u8Zcc

u8Zcc

u8Zcc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to Consolidated Financial Statements (Continued)<br />

(7) Investment gains/losses (Continued)<br />

in the cost basis of the investment, but not the fair value. Accordingly, such losses that are included in earnings are generally<br />

offset by a corresponding credit to other comprehensive income and therefore have no net effect on shareholders’ equity as of<br />

the balance sheet date.<br />

We recorded OTTI losses on bonds issued by Texas Competitive Electric Holdings (“TCEH”) of $228 million in 2013,<br />

$337 million in 2012 and $390 million in 2011. In 2011, OTTI losses also included $337 million with respect to 103.6 million<br />

shares of our investment in Wells Fargo & Company (“Wells Fargo”) common stock. These shares had an aggregate original<br />

cost of $3.6 billion. On March 31, 2011, when we recorded the losses, we also held an additional 255.4 million shares of Wells<br />

Fargo which were acquired at an aggregate cost of $4.4 billion and which had unrealized gains of $3.7 billion. However, the<br />

unrealized gains were not reflected in earnings but were instead recorded directly in shareholders’ equity as a component of<br />

accumulated other comprehensive income.<br />

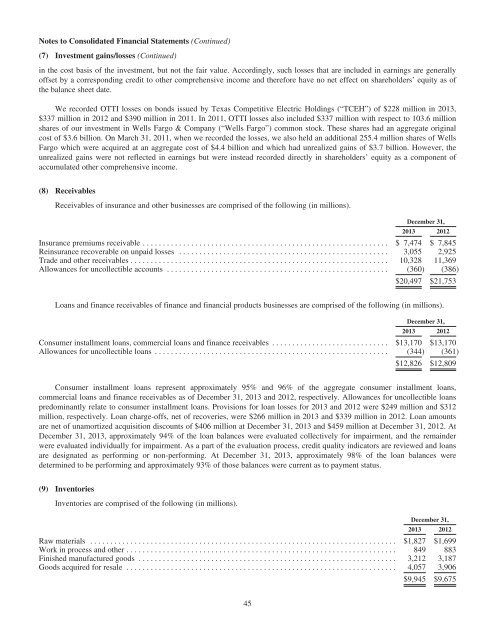

(8) Receivables<br />

Receivables of insurance and other businesses are comprised of the following (in millions).<br />

December 31,<br />

2013 2012<br />

Insurance premiums receivable ............................................................. $ 7,474 $ 7,845<br />

Reinsurance recoverable on unpaid losses .................................................... 3,055 2,925<br />

Trade and other receivables ................................................................ 10,328 11,369<br />

Allowances for uncollectible accounts ....................................................... (360) (386)<br />

$20,497 $21,753<br />

Loans and finance receivables of finance and financial products businesses are comprised of the following (in millions).<br />

December 31,<br />

2013 2012<br />

Consumer installment loans, commercial loans and finance receivables ............................. $13,170 $13,170<br />

Allowances for uncollectible loans .......................................................... (344) (361)<br />

$12,826 $12,809<br />

Consumer installment loans represent approximately 95% and 96% of the aggregate consumer installment loans,<br />

commercial loans and finance receivables as of December 31, 2013 and 2012, respectively. Allowances for uncollectible loans<br />

predominantly relate to consumer installment loans. Provisions for loan losses for 2013 and 2012 were $249 million and $312<br />

million, respectively. Loan charge-offs, net of recoveries, were $266 million in 2013 and $339 million in 2012. Loan amounts<br />

are net of unamortized acquisition discounts of $406 million at December 31, 2013 and $459 million at December 31, 2012. At<br />

December 31, 2013, approximately 94% of the loan balances were evaluated collectively for impairment, and the remainder<br />

were evaluated individually for impairment. As a part of the evaluation process, credit quality indicators are reviewed and loans<br />

are designated as performing or non-performing. At December 31, 2013, approximately 98% of the loan balances were<br />

determined to be performing and approximately 93% of those balances were current as to payment status.<br />

(9) Inventories<br />

Inventories are comprised of the following (in millions).<br />

December 31,<br />

2013 2012<br />

Raw materials ............................................................................ $1,827 $1,699<br />

Work in process and other ................................................................... 849 883<br />

Finished manufactured goods ................................................................ 3,212 3,187<br />

Goods acquired for resale ................................................................... 4,057 3,906<br />

$9,945 $9,675<br />

45