Download PDF version English(2664KB) - Hamon

Download PDF version English(2664KB) - Hamon

Download PDF version English(2664KB) - Hamon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

64<br />

<strong>Hamon</strong> Annual Report 2010<br />

Tangible Assets<br />

An item of property, plant and equipment is recognized<br />

as a tangible asset if it is probable that the future<br />

economic benefits attributable to the asset will flow to<br />

the Group and if their costs can be measured reliably.<br />

After the initial accounting, all tangible assets are<br />

stated at cost less the accumulated depreciation and<br />

impairment losses. The cost includes all the costs<br />

directly attributable to bringing the asset to the location<br />

and condition necessary for it to be capable of operating<br />

in the intended manner.<br />

Repair and maintenance costs and other subsequent<br />

expenditures linked to an asset are charged as<br />

expenses in the income statement of the financial year<br />

during which they are incurred.<br />

The depreciable amount of an asset is allocated<br />

systematically over its useful life using the straight-line<br />

method.<br />

The depreciation of an asset begins when it is available<br />

for use. The estimated useful lives of the most significant<br />

elements of tangible assets are as follows:<br />

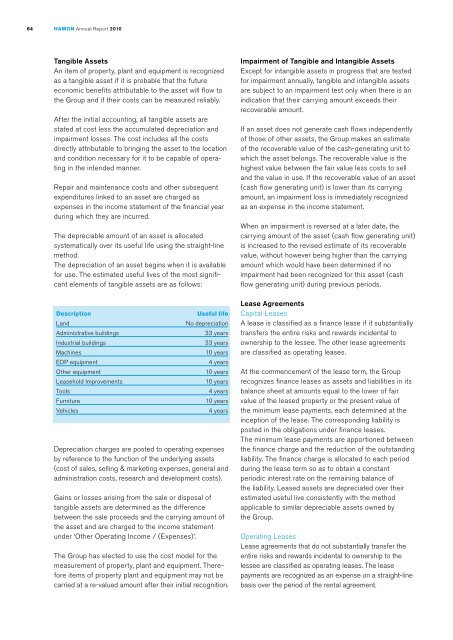

Description<br />

Land<br />

Administrative buildings<br />

Industrial buildings<br />

Machines<br />

EDP equipment<br />

Other equipment<br />

Leasehold Improvements<br />

Tools<br />

Furniture<br />

Vehicles<br />

Useful life<br />

No depreciation<br />

33 years<br />

33 years<br />

10 years<br />

4 years<br />

10 years<br />

10 years<br />

4 years<br />

10 years<br />

4 years<br />

Depreciation charges are posted to operating expenses<br />

by reference to the function of the underlying assets<br />

(cost of sales, selling & marketing expenses, general and<br />

administration costs, research and development costs).<br />

Gains or losses arising from the sale or disposal of<br />

tangible assets are determined as the difference<br />

between the sale proceeds and the carrying amount of<br />

the asset and are charged to the income statement<br />

under ‘Other Operating Income / (Expenses)’.<br />

The Group has elected to use the cost model for the<br />

measurement of property, plant and equipment. Therefore<br />

items of property plant and equipment may not be<br />

carried at a re-valued amount after their initial recognition.<br />

Impairment of Tangible and Intangible Assets<br />

Except for intangible assets in progress that are tested<br />

for impairment annually, tangible and intangible assets<br />

are subject to an impairment test only when there is an<br />

indication that their carrying amount exceeds their<br />

recoverable amount.<br />

If an asset does not generate cash flows independently<br />

of those of other assets, the Group makes an estimate<br />

of the recoverable value of the cash-generating unit to<br />

which the asset belongs. The recoverable value is the<br />

highest value between the fair value less costs to sell<br />

and the value in use. If the recoverable value of an asset<br />

(cash flow generating unit) is lower than its carrying<br />

amount, an impairment loss is immediately recognized<br />

as an expense in the income statement.<br />

When an impairment is reversed at a later date, the<br />

carrying amount of the asset (cash flow generating unit)<br />

is increased to the revised estimate of its recoverable<br />

value, without however being higher than the carrying<br />

amount which would have been determined if no<br />

impairment had been recognized for this asset (cash<br />

flow generating unit) during previous periods.<br />

Lease Agreements<br />

Capital Leases<br />

A lease is classified as a finance lease if it substantially<br />

transfers the entire risks and rewards incidental to<br />

ownership to the lessee. The other lease agreements<br />

are classified as operating leases.<br />

At the commencement of the lease term, the Group<br />

recognizes finance leases as assets and liabilities in its<br />

balance sheet at amounts equal to the lower of fair<br />

value of the leased property or the present value of<br />

the minimum lease payments, each determined at the<br />

inception of the lease. The corresponding liability is<br />

posted in the obligations under finance leases.<br />

The minimum lease payments are apportioned between<br />

the finance charge and the reduction of the outstanding<br />

liability. The finance charge is allocated to each period<br />

during the lease term so as to obtain a constant<br />

periodic interest rate on the remaining balance of<br />

the liability. Leased assets are depreciated over their<br />

estimated useful live consistently with the method<br />

applicable to similar depreciable assets owned by<br />

the Group.<br />

Operating Leases<br />

Lease agreements that do not substantially transfer the<br />

entire risks and rewards incidental to ownership to the<br />

lessee are classified as operating leases. The lease<br />

payments are recognized as an expense on a straight-line<br />

basis over the period of the rental agreement.