PA - Banco Security

PA - Banco Security

PA - Banco Security

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

199<br />

<strong>PA</strong>GE<br />

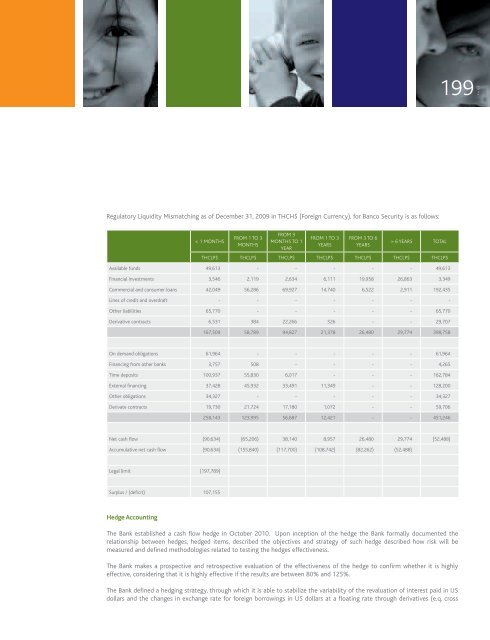

Regulatory Liquidity Mismatching as of December 31, 2009 in THCH$ (Foreign Currency), for <strong>Banco</strong> <strong>Security</strong> is as follows:<br />

< 1 months<br />

From 1 to 3<br />

months<br />

From 3<br />

months to 1<br />

year<br />

From 1 to 3<br />

years<br />

From 3 to 6<br />

years<br />

> 6 years total<br />

ThCLP$ ThCLP$ ThCLP$ ThCLP$ ThCLP$ ThCLP$ ThCLP$<br />

Available funds 49,613 - - - - - 49,613<br />

Financial investments 3,546 2,119 2,634 6,111 19,958 26,863 3,349<br />

Commercial and consumer loans 42,049 56,286 69,927 14,740 6,522 2,911 192,435<br />

Lines of credit and overdraft - - - - - - -<br />

Other liabilities 65,770 - - - - - 65,770<br />

Derivative contracts 6,531 384 22,266 526 - - 29,707<br />

167,509 58,789 94,827 21,378 26,480 29,774 398,758<br />

On demand obligations 61,964 - - - - - 61,964<br />

Financing from other banks 3,757 508 - - - - 4,265<br />

Time deposits 100,937 55,830 6,017 - - - 162,784<br />

External financing 37,428 45,932 33,491 11,349 - - 128,200<br />

Other obligations 34,327 - - - - - 34,327<br />

Derivate contracts 19,730 21,724 17,180 1,072 - - 59,706<br />

258,143 123,995 56,687 12,421 - - 451,246<br />

Net cash flow (90,634) (65,206) 38,140 8,957 26,480 29,774 (52,488)<br />

Accumulative net cash flow (90,634) (155,840) (117,700) (108,742) (82,262) (52,488)<br />

Legal limit (197,789)<br />

Surplus / (deficit) 107,155<br />

Hedge Accounting<br />

The Bank established a cash flow hedge in October 2010. Upon inception of the hedge the Bank formally documented the<br />

relationship between hedges, hedged items, described the objectives and strategy of such hedge described how risk will be<br />

measured and defined methodologies related to testing the hedges effectiveness.<br />

The Bank makes a prospective and retrospective evaluation of the effectiveness of the hedge to confirm whether it is highly<br />

effective, considering that it is highly effective if the results are between 80% and 125%.<br />

The Bank defined a hedging strategy, through which it is able to stabilize the variability of the revaluation of interest paid in US<br />

dollars and the changes in exchange rate for foreign borrowings in US dollars at a floating rate through derivatives (e.q. cross