filing-the-fafsa-2015-2016-edition

filing-the-fafsa-2015-2016-edition

filing-the-fafsa-2015-2016-edition

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Filing <strong>the</strong> FAFSA 1<br />

INTRODUCTION<br />

Paying for college is <strong>the</strong> second largest expense most families incur, second only to <strong>the</strong> purchase of a<br />

home.<br />

A college education provides many benefits. College graduates earn more money and have lower<br />

unemployment rates, on average, than high school graduates. The prospects for future job growth are<br />

greatest for jobs requiring a college degree. People with college degrees are also healthier, happier, more<br />

likely to volunteer and more likely to vote. College is a pathway to success and a better life. 1<br />

To go to college, most people need some financial help. Everybody, regardless of income, struggles to<br />

pay for college. Even wealthy students need some help. Luckily, <strong>the</strong>re are many sources of money to help<br />

students pay for college costs and make college more affordable.<br />

▶ Money for College<br />

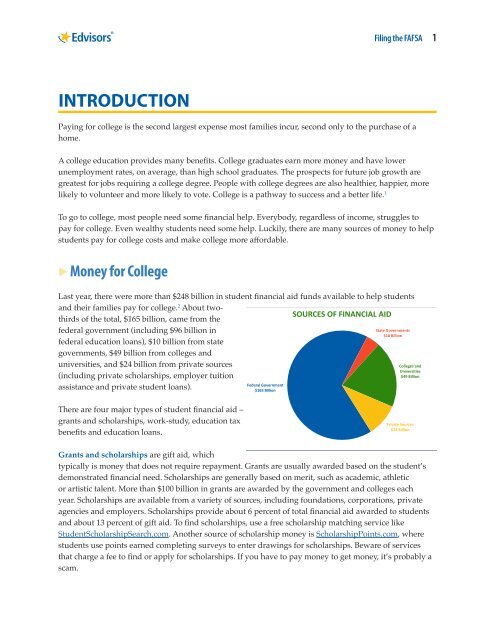

Last year, <strong>the</strong>re were more than $248 billion in student financial aid funds available to help students<br />

and <strong>the</strong>ir families pay for college. 2 About twothirds<br />

of <strong>the</strong> total, $165 billion, came from <strong>the</strong><br />

federal government (including $96 billion in<br />

federal education loans), $10 billion from state<br />

governments, $49 billion from colleges and<br />

universities, and $24 billion from private sources<br />

(including private scholarships, employer tuition<br />

assistance and private student loans).<br />

Federal Government<br />

$165 Billion<br />

SOURCES OF FINANCIAL AID<br />

State Governments<br />

$10 Billion<br />

Colleges and<br />

Universities<br />

$49 Billion<br />

There are four major types of student financial aid –<br />

grants and scholarships, work-study, education tax<br />

benefits and education loans.<br />

Private Sources<br />

$24 Billion<br />

Grants and scholarships are gift aid, which<br />

typically is money that does not require repayment. Grants are usually awarded based on <strong>the</strong> student’s<br />

demonstrated financial need. Scholarships are generally based on merit, such as academic, athletic<br />

or artistic talent. More than $100 billion in grants are awarded by <strong>the</strong> government and colleges each<br />

year. Scholarships are available from a variety of sources, including foundations, corporations, private<br />

agencies and employers. Scholarships provide about 6 percent of total financial aid awarded to students<br />

and about 13 percent of gift aid. To find scholarships, use a free scholarship matching service like<br />

StudentScholarshipSearch.com. Ano<strong>the</strong>r source of scholarship money is ScholarshipPoints.com, where<br />

students use points earned completing surveys to enter drawings for scholarships. Beware of services<br />

that charge a fee to find or apply for scholarships. If you have to pay money to get money, it’s probably a<br />

scam.