Motor Vehicle Tax Guidebook 2011 - Texas Comptroller of Public ...

Motor Vehicle Tax Guidebook 2011 - Texas Comptroller of Public ...

Motor Vehicle Tax Guidebook 2011 - Texas Comptroller of Public ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Section III<br />

Specific Provisions<br />

Accessories and Attachments<br />

Affixed to a <strong>Motor</strong> <strong>Vehicle</strong><br />

• <strong>Tax</strong> Due at Time <strong>of</strong> Sale<br />

• Three Situations and <strong>Tax</strong> Consequences<br />

• Accessories/Attachments Affixed<br />

at the Time <strong>of</strong> Sale<br />

• Accessories/Attachments Purchased Separately<br />

• Accessories/Attachments Purchased to<br />

Combine into a Homemade or Shop-Made<br />

<strong>Motor</strong> <strong>Vehicle</strong><br />

<strong>Tax</strong> Due at Time <strong>of</strong> Sale<br />

<strong>Motor</strong> vehicle tax is due on the consideration paid or to<br />

be paid for a motor vehicle, including all accessories or<br />

attachments affixed at the time <strong>of</strong> sale.<br />

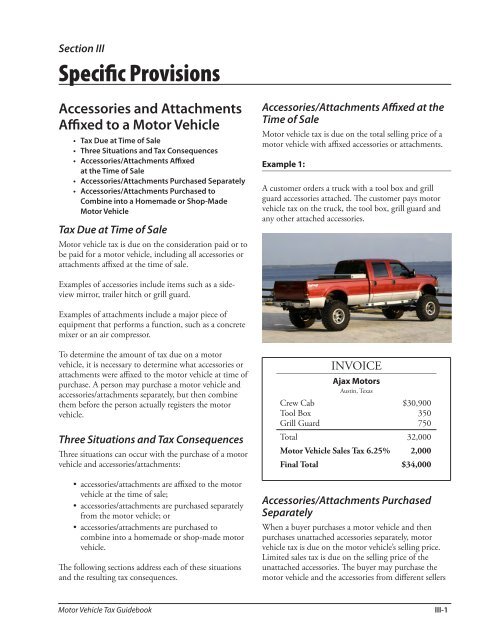

Accessories/Attachments Affixed at the<br />

Time <strong>of</strong> Sale<br />

<strong>Motor</strong> vehicle tax is due on the total selling price <strong>of</strong> a<br />

motor vehicle with affixed accessories or attachments.<br />

Example 1:<br />

A customer orders a truck with a tool box and grill<br />

guard accessories attached. The customer pays motor<br />

vehicle tax on the truck, the tool box, grill guard and<br />

any other attached accessories.<br />

Examples <strong>of</strong> accessories include items such as a sideview<br />

mirror, trailer hitch or grill guard.<br />

Examples <strong>of</strong> attachments include a major piece <strong>of</strong><br />

equipment that performs a function, such as a concrete<br />

mixer or an air compressor.<br />

To determine the amount <strong>of</strong> tax due on a motor<br />

vehicle, it is necessary to determine what accessories or<br />

attachments were affixed to the motor vehicle at time <strong>of</strong><br />

purchase. A person may purchase a motor vehicle and<br />

accessories/attachments separately, but then combine<br />

them before the person actually registers the motor<br />

vehicle.<br />

Three Situations and <strong>Tax</strong> Consequences<br />

Three situations can occur with the purchase <strong>of</strong> a motor<br />

vehicle and accessories/attachments:<br />

• accessories/attachments are affixed to the motor<br />

vehicle at the time <strong>of</strong> sale;<br />

• accessories/attachments are purchased separately<br />

from the motor vehicle; or<br />

• accessories/attachments are purchased to<br />

combine into a homemade or shop-made motor<br />

vehicle.<br />

The following sections address each <strong>of</strong> these situations<br />

and the resulting tax consequences.<br />

INVOICE<br />

Ajax <strong>Motor</strong>s<br />

Austin, <strong>Texas</strong><br />

Crew Cab $30,900<br />

Tool Box 350<br />

Grill Guard 750<br />

Total 32,000<br />

<strong>Motor</strong> <strong>Vehicle</strong> Sales <strong>Tax</strong> 6.25% 2,000<br />

Final Total $34,000<br />

Accessories/Attachments Purchased<br />

Separately<br />

When a buyer purchases a motor vehicle and then<br />

purchases unattached accessories separately, motor<br />

vehicle tax is due on the motor vehicle’s selling price.<br />

Limited sales tax is due on the selling price <strong>of</strong> the<br />

unattached accessories. The buyer may purchase the<br />

motor vehicle and the accessories from different sellers<br />

<strong>Motor</strong> <strong>Vehicle</strong> <strong>Tax</strong> <strong>Guidebook</strong><br />

III-1