement 11<br />

As at December 31, 2008 (133)<br />

83