filing-the-fafsa-2015-2016-edition

filing-the-fafsa-2015-2016-edition

filing-the-fafsa-2015-2016-edition

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Filing <strong>the</strong> FAFSA 86<br />

The intention is to include untaxed income of a discretionary nature in total income. Non-elective pension<br />

plan and retirement plan contributions are not counted in untaxed income. For example, contributions to<br />

certain state public employee retirement systems, such as <strong>the</strong> IPERS (Iowa), KPERS (Kansas) and OPERS<br />

(Ohio) retirement systems, are involuntary and so should not be reported as untaxed income on <strong>the</strong><br />

FAFSA. Contributions to a 401(k), 403(b) or IRA, on <strong>the</strong> o<strong>the</strong>r hand, are voluntary and must be reported<br />

as untaxed income on <strong>the</strong> FAFSA. Likewise, contributions by federal employees to <strong>the</strong> Thrift Savings<br />

Plan (TSP) are voluntary and, <strong>the</strong>refore, represent untaxed income. Note that employer contributions to<br />

retirement plans, health benefits and pension plans are not counted in untaxed income.<br />

Note that <strong>the</strong> student’s untaxed income figure includes cash<br />

support, while <strong>the</strong> parents’ untaxed income figure does not.<br />

Cash support includes money, gifts and loans, plus expenses<br />

paid by o<strong>the</strong>rs on <strong>the</strong> student’s behalf, such as food,<br />

clothing, housing, car payments or expenses, medical and<br />

dental care and college costs. A dependent student does not<br />

report cash support received from his or her parents, except<br />

that cash support received from a non-custodial parent is<br />

counted as untaxed income if it is not part of a legal child<br />

support agreement.<br />

Examples:<br />

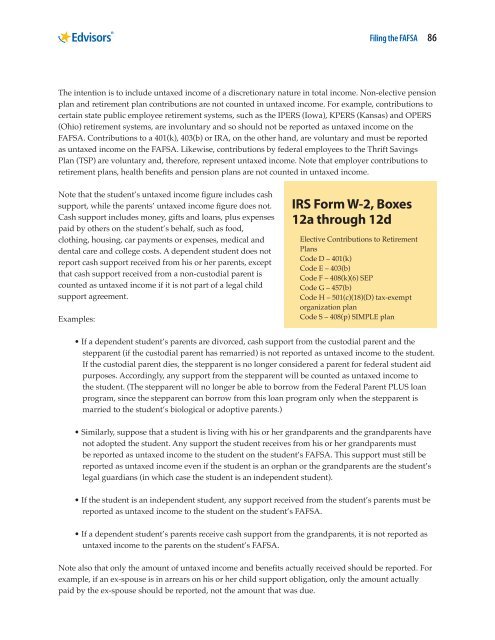

IRS Form W-2, Boxes<br />

12a through 12d<br />

Elective Contributions to Retirement<br />

Plans<br />

Code D – 401(k)<br />

Code E – 403(b)<br />

Code F – 408(k)(6) SEP<br />

Code G – 457(b)<br />

Code H – 501(c)(18)(D) tax-exempt<br />

organization plan<br />

Code S – 408(p) SIMPLE plan<br />

• If a dependent student’s parents are divorced, cash support from <strong>the</strong> custodial parent and <strong>the</strong><br />

stepparent (if <strong>the</strong> custodial parent has remarried) is not reported as untaxed income to <strong>the</strong> student.<br />

If <strong>the</strong> custodial parent dies, <strong>the</strong> stepparent is no longer considered a parent for federal student aid<br />

purposes. Accordingly, any support from <strong>the</strong> stepparent will be counted as untaxed income to<br />

<strong>the</strong> student. (The stepparent will no longer be able to borrow from <strong>the</strong> Federal Parent PLUS loan<br />

program, since <strong>the</strong> stepparent can borrow from this loan program only when <strong>the</strong> stepparent is<br />

married to <strong>the</strong> student’s biological or adoptive parents.)<br />

• Similarly, suppose that a student is living with his or her grandparents and <strong>the</strong> grandparents have<br />

not adopted <strong>the</strong> student. Any support <strong>the</strong> student receives from his or her grandparents must<br />

be reported as untaxed income to <strong>the</strong> student on <strong>the</strong> student’s FAFSA. This support must still be<br />

reported as untaxed income even if <strong>the</strong> student is an orphan or <strong>the</strong> grandparents are <strong>the</strong> student’s<br />

legal guardians (in which case <strong>the</strong> student is an independent student).<br />

• If <strong>the</strong> student is an independent student, any support received from <strong>the</strong> student’s parents must be<br />

reported as untaxed income to <strong>the</strong> student on <strong>the</strong> student’s FAFSA.<br />

• If a dependent student’s parents receive cash support from <strong>the</strong> grandparents, it is not reported as<br />

untaxed income to <strong>the</strong> parents on <strong>the</strong> student’s FAFSA.<br />

Note also that only <strong>the</strong> amount of untaxed income and benefits actually received should be reported. For<br />

example, if an ex-spouse is in arrears on his or her child support obligation, only <strong>the</strong> amount actually<br />

paid by <strong>the</strong> ex-spouse should be reported, not <strong>the</strong> amount that was due.