VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

VÝROČNÍ ZPRÁVA ANNUAL REPORT - Philip Morris

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

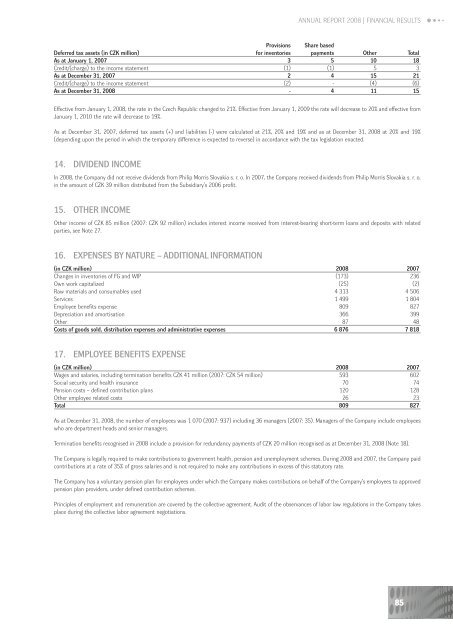

<strong>ANNUAL</strong> <strong>REPORT</strong> 2008 | FINANCIAL RESULTS<br />

Provisions Share based<br />

Deferred tax assets (in CZK million) for inventories payments Other Total<br />

As at January 1, 2007 3 5 10 18<br />

Credit/(charge) to the income statement (1) (1) 5 3<br />

As at December 31, 2007 2 4 15 21<br />

Credit/(charge) to the income statement (2) - (4) (6)<br />

As at December 31, 2008 - 4 11 15<br />

Effective from January 1, 2008, the rate in the Czech Republic changed to 21%. Effective from January 1, 2009 the rate will decrease to 20% and effective from<br />

January 1, 2010 the rate will decrease to 19%.<br />

As at December 31, 2007, deferred tax assets (+) and liabilities (-) were calculated at 21%, 20% and 19% and as at December 31, 2008 at 20% and 19%<br />

(depending upon the period in which the temporary difference is expected to reverse) in accordance with the tax legislation enacted.<br />

14. DIVIDEND INCOME<br />

In 2008, the Company did not receive dividends from <strong>Philip</strong> <strong>Morris</strong> Slovakia s. r. o. In 2007, the Company received dividends from <strong>Philip</strong> <strong>Morris</strong> Slovakia s. r. o.<br />

in the amount of CZK 39 million distributed from the Subsidiary’s 2006 profit.<br />

15. OTHER INCOME<br />

Other income of CZK 85 million (2007: CZK 92 million) includes interest income received from interest-bearing short-term loans and deposits with related<br />

parties, see Note 27.<br />

16. EXPENSES BY NATURE – ADDITIONAL INFORMATION<br />

(in CZK million) 2008 2007<br />

Changes in inventories of FG and WIP (173) 236<br />

Own work capitalized (25) (2)<br />

Raw materials and consumables used 4 313 4 506<br />

Services 1 499 1 804<br />

Employee benefits expense 809 827<br />

Depreciation and amortisation 366 399<br />

Other 87 48<br />

Costs of goods sold, distribution expenses and administrative expenses 6 876 7 818<br />

17. EMPLOYEE BENEFITS EXPENSE<br />

(in CZK million) 2008 2007<br />

Wages and salaries, including termination benefits CZK 41 million (2007: CZK 54 million) 593 602<br />

Social security and health insurance 70 74<br />

Pension costs – defined contribution plans 120 128<br />

Other employee related costs 26 23<br />

Total 809 827<br />

As at December 31, 2008, the number of employees was 1 070 (2007: 937) including 36 managers (2007: 35). Managers of the Company include employees<br />

who are department heads and senior managers.<br />

Termination benefits recognised in 2008 include a provision for redundancy payments of CZK 20 million recognised as at December 31, 2008 (Note 18).<br />

The Company is legally required to make contributions to government health, pension and unemployment schemes. During 2008 and 2007, the Company paid<br />

contributions at a rate of 35% of gross salaries and is not required to make any contributions in excess of this statutory rate.<br />

The Company has a voluntary pension plan for employees under which the Company makes contributions on behalf of the Company’s employees to approved<br />

pension plan providers, under defined contribution schemes.<br />

Principles of employment and remuneration are covered by the collective agreement. Audit of the observances of labor law regulations in the Company takes<br />

place during the collective labor agreement negotiations.<br />

85