PA - Banco Security

PA - Banco Security

PA - Banco Security

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

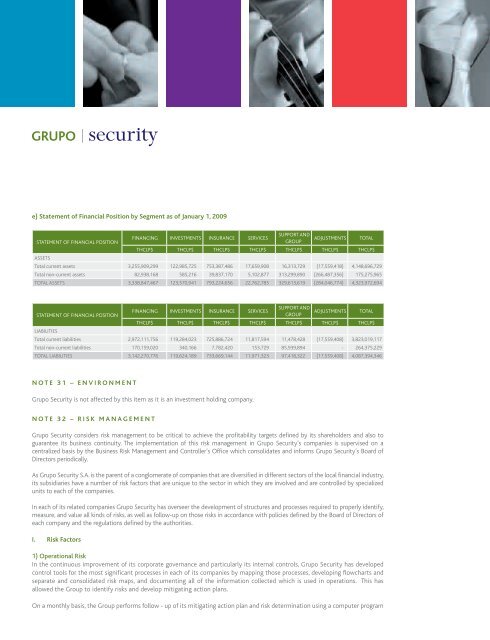

e) Statement of Financial Position by Segment as of January 1, 2009<br />

Statement of Financial Position<br />

FINANCING INVESTMENTS INSURANCE SERVICES<br />

SUPPORT AND<br />

GROUP<br />

ADJUSTMENTS<br />

TOTAL<br />

ThCLP$ ThCLP$ ThCLP$ ThCLP$ ThCLP$ ThCLP$ ThCLP$<br />

Assets<br />

Total current assets 3,255,909,299 122,985,725 753,387,486 17,659,908 16,313,729 (17,559,418) 4,148,696,729<br />

Total non-current assets 82,938,168 585,216 39,837,170 5,102,877 313,299,890 (266,487,356) 175,275,965<br />

Total assets 3,338,847,467 123,570,941 793,224,656 22,762,785 329,613,619 (284,046,774) 4,323,972,694<br />

SUPPORT AND<br />

FINANCING INVESTMENTS INSURANCE SERVICES<br />

Statement of Financial Position<br />

GROUP<br />

ADJUSTMENTS TOTAL<br />

ThCLP$ ThCLP$ ThCLP$ ThCLP$ ThCLP$ ThCLP$ ThCLP$<br />

Liabilities<br />

Total current liabilities 2,972,111,756 119,284,023 725,886,724 11,817,594 11,478,428 (17,559,408) 3,823,019,117<br />

Total non-current liabilities 170,159,020 340,166 7,782,420 153,729 85,939,894 - 264,375,229<br />

Total liabilities 3,142,270,776 119,624,189 733,669,144 11,971,323 97,418,322 (17,559,408) 4,087,394,346<br />

Note 31 – Environment<br />

Grupo <strong>Security</strong> is not affected by this item as it is an investment holding company.<br />

Note 32 – Risk Management<br />

Grupo <strong>Security</strong> considers risk management to be critical to achieve the profitability targets defined by its shareholders and also to<br />

guarantee its business continuity. The implementation of this risk management in Grupo <strong>Security</strong>’s companies is supervised on a<br />

centralized basis by the Business Risk Management and Controller’s Office which consolidates and informs Grupo <strong>Security</strong>’s Board of<br />

Directors periodically.<br />

As Grupo <strong>Security</strong> S.A. is the parent of a conglomerate of companies that are diversified in different sectors of the local financial industry,<br />

its subsidiaries have a number of risk factors that are unique to the sector in which they are involved and are controlled by specialized<br />

units to each of the companies.<br />

In each of its related companies Grupo <strong>Security</strong> has overseer the development of structures and processes required to properly identify,<br />

measure, and value all kinds of risks, as well as follow-up on those risks in accordance with policies defined by the Board of Directors of<br />

each company and the regulations defined by the authorities.<br />

I. Risk Factors<br />

1) Operational Risk<br />

In the continuous improvement of its corporate governance and particularly its internal controls, Grupo <strong>Security</strong> has developed<br />

control tools for the most significant processes in each of its companies by mapping those processes, developing flowcharts and<br />

separate and consolidated risk maps, and documenting all of the information collected which is used in operations. This has<br />

allowed the Group to identify risks and develop mitigating action plans.<br />

On a monthly basis, the Group performs follow - up of its mitigating action plan and risk determination using a computer program