QuickBooks 2010 - Get Ready for the VAT Change 04 Jan 2011

QuickBooks 2010 - Get Ready for the VAT Change 04 Jan 2011

QuickBooks 2010 - Get Ready for the VAT Change 04 Jan 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

25<br />

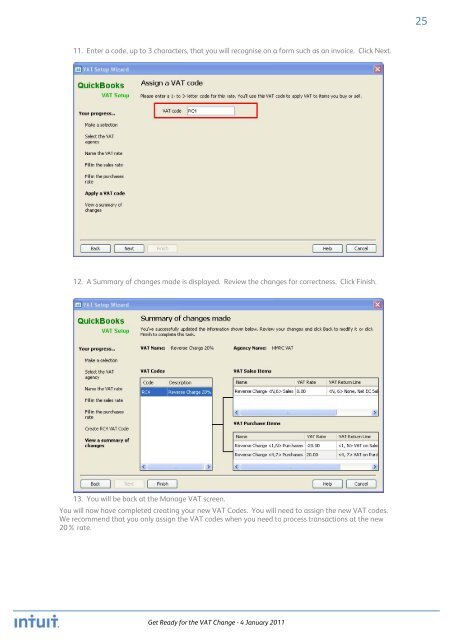

11. Enter a code, up to 3 characters, that you will recognise on a <strong>for</strong>m such as an invoice. Click Next.<br />

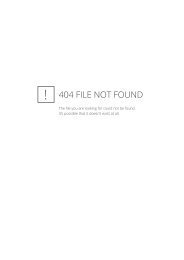

12. A Summary of changes made is displayed. Review <strong>the</strong> changes <strong>for</strong> correctness. Click Finish.<br />

13. You will be back at <strong>the</strong> Manage <strong>VAT</strong> screen.<br />

You will now have completed creating your new <strong>VAT</strong> Codes. You will need to assign <strong>the</strong> new <strong>VAT</strong> codes.<br />

We recommend that you only assign <strong>the</strong> <strong>VAT</strong> codes when you need to process transactions at <strong>the</strong> new<br />

20% rate.<br />

<strong>Get</strong> <strong>Ready</strong> <strong>for</strong> <strong>the</strong> <strong>VAT</strong> <strong>Change</strong> - 4 <strong>Jan</strong>uary <strong>2011</strong>