PA - Banco Security

PA - Banco Security

PA - Banco Security

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

233<br />

<strong>PA</strong>GE<br />

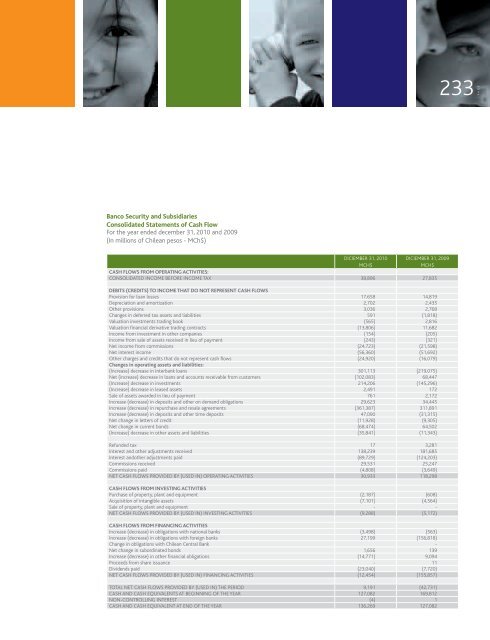

<strong>Banco</strong> <strong>Security</strong> and Subsidiaries<br />

Consolidated Statements of Cash Flow<br />

For the year ended december 31, 2010 and 2009<br />

(In millions of Chilean pesos - MCh$)<br />

diciembeR 31, 2010<br />

MCH$<br />

diciembeR 31, 2009<br />

MCH$<br />

CASH FLOWS FROM OPERATING ACTIVITIES:<br />

Consolidated income before income tax 38,896 27,835<br />

Debits (credits) to income that do not represent cash flows<br />

Provision for loan losses 17,658 14,819<br />

Depreciation and amortization 2,702 2,435<br />

Other provisions 3,036 2,768<br />

Changes in deferred tax assets and liabilities 591 (1,818)<br />

Valuation investments trading book (565) 2,816<br />

Valuation financial derivative trading contracts (13,806) 11,682<br />

Income from investment in other companies (154) (205)<br />

Income from sale of assets received in lieu of payment (243) (321)<br />

Net income from commissions (24,723) (21,598)<br />

Net interest income (56,360) (51,692)<br />

Other charges and credits that do not represent cash flows (24,920) (16,079)<br />

Changes in operating assets and liabilities:<br />

(Increase) decrease in interbank loans 301,113 (219,075)<br />

Net (increase) decrease in loans and accounts receivable from customers (102,083) 68,447<br />

(Increase) decrease in investments 214,206 (145,296)<br />

(Increase) decrease in leased assets 2,491 172<br />

Sale of assets awarded in lieu of payment 761 2,172<br />

Increase (decrease) in deposits and other on demand obligations 29,623 34,445<br />

Increase (decrease) in repurchase and resale agreements (361,387) 311,891<br />

Increase (decrease) in deposits and other time deposits 47,090 (31,315)<br />

Net change in letters of credit (11,928) (9,305)<br />

Net change in current bonds (68,474) 64,502<br />

(Increase) decrease in other assets and liabilities (35,841) (11,343)<br />

Refunded tax 17 3,281<br />

Interest and other adjustments received 138,239 181,685<br />

Interest andother adjustments paid (89,729) (124,203)<br />

Commissions received 29,531 25,247<br />

Commissions paid (4,808) (3,649)<br />

Net cash flows provided by (used in) operating activities 30,933 118,298<br />

CASH FLOWS FROM INVESTING ACTIVITIES<br />

Purchase of property, plant and equipment (2,187) (608)<br />

Acquisition of intangible assets (7,101) (4,564)<br />

Sale of property, plant and equipment - -<br />

Net cash flows provided by (used in) investing activities (9,288) (5,172)<br />

CASH FLOWS FROM FINANCING ACTIVITIES<br />

Increase (decrease) in obligations with national banks (3,498) (563)<br />

Increase (decrease) in obligations with foreign banks 27,199 (156,818)<br />

Change in obligations with Chilean Central Bank -<br />

Net change in subordinated bonds 1,656 139<br />

Increase (decrease) in other financial obligations (14,771) 9,094<br />

Proceeds from share issuance - 11<br />

Dividends paid (23,040) (7,720)<br />

Net cash flows provided by (used in) financing activities (12,454) (155,857)<br />

TOTAL NET CASH FLOWS PROVIDED BY (USED IN) THE PERIOD 9,191 (42,731)<br />

CASH AND CASH EQUIVALENTS AT BEGINNING OF THE YEAR 127,082 169,812<br />

NON-CONTROLLING INTEREST (4) 1<br />

CASH AND CASH EQUIVALENT AT END OF THE YEAR 136,269 127,082