u8Zcc

u8Zcc

u8Zcc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion (Continued)<br />

Insurance—Underwriting (Continued)<br />

GEICO (Continued)<br />

underwriting costs that are capitalized and expensed as premiums are earned over the policy period. The new accounting<br />

standard, which we adopted on a prospective basis as of January 1, 2012, accelerates the timing of when certain underwriting<br />

costs are recognized in earnings. We estimate that GEICO’s underwriting expenses in 2012 would have been about $410 million<br />

less had we computed DPAC under the prior accounting standard. The effect of transitioning to this new accounting standard<br />

was completed in 2012. Excluding the effects of the accounting change in 2012, the ratio of underwriting expenses to premiums<br />

earned (the “expense ratio”) in 2013 declined by approximately 0.4 percentage points from 2012.<br />

Premiums earned in 2012 were approximately $16.7 billion, an increase of $1.4 billion (9.0%) over 2011. The growth in<br />

premiums earned for voluntary auto was 9.0% as a result of a 6.5% increase in policies-in-force and an increase in average<br />

premium per policy as compared to 2011. Voluntary auto new business sales in 2012 increased slightly compared with 2011.<br />

Voluntary auto policies-in-force at December 31, 2012 were approximately 704,000 greater than at December 31, 2011.<br />

Losses and loss adjustment expenses incurred in 2012 were $12.7 billion, an increase of $687 million (5.7%) over 2011.<br />

The loss ratio was 75.9% in 2012 and 78.2% in 2011. Losses and loss adjustment expenses in 2012 included $490 million<br />

related to Hurricane Sandy. With the exception of Hurricane Sandy, GEICO’s catastrophe losses tend to occur regularly and are<br />

normally not individually significant in amount.<br />

Despite the losses from Hurricane Sandy, our loss ratio declined in 2012 as compared to 2011. Claims frequencies for<br />

property damage and collision coverages were down about one percent, comprehensive coverage frequencies were down about<br />

ten percent, excluding Hurricane Sandy, and frequencies for bodily injury coverages were relatively unchanged. Physical<br />

damage severities increased in the two to four percent range and bodily injury severities increased in the one to three percent<br />

range from 2011.<br />

Underwriting expenses incurred in 2012 increased $586 million (21.1%) compared with 2011. The increase was primarily<br />

the result of the change in U.S. GAAP concerning DPAC discussed previously. We estimate that GEICO’s underwriting<br />

expenses in 2012 would have been about $410 million less had we computed DPAC under the prior accounting standard. Based<br />

on that estimate, GEICO’s expense ratio in 2012 would have been less than in 2011.<br />

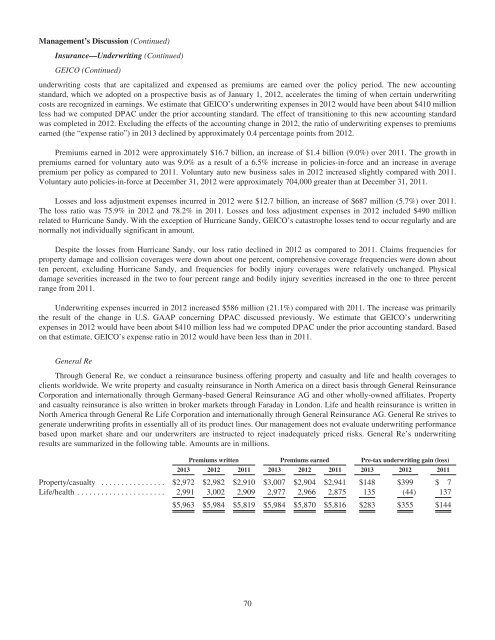

General Re<br />

Through General Re, we conduct a reinsurance business offering property and casualty and life and health coverages to<br />

clients worldwide. We write property and casualty reinsurance in North America on a direct basis through General Reinsurance<br />

Corporation and internationally through Germany-based General Reinsurance AG and other wholly-owned affiliates. Property<br />

and casualty reinsurance is also written in broker markets through Faraday in London. Life and health reinsurance is written in<br />

North America through General Re Life Corporation and internationally through General Reinsurance AG. General Re strives to<br />

generate underwriting profits in essentially all of its product lines. Our management does not evaluate underwriting performance<br />

based upon market share and our underwriters are instructed to reject inadequately priced risks. General Re’s underwriting<br />

results are summarized in the following table. Amounts are in millions.<br />

Premiums written Premiums earned Pre-tax underwriting gain (loss)<br />

2013 2012 2011 2013 2012 2011 2013 2012 2011<br />

Property/casualty ................ $2,972 $2,982 $2,910 $3,007 $2,904 $2,941 $148 $399 $ 7<br />

Life/health ...................... 2,991 3,002 2,909 2,977 2,966 2,875 135 (44) 137<br />

$5,963 $5,984 $5,819 $5,984 $5,870 $5,816 $283 $355 $144<br />

70