- Page 1 and 2:

FILING THE FAFSA The Edvisors ® Gu

- Page 3 and 4:

About the Authors Mark Kantrowitz i

- Page 5 and 6:

Our co-workers at Edvisors deserve

- Page 7 and 8:

Student Marital Status 23 Driver’

- Page 9 and 10:

▶ Adjustments and Overrides 132

- Page 11 and 12:

Filing the FAFSA 2 Work-study progr

- Page 13 and 14:

Filing the FAFSA 4 Institutional St

- Page 15 and 16:

Filing the FAFSA 6 FAFSA Applicatio

- Page 17 and 18:

Filing the FAFSA 8 • Macintosh us

- Page 19 and 20:

Filing the FAFSA 10 • Records of

- Page 21 and 22:

Filing the FAFSA 12 The PIN works l

- Page 23 and 24:

Filing the FAFSA 14 FAFSA on the We

- Page 25 and 26:

Filing the FAFSA 16 Step 2 - FAFSA

- Page 27 and 28:

Filing the FAFSA 18 There are no ag

- Page 29 and 30:

Filing the FAFSA 20 Step 3 - COMPLE

- Page 31 and 32:

Filing the FAFSA 22 and universitie

- Page 33 and 34:

Filing the FAFSA 24 will not ask an

- Page 35 and 36:

Filing the FAFSA 26 • Other eligi

- Page 37 and 38:

Filing the FAFSA 28 • Male studen

- Page 39 and 40:

Filing the FAFSA 30 Grade Level If

- Page 41 and 42: Filing the FAFSA 32 Parents’ Educ

- Page 43 and 44: Filing the FAFSA 34 the list that i

- Page 45 and 46: Filing the FAFSA 36 Federal School

- Page 47 and 48: Filing the FAFSA 38 Transferring to

- Page 49 and 50: Filing the FAFSA 40 Note that after

- Page 51 and 52: ▶ Section 3 - Dependency Status F

- Page 53 and 54: Filing the FAFSA 44 Dependency Over

- Page 55 and 56: Filing the FAFSA 46 marriage, the c

- Page 57 and 58: Filing the FAFSA 48 The following t

- Page 59 and 60: Filing the FAFSA 50 Whether the stu

- Page 61 and 62: Filing the FAFSA 52 Because of the

- Page 63 and 64: Filing the FAFSA 54 It is not uncom

- Page 65 and 66: Filing the FAFSA 56 If the student

- Page 67 and 68: Filing the FAFSA 58 This section as

- Page 69 and 70: Filing the FAFSA 60 be an even numb

- Page 71 and 72: Filing the FAFSA 62 support provide

- Page 73 and 74: Filing the FAFSA 64 The most common

- Page 75 and 76: Filing the FAFSA 66 student, in whi

- Page 77 and 78: Filing the FAFSA 68 Parent Financia

- Page 79 and 80: Filing the FAFSA 70 Parents’ Tax

- Page 81 and 82: Filing the FAFSA 72 The IRS Data Re

- Page 83 and 84: Filing the FAFSA 74 Then, the IRS D

- Page 85 and 86: Filing the FAFSA 76

- Page 87 and 88: Filing the FAFSA 78 In some cases,

- Page 89 and 90: Filing the FAFSA 80 • He or she w

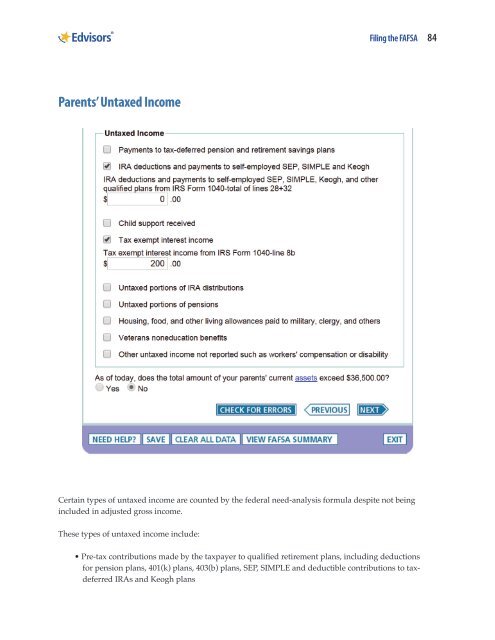

- Page 91: Filing the FAFSA 82 Although the nu

- Page 95 and 96: Filing the FAFSA 86 The intention i

- Page 97 and 98: Filing the FAFSA 88 • The student

- Page 99 and 100: Filing the FAFSA 90 • Farm income

- Page 101 and 102: Filing the FAFSA 92 card debt does

- Page 103 and 104: Filing the FAFSA 94 a retirement pl

- Page 105 and 106: Filing the FAFSA 96 Rental Properti

- Page 107 and 108: Filing the FAFSA 98 Qualified tuiti

- Page 109 and 110: Filing the FAFSA 100 Impact of Repo

- Page 111 and 112: Filing the FAFSA 102 Section 5 also

- Page 113 and 114: Filing the FAFSA 104 money from gov

- Page 115 and 116: Filing the FAFSA 106 ▶ Section 6

- Page 117 and 118: Filing the FAFSA 108 Need Help The

- Page 119 and 120: Filing the FAFSA 110 If filing FAFS

- Page 121 and 122: Filing the FAFSA 112 Web Certificat

- Page 123 and 124: ▶ Section 7 - Confirmation Filing

- Page 125 and 126: Filing the FAFSA 116

- Page 127 and 128: Filing the FAFSA 118 If family circ

- Page 129 and 130: Filing the FAFSA 120 INCREASING ELI

- Page 131 and 132: Filing the FAFSA 122 business incom

- Page 133 and 134: Filing the FAFSA 124 • Roll the c

- Page 135 and 136: Filing the FAFSA 126 Avoid Trust Fu

- Page 137 and 138: Filing the FAFSA 128 Divorce and Se

- Page 139 and 140: Filing the FAFSA 130 CHANGES: CORRE

- Page 141 and 142: Filing the FAFSA 132 ▶ Adjustment

- Page 143 and 144:

Filing the FAFSA 134 • exclusion

- Page 145 and 146:

Filing the FAFSA 136 • Financial

- Page 147 and 148:

Filing the FAFSA 138 Any data eleme

- Page 149 and 150:

Filing the FAFSA 140 ▶ Common Err

- Page 151 and 152:

Filing the FAFSA 142 • Applicants

- Page 153 and 154:

Filing the FAFSA 144 Errors Involvi

- Page 155 and 156:

Filing the FAFSA 146 Errors Involvi

- Page 157 and 158:

Filing the FAFSA 148 CONCLUSION Fil

- Page 159 and 160:

Filing the FAFSA 150 FM and IM have

- Page 161 and 162:

Filing the FAFSA 152 COA COD COTW C

- Page 163 and 164:

Filing the FAFSA 154 HEOA Higher Ed

- Page 165 and 166:

Filing the FAFSA 156 SIC SID SIMPLE

- Page 167 and 168:

Filing the FAFSA 158 1099-C IRS For

- Page 169 and 170:

Filing the FAFSA 160 Appeal A finan

- Page 171 and 172:

Filing the FAFSA 162 Clergy A membe

- Page 173 and 174:

Filing the FAFSA 164 Depreciation D

- Page 175 and 176:

Filing the FAFSA 166 Family Educati

- Page 177 and 178:

Filing the FAFSA 168 Gift Aid Gift

- Page 179 and 180:

Filing the FAFSA 170 Legal Dependen

- Page 181 and 182:

Filing the FAFSA 172 Orphan An orph

- Page 183 and 184:

Filing the FAFSA 174 PROFILE See CS

- Page 185 and 186:

Filing the FAFSA 176 Sticker Price

- Page 187 and 188:

Filing the FAFSA 178 Untaxed Income

- Page 189 and 190:

Filing the FAFSA 180 15 http://thom

- Page 191 and 192:

Filing the FAFSA 182 ▶ Quick Refe