filing-the-fafsa-2015-2016-edition

filing-the-fafsa-2015-2016-edition

filing-the-fafsa-2015-2016-edition

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Filing <strong>the</strong> FAFSA 72<br />

The IRS Data Retrieval Tool may be used to complete<br />

<strong>the</strong> initial FAFSA or to update <strong>the</strong> information on<br />

<strong>the</strong> FAFSA after <strong>the</strong> student and/or parent’s federal<br />

income tax returns have been filed. Since many<br />

states and colleges have early financial aid deadlines,<br />

many families will submit <strong>the</strong> FAFSA with estimated<br />

income and tax information and later use <strong>the</strong> IRS Data<br />

Retrieval Tool to update <strong>the</strong> information after <strong>the</strong>ir<br />

federal income tax returns have been filed.<br />

Students and parents must use <strong>the</strong> IRS Data Retrieval<br />

Tool separately for <strong>the</strong>ir respective federal income tax<br />

returns.<br />

The IRS Data Retrieval Tool typically becomes available<br />

<strong>the</strong> first Sunday in February and may be used 3 weeks<br />

after <strong>filing</strong> <strong>the</strong> federal income tax return electronically<br />

and 6-8 weeks after <strong>filing</strong> a paper federal income tax<br />

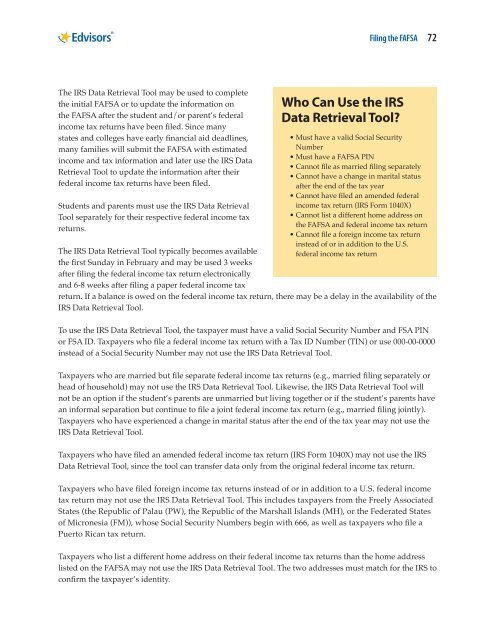

Who Can Use <strong>the</strong> IRS<br />

Data Retrieval Tool<br />

• Must have a valid Social Security<br />

Number<br />

• Must have a FAFSA PIN<br />

• Cannot file as married <strong>filing</strong> separately<br />

• Cannot have a change in marital status<br />

after <strong>the</strong> end of <strong>the</strong> tax year<br />

• Cannot have filed an amended federal<br />

income tax return (IRS Form 1040X)<br />

• Cannot list a different home address on<br />

<strong>the</strong> FAFSA and federal income tax return<br />

• Cannot file a foreign income tax return<br />

instead of or in addition to <strong>the</strong> U.S.<br />

federal income tax return<br />

return. If a balance is owed on <strong>the</strong> federal income tax return, <strong>the</strong>re may be a delay in <strong>the</strong> availability of <strong>the</strong><br />

IRS Data Retrieval Tool.<br />

To use <strong>the</strong> IRS Data Retrieval Tool, <strong>the</strong> taxpayer must have a valid Social Security Number and FSA PIN<br />

or FSA ID. Taxpayers who file a federal income tax return with a Tax ID Number (TIN) or use 000-00-0000<br />

instead of a Social Security Number may not use <strong>the</strong> IRS Data Retrieval Tool.<br />

Taxpayers who are married but file separate federal income tax returns (e.g., married <strong>filing</strong> separately or<br />

head of household) may not use <strong>the</strong> IRS Data Retrieval Tool. Likewise, <strong>the</strong> IRS Data Retrieval Tool will<br />

not be an option if <strong>the</strong> student’s parents are unmarried but living toge<strong>the</strong>r or if <strong>the</strong> student’s parents have<br />

an informal separation but continue to file a joint federal income tax return (e.g., married <strong>filing</strong> jointly).<br />

Taxpayers who have experienced a change in marital status after <strong>the</strong> end of <strong>the</strong> tax year may not use <strong>the</strong><br />

IRS Data Retrieval Tool.<br />

Taxpayers who have filed an amended federal income tax return (IRS Form 1040X) may not use <strong>the</strong> IRS<br />

Data Retrieval Tool, since <strong>the</strong> tool can transfer data only from <strong>the</strong> original federal income tax return.<br />

Taxpayers who have filed foreign income tax returns instead of or in addition to a U.S. federal income<br />

tax return may not use <strong>the</strong> IRS Data Retrieval Tool. This includes taxpayers from <strong>the</strong> Freely Associated<br />

States (<strong>the</strong> Republic of Palau (PW), <strong>the</strong> Republic of <strong>the</strong> Marshall Islands (MH), or <strong>the</strong> Federated States<br />

of Micronesia (FM)), whose Social Security Numbers begin with 666, as well as taxpayers who file a<br />

Puerto Rican tax return.<br />

Taxpayers who list a different home address on <strong>the</strong>ir federal income tax returns than <strong>the</strong> home address<br />

listed on <strong>the</strong> FAFSA may not use <strong>the</strong> IRS Data Retrieval Tool. The two addresses must match for <strong>the</strong> IRS to<br />

confirm <strong>the</strong> taxpayer’s identity.