Motor Vehicle Tax Guidebook 2011 - Texas Comptroller of Public ...

Motor Vehicle Tax Guidebook 2011 - Texas Comptroller of Public ...

Motor Vehicle Tax Guidebook 2011 - Texas Comptroller of Public ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Section II<br />

<strong>Tax</strong> Rates and Types<br />

<strong>Tax</strong> Rates<br />

• Current <strong>Tax</strong> Rate<br />

• Prior <strong>Tax</strong> Rates<br />

Current <strong>Tax</strong> Rate<br />

The current motor vehicle tax rate is 6.25 percent. The<br />

tax due on a motor vehicle, however, is calculated at<br />

the rate in effect on the date the owner purchased the<br />

motor vehicle in <strong>Texas</strong> or the date it was first brought<br />

into <strong>Texas</strong>.<br />

Prior <strong>Tax</strong> Rates<br />

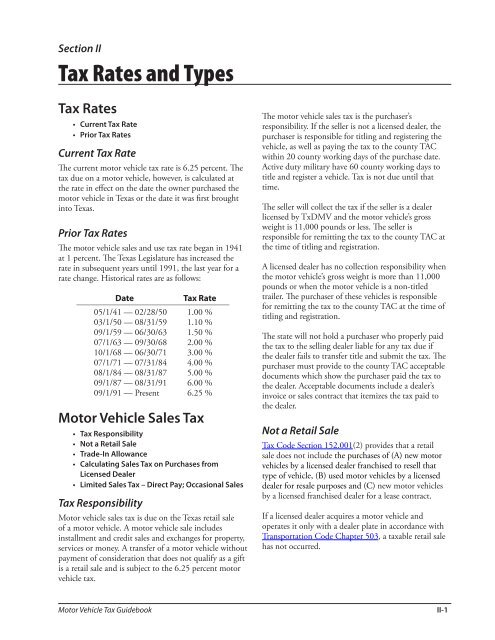

The motor vehicle sales and use tax rate began in 1941<br />

at 1 percent. The <strong>Texas</strong> Legislature has increased the<br />

rate in subsequent years until 1991, the last year for a<br />

rate change. Historical rates are as follows:<br />

Date<br />

<strong>Tax</strong> Rate<br />

05/1/41 — 02/28/50 1.00 %<br />

03/1/50 — 08/31/59 1.10 %<br />

09/1/59 — 06/30/63 1.50 %<br />

07/1/63 — 09/30/68 2.00 %<br />

10/1/68 — 06/30/71 3.00 %<br />

07/1/71 — 07/31/84 4.00 %<br />

08/1/84 — 08/31/87 5.00 %<br />

09/1/87 — 08/31/91 6.00 %<br />

09/1/91 — Present 6.25 %<br />

<strong>Motor</strong> <strong>Vehicle</strong> Sales <strong>Tax</strong><br />

• <strong>Tax</strong> Responsibility<br />

• Not a Retail Sale<br />

• Trade-In Allowance<br />

• Calculating Sales <strong>Tax</strong> on Purchases from<br />

Licensed Dealer<br />

• Limited Sales <strong>Tax</strong> – Direct Pay; Occasional Sales<br />

<strong>Tax</strong> Responsibility<br />

<strong>Motor</strong> vehicle sales tax is due on the <strong>Texas</strong> retail sale<br />

<strong>of</strong> a motor vehicle. A motor vehicle sale includes<br />

installment and credit sales and exchanges for property,<br />

services or money. A transfer <strong>of</strong> a motor vehicle without<br />

payment <strong>of</strong> consideration that does not qualify as a gift<br />

is a retail sale and is subject to the 6.25 percent motor<br />

vehicle tax.<br />

The motor vehicle sales tax is the purchaser’s<br />

responsibility. If the seller is not a licensed dealer, the<br />

purchaser is responsible for titling and registering the<br />

vehicle, as well as paying the tax to the county TAC<br />

within 20 county working days <strong>of</strong> the purchase date.<br />

Active duty military have 60 county working days to<br />

title and register a vehicle. <strong>Tax</strong> is not due until that<br />

time.<br />

The seller will collect the tax if the seller is a dealer<br />

licensed by TxDMV and the motor vehicle’s gross<br />

weight is 11,000 pounds or less. The seller is<br />

responsible for remitting the tax to the county TAC at<br />

the time <strong>of</strong> titling and registration.<br />

A licensed dealer has no collection responsibility when<br />

the motor vehicle’s gross weight is more than 11,000<br />

pounds or when the motor vehicle is a non-titled<br />

trailer. The purchaser <strong>of</strong> these vehicles is responsible<br />

for remitting the tax to the county TAC at the time <strong>of</strong><br />

titling and registration.<br />

The state will not hold a purchaser who properly paid<br />

the tax to the selling dealer liable for any tax due if<br />

the dealer fails to transfer title and submit the tax. The<br />

purchaser must provide to the county TAC acceptable<br />

documents which show the purchaser paid the tax to<br />

the dealer. Acceptable documents include a dealer’s<br />

invoice or sales contract that itemizes the tax paid to<br />

the dealer.<br />

Not a Retail Sale<br />

<strong>Tax</strong> Code Section 152.001(2) provides that a retail<br />

sale does not include the purchases <strong>of</strong> (A) new motor<br />

vehicles by a licensed dealer franchised to resell that<br />

type <strong>of</strong> vehicle, (B) used motor vehicles by a licensed<br />

dealer for resale purposes and (C) new motor vehicles<br />

by a licensed franchised dealer for a lease contract.<br />

If a licensed dealer acquires a motor vehicle and<br />

operates it only with a dealer plate in accordance with<br />

Transportation Code Chapter 503, a taxable retail sale<br />

has not occurred.<br />

<strong>Motor</strong> <strong>Vehicle</strong> <strong>Tax</strong> <strong>Guidebook</strong><br />

II-1