filing-the-fafsa-2015-2016-edition

filing-the-fafsa-2015-2016-edition

filing-the-fafsa-2015-2016-edition

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Filing <strong>the</strong> FAFSA 95<br />

and once as an asset. This is true. If <strong>the</strong> income is a one-time event that is not reflective of <strong>the</strong> family’s<br />

ability to pay during <strong>the</strong> award year, such as an inheritance or life insurance settlement, <strong>the</strong> family can<br />

ask <strong>the</strong> college financial aid administrator for a professional judgment review. Some college financial<br />

aid administrators will make an adjustment to exclude such one-time events from income. However, <strong>the</strong><br />

money will still be counted as an asset.<br />

O<strong>the</strong>r Real Estate<br />

While <strong>the</strong> family’s principal place of residence is excluded as an asset on <strong>the</strong> FAFSA, <strong>the</strong> net worth of<br />

o<strong>the</strong>r real estate must be reported on <strong>the</strong> FAFSA. The net worth should be based on <strong>the</strong> current market<br />

value of <strong>the</strong> real estate minus any debts secured by <strong>the</strong> real estate. Given <strong>the</strong> recent volatility in <strong>the</strong> real<br />

estate market, <strong>the</strong> market value should be as up-to-date as possible.<br />

There are several approaches to determining <strong>the</strong> current market value of real estate before subtracting <strong>the</strong><br />

mortgage debt.<br />

The best approach is to obtain a current appraisal of <strong>the</strong> property from a licensed appraiser. A real<br />

appraisal will cost a few hundred dollars and will be based on comparable sales. A similar approach is<br />

used by web sites like Zillow.com.<br />

One could also use <strong>the</strong> most recent assessment for <strong>the</strong> real estate, if assessments are based on up-todate<br />

market valuations. Unfortunately, many counties use assessments that are not based on current<br />

market values. Often, <strong>the</strong> assessments are out-of-date and may be unrelated to <strong>the</strong> current market value.<br />

Assessments are used to determine property tax, not to determine a reasonable market value.<br />

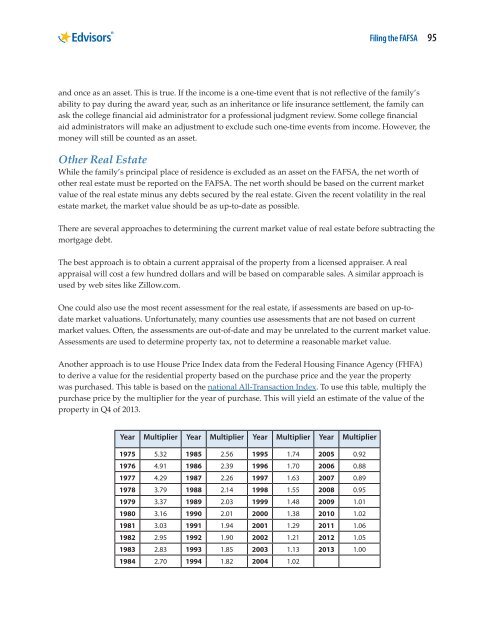

Ano<strong>the</strong>r approach is to use House Price Index data from <strong>the</strong> Federal Housing Finance Agency (FHFA)<br />

to derive a value for <strong>the</strong> residential property based on <strong>the</strong> purchase price and <strong>the</strong> year <strong>the</strong> property<br />

was purchased. This table is based on <strong>the</strong> national All-Transaction Index. To use this table, multiply <strong>the</strong><br />

purchase price by <strong>the</strong> multiplier for <strong>the</strong> year of purchase. This will yield an estimate of <strong>the</strong> value of <strong>the</strong><br />

property in Q4 of 2013.<br />

Year Multiplier Year Multiplier Year Multiplier Year Multiplier<br />

1975 5.32 1985 2.56 1995 1.74 2005 0.92<br />

1976 4.91 1986 2.39 1996 1.70 2006 0.88<br />

1977 4.29 1987 2.26 1997 1.63 2007 0.89<br />

1978 3.79 1988 2.14 1998 1.55 2008 0.95<br />

1979 3.37 1989 2.03 1999 1.48 2009 1.01<br />

1980 3.16 1990 2.01 2000 1.38 2010 1.02<br />

1981 3.03 1991 1.94 2001 1.29 2011 1.06<br />

1982 2.95 1992 1.90 2002 1.21 2012 1.05<br />

1983 2.83 1993 1.85 2003 1.13 2013 1.00<br />

1984 2.70 1994 1.82 2004 1.02