u8Zcc

u8Zcc

u8Zcc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion (Continued)<br />

Insurance—Investment Income (Continued)<br />

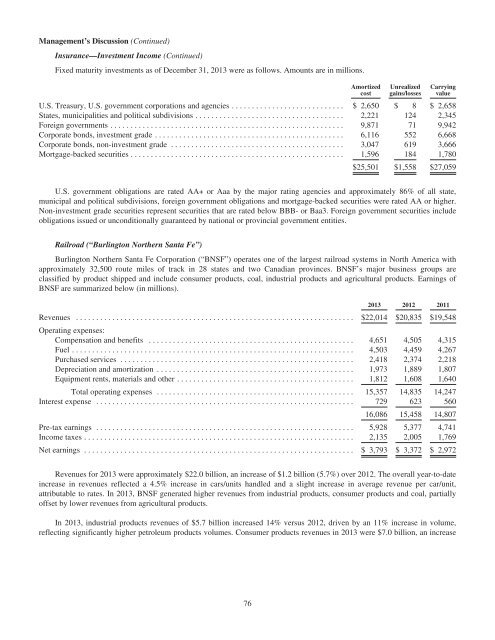

Fixed maturity investments as of December 31, 2013 were as follows. Amounts are in millions.<br />

Amortized<br />

cost<br />

Unrealized<br />

gains/losses<br />

Carrying<br />

value<br />

U.S. Treasury, U.S. government corporations and agencies ............................ $ 2,650 $ 8 $ 2,658<br />

States, municipalities and political subdivisions ..................................... 2,221 124 2,345<br />

Foreign governments .......................................................... 9,871 71 9,942<br />

Corporate bonds, investment grade ............................................... 6,116 552 6,668<br />

Corporate bonds, non-investment grade ........................................... 3,047 619 3,666<br />

Mortgage-backed securities ..................................................... 1,596 184 1,780<br />

$25,501 $1,558 $27,059<br />

U.S. government obligations are rated AA+ or Aaa by the major rating agencies and approximately 86% of all state,<br />

municipal and political subdivisions, foreign government obligations and mortgage-backed securities were rated AA or higher.<br />

Non-investment grade securities represent securities that are rated below BBB- or Baa3. Foreign government securities include<br />

obligations issued or unconditionally guaranteed by national or provincial government entities.<br />

Railroad (“Burlington Northern Santa Fe”)<br />

Burlington Northern Santa Fe Corporation (“BNSF”) operates one of the largest railroad systems in North America with<br />

approximately 32,500 route miles of track in 28 states and two Canadian provinces. BNSF’s major business groups are<br />

classified by product shipped and include consumer products, coal, industrial products and agricultural products. Earnings of<br />

BNSF are summarized below (in millions).<br />

2013 2012 2011<br />

Revenues ..................................................................... $22,014 $20,835 $19,548<br />

Operating expenses:<br />

Compensation and benefits ................................................... 4,651 4,505 4,315<br />

Fuel ...................................................................... 4,503 4,459 4,267<br />

Purchased services .......................................................... 2,418 2,374 2,218<br />

Depreciation and amortization ................................................. 1,973 1,889 1,807<br />

Equipment rents, materials and other ............................................ 1,812 1,608 1,640<br />

Total operating expenses ................................................. 15,357 14,835 14,247<br />

Interest expense ................................................................ 729 623 560<br />

16,086 15,458 14,807<br />

Pre-tax earnings ................................................................ 5,928 5,377 4,741<br />

Income taxes ................................................................... 2,135 2,005 1,769<br />

Net earnings ................................................................... $ 3,793 $ 3,372 $ 2,972<br />

Revenues for 2013 were approximately $22.0 billion, an increase of $1.2 billion (5.7%) over 2012. The overall year-to-date<br />

increase in revenues reflected a 4.5% increase in cars/units handled and a slight increase in average revenue per car/unit,<br />

attributable to rates. In 2013, BNSF generated higher revenues from industrial products, consumer products and coal, partially<br />

offset by lower revenues from agricultural products.<br />

In 2013, industrial products revenues of $5.7 billion increased 14% versus 2012, driven by an 11% increase in volume,<br />

reflecting significantly higher petroleum products volumes. Consumer products revenues in 2013 were $7.0 billion, an increase<br />

76