PA - Banco Security

PA - Banco Security

PA - Banco Security

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

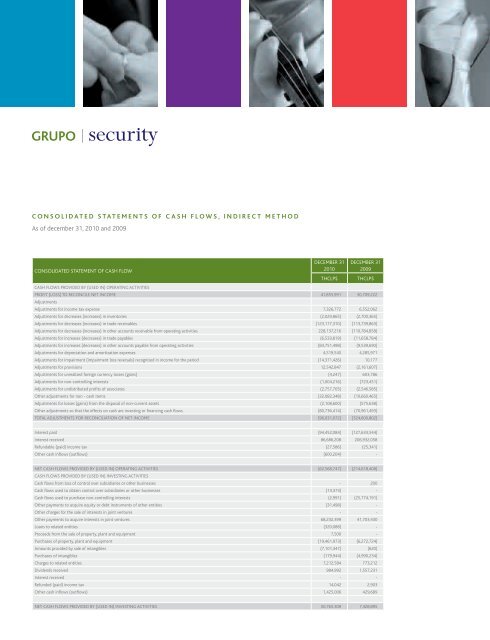

CONSOLIDATED STATEMENTS OF CASH FLOWS, INDIRECT METHOD<br />

As of december 31, 2010 and 2009<br />

CONSOLIDATED STATEMENT OF CASH FLOW<br />

Cash flows provided by (used in) operating activities<br />

December 31<br />

2010<br />

ThCLP$<br />

December 31<br />

2009<br />

Profit (loss) to reconcile net income 41,855,991 30,709,222<br />

Adjustments<br />

Adjustments for income tax expense 7,326,772 6,552,062<br />

Adjustments for decreases (increases) in inventories (2,029,865) (2,700,365)<br />

Adjustments for decreases (increases) in trade receivables (123,177,310) (113,739,863)<br />

Adjustments for decreases (increases) in other accounts receivable from operating activities 228,137,216 (110,784,858)<br />

Adjustments for increases (decreases) in trade payables (6,533,819) (11,658,784)<br />

Adjustments for increases (decreases) in other accounts payable from operating activities (83,751,498) (9,539,690)<br />

Adjustments for depreciation and amortization expenses 4,519,540 4,285,971<br />

Adjustments for impairment (impairment loss reversals) recognized in income for the period (14,371,426) 10,177<br />

Adjustments for provisions 12,542,847 (2,161,607)<br />

Adjustments for unrealized foreign currency losses (gains) (4,247) 603,786<br />

Adjustments for non-controlling interests (1,004,216) (723,451)<br />

Adjustments for undistributed profits of associates (2,757,705) (2,546,585)<br />

Other adjustments for non - cash items (32,082,348) (10,660,465)<br />

Adjustments for losses (gains) from the disposal of non-current assets (2,108,600) (575,638)<br />

Other adjustments so that the effects on cash are investing or financing cash flows. (80,736,414) (70,961,493)<br />

Total adjustments for reconciliation of net income (96,031,072) (324,600,802)<br />

ThCLP$<br />

Interest paid (94,452,084) (127,633,544)<br />

Interest received 86,686,208 206,932,058<br />

Refundable (paid) income tax (27,586) (25,341)<br />

Other cash inflows (outflows) (600,204) -<br />

Net cash flows provided by (used in) operating activities (62,568,747) (214,618,408)<br />

Cash flows provided by (used in) investing activities<br />

Cash flows from loss of control over subsidiaries or other businesses - 200<br />

Cash flows used to obtain control over subsidiaries or other businesses (13,373) -<br />

Cash flows used to purchase non-controlling interests (2,991) (25,774,191)<br />

Other payments to acquire equity or debt instruments of other entities (31,498) -<br />

Other charges for the sale of interests in joint ventures - -<br />

Other payments to acquire interests in joint ventures 68,232,399 41,703,430<br />

Loans to related entities (320,088) -<br />

Proceeds from the sale of property, plant and equipment 7,500 -<br />

Purchases of property, plant and equipment (19,461,973) (6,272,724)<br />

Amounts provided by sale of intangibles (7,101,347) (620)<br />

Purchases of intangibles (179,944) (4,990,234)<br />

Charges to related entities 7,212,584 773,212<br />

Dividends received 984,992 1,557,231<br />

Interest received - -<br />

Refunded (paid) income tax 14,042 2,903<br />

Other cash inflows (outflows) 1,425,006 429,689<br />

Net cash flows provided by (used in) investing activities 50,765,309 7,428,895