filing-the-fafsa-2015-2016-edition

filing-the-fafsa-2015-2016-edition

filing-the-fafsa-2015-2016-edition

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Filing <strong>the</strong> FAFSA 157<br />

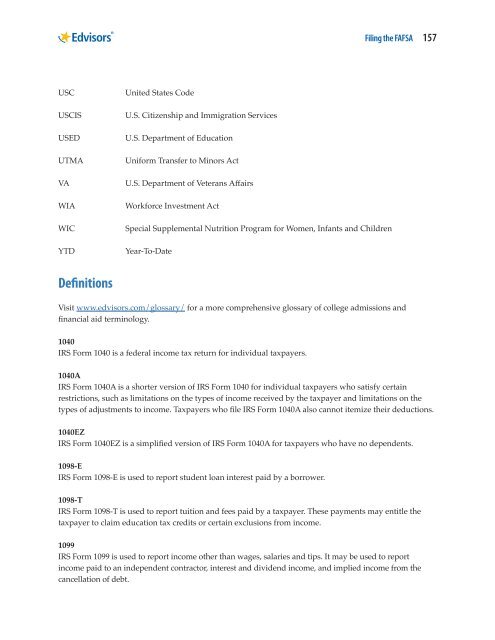

USC<br />

USCIS<br />

USED<br />

UTMA<br />

VA<br />

WIA<br />

WIC<br />

YTD<br />

United States Code<br />

U.S. Citizenship and Immigration Services<br />

U.S. Department of Education<br />

Uniform Transfer to Minors Act<br />

U.S. Department of Veterans Affairs<br />

Workforce Investment Act<br />

Special Supplemental Nutrition Program for Women, Infants and Children<br />

Year-To-Date<br />

Definitions<br />

Visit www.edvisors.com/glossary/ for a more comprehensive glossary of college admissions and<br />

financial aid terminology.<br />

1040<br />

IRS Form 1040 is a federal income tax return for individual taxpayers.<br />

1040A<br />

IRS Form 1040A is a shorter version of IRS Form 1040 for individual taxpayers who satisfy certain<br />

restrictions, such as limitations on <strong>the</strong> types of income received by <strong>the</strong> taxpayer and limitations on <strong>the</strong><br />

types of adjustments to income. Taxpayers who file IRS Form 1040A also cannot itemize <strong>the</strong>ir deductions.<br />

1040EZ<br />

IRS Form 1040EZ is a simplified version of IRS Form 1040A for taxpayers who have no dependents.<br />

1098-E<br />

IRS Form 1098-E is used to report student loan interest paid by a borrower.<br />

1098-T<br />

IRS Form 1098-T is used to report tuition and fees paid by a taxpayer. These payments may entitle <strong>the</strong><br />

taxpayer to claim education tax credits or certain exclusions from income.<br />

1099<br />

IRS Form 1099 is used to report income o<strong>the</strong>r than wages, salaries and tips. It may be used to report<br />

income paid to an independent contractor, interest and dividend income, and implied income from <strong>the</strong><br />

cancellation of debt.