PA - Banco Security

PA - Banco Security

PA - Banco Security

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7) Regulatory Capital Requirement<br />

In accordance with the Chilean General Banking Law, the Bank should have a minimum 8% effective equity/risk-weighted consolidated<br />

assets ratio, net of required provisions, and a minimum 3% Basic Capital/Total Consolidated Assets ratio, net of required provisions. For<br />

that purpose the effective equity is calculated based on the Equity and Reserves or the Basic Capital, with the following adjustments:<br />

a) Junior bonds with a ceiling of 50% of the Basic Capital are added. b) The balance of assets corresponding to goodwill or markups<br />

paid and investments in companies not participating in the consolidation are deducted.<br />

Assets are weighted according to their risk category, to which a risk percentage is assigned depending on the amount of capital<br />

needed to support each of the assets. Five risk categories are applied (0%, 10%, 20%, 60% and 100%). For example, cash, deposits in<br />

other banks and financial instruments issued by the Chilean Central Bank have 0% risk, which means that, under current regulations,<br />

no capital is needed to back up these assets. Fixed assets have a 100% risk, which means that a minimum capital equivalent to 8%<br />

of the amount of such assets needs to be maintained.<br />

All derivative instruments traded over the counter are considered in calculating assets at risk by using a conversion factor on notional<br />

values, thereby obtaining the amount of exposure to credit risk (or “credit equivalent”). Off-balance sheet contingent credits are also<br />

considered as a “credit equivalent” for weighting.<br />

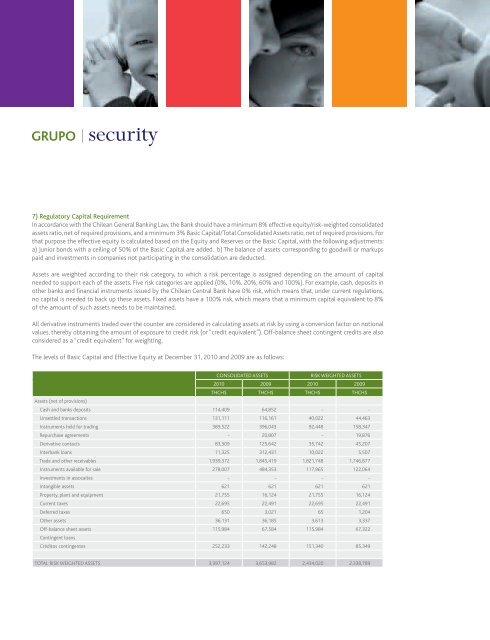

The levels of Basic Capital and Effective Equity at December 31, 2010 and 2009 are as follows:<br />

Consolidated Assets<br />

Risk weighted Assets<br />

2010 2009 2010 2009<br />

THCH$ THCH$ THCH$ THCH$<br />

Assets (net of provisions)<br />

Cash and banks deposits 114,409 64,852 - -<br />

Unsettled transactions 131,111 116,161 40,022 44,463<br />

Instruments held for trading 389,522 396,043 92,448 158,347<br />

Repurchase agreements - 20,807 - 19,876<br />

Derivative contacts 83,309 125,642 35,742 45,207<br />

Interbank loans 11,325 312,431 10,022 5,507<br />

Trade and other receivables 1,939,372 1,845,419 1,821,748 1,746,877<br />

Instruments available for sale 278,007 484,353 117,965 122,064<br />

Investments in assocaites - - - -<br />

Intangible assets 621 621 621 621<br />

Property, plant and equipment 21,755 16,124 21,755 16,124<br />

Current taxes 22,695 22,491 22,695 22,491<br />

Deferred taxes 650 3,021 65 1,204<br />

Other assets 36,131 36,185 3,613 3,337<br />

Off-balance sheet assets 115,984 67,584 115,984 67,322<br />

Contingent loans<br />

Créditos contingentes 252,233 142,248 151,340 85,349<br />

Total risk weighted assets 3,397,124 3,653,982 2,434,020 2,338,789